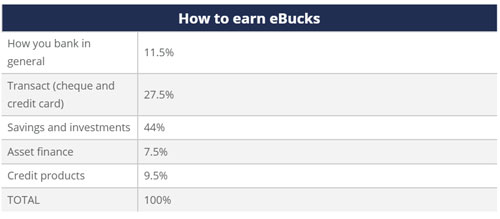

Nearly half of the ways to earn eBucks will soon be by saving and investing, a sneak peek of First National Bank’s annual changes to its rewards programme, due to come into effect on 1 July, reveal.

eBucks is a programme that rewards customers for holding FNB products and for doing certain things with those products.

For specific behaviours, customers are given points (except on the Easy and Gold accounts), which equate to a reward level that determines the discounts and benefits they can enjoy across a range of goods and services.

While there remain a number of ways to earn eBucks by spending money (mostly on your credit card), FNB has definitely beefed up incentives to save and invest.

The following breakdown reflects the weighting of different activities and products on which FNB customers can earn benefits.

Changes made to the programme this year underline FNB’s desire to drive customer behaviour and reward loyalty.

For example, on the Easy and Gold accounts, customers are placed on a rewards level based on the number of different FNB products they hold, while on its premier banking accounts (Premier, Private Client and Private Wealth), customers now have to use the banking app at least once a month to qualify for eBucks, as part of the bank’s drive to push customers to mobile channels.

FNB has introduced a cash back rewards system for its Easy customers (previously rewards were restricted to airtime), which works in a similar manner to eBucks, so as to familiarise these customers with the programme for when they (hopefully) upgrade their accounts.

The bank has removed the points system from its Gold accounts, so that these customers will now also be placed on a reward level based on the products they hold, which will determine the eBucks rewards and discounts they enjoy.

The number of different product groups in which they hold products will determine reward levels for Easy and Gold account holders. These product groups comprise cheque, credit card, loans, savings, FNB Connect, asset finance and investments.

One product group is equivalent to one reward level, up to a maximum of level five.

Within each product group, there are multiple potential products that the customer can elect to have. The upside of this is that customers are not, for example, rewarded for having multiple loan products since these products are all grouped into the “loans” bucket, which counts towards only one reward level.

The number of points allocated to different reward levels have been aligned across FNB Premier, Private Clients and Private Wealth, with a reduction in points needed to reach levels 3 to 5, “to make it easier for customers to move up a level”, according to FNB.

The richness of the eBucks discounts that your reward level gives you depends on which of the premier accounts you hold, with Private Wealth being the top tier.

New points-earning opportunities across the premier banking accounts reveal a focus on saving and investing. For example, points can now be collected for holding a tax-free share account or FNB savings and investments accounts, as well as making minimum monthly payments into any FNB unit trust.

Naturally, clients are still rewarded for credit card purchases and can earn up to 2% back in eBucks when swiping their credit cards (compared with a new flat rate of 0,25% on a cheque card).

Maintaining that higher fees earned on credit card (over debit card) swipes is not the reason why FNB rewards customers for using their credit cards, CEO of eBucks, Johan Moolman contends that the bank is attempting to teach and reward good credit behaviour.

“Customers are given additional rewards if there is a standing payment from their debit account to pay their credit card off in full every month, which instils the right long-term behaviour. If they later take up other credit products, they will already be in the habit of managing credit well,” Moolman explains.

Since its inception in 2000, eBucks has paid customers R7bn in rewards, according to Moolman, with R2bn of that paid in the past year.

- This article was originally published on Moneyweb and is used here with permission