Construction of the planned multibillion-rand expansion of the Gautrain rapid rail network, dubbed Gautrain 2, could realistically commence at the end of 2024, according to the Gautrain Management Agency (GMA).

Construction of the planned multibillion-rand expansion of the Gautrain rapid rail network, dubbed Gautrain 2, could realistically commence at the end of 2024, according to the Gautrain Management Agency (GMA).

But GMA CEO William Dachs also confirmed that its application to national treasury for authorisation for the project in terms of Public Finance Management Act is still with treasury.

Funding could also prove problematic, particularly as the massive efforts to curb the spread of Covid-19 drain government’s already-stretched coffers.

The destruction of the construction industry for various reasons, including a lack of work, non-payment or late payments and disruptions of construction sites, means the GMA could also have difficulty finding a South African construction company with the technical expertise and financial strength willing to take on such a large project.

Former GMA CEO Jack van der Merwe said last year the construction of Gautrain 2 was expected to start by July 2023 if President Cyril Ramaphosa and his cabinet allocated money to the National Development Plan and started funding it.

However, Dachs said last week it will not be possible to start construction by 2023.

Delays

“Given the delays in approvals and the detailed design and planning, as well as land rights acquisition and the environmental authorisation process, a more realistic date for construction would be the end of 2024,” he said.

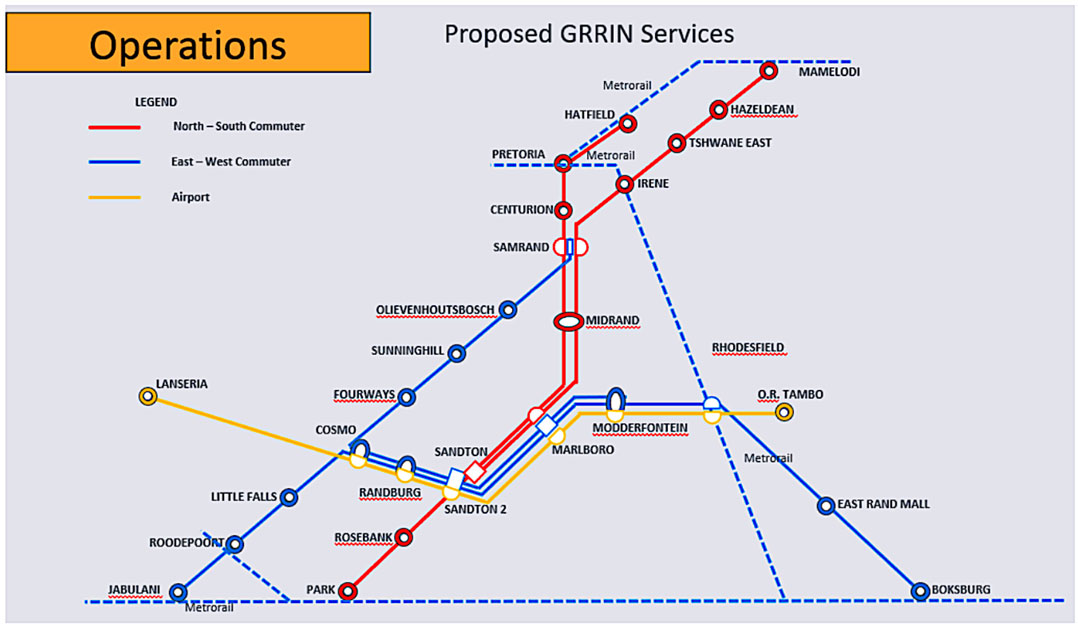

The current Gautrain network comprises 80km of rail along two route links: a link between Tshwane and Johannesburg and a link between OR Tambo International airport and Sandton. Gautrain 2 comprises another 150km of rail and a further 19 stations.

Dachs said the first phase of Gautrain 2 is a new line from Marlboro through Sandton and Randburg to Cosmo City and then to Little Falls.

While Lanseria is the ultimate destination for a rail service running east-west between the two airports, connecting Lanseria is in a later phase, he said.

Dachs said the second phase extends the line from Little Falls to Roodepoort to Jabulani in northern Soweto.

“This is a very important link from an economic and socioeconomic perspective as connectivity between Roodepoort and Soweto and the economic and employment nodes in Randburg and Sandton is a massive constraint at the moment.

“The time saving of a trip from Soweto to Randburg and Sandton, via Gautrain 2, is estimated to be 86 minutes compared to the current trip time between Soweto and Randburg. This would cause a major economic injection into the Soweto economy and job market,” he said.

Dachs said three more phases are envisaged to complete the network but timelines for these are completely dependent on factors such as economic growth, population growth and transport demand as well as the availability of funding from government and the private sector.

Debt financing

“We can’t make any statements on timelines beyond phase one,” he said. “If construction commences in late 2024 then we anticipate that it (phase one) would be completed in 2029 – a five-year construction period. It takes into account the 18-month delay from the initial date mentioned.”

Gautrain 1 had private sector debt of about 12%, with the balance comprising provincial borrowings and provincial budget allocations via national government.

Van der Merwe said last year the plan was to increase private sector funding for Gautrain 2 to 33%. However, this might be unrealistic in light of the severe impact Covid-19 has had on the economy and the private sector.

Dachs admitted this, adding that the answer will lie in the economic growth path of the province and country, particularly the property sector.

He said the development of transit-orientated developments around stations depends on the ability of the private sector to take up development opportunities around these stations.

There are a number of scenarios the GMA is considering if private sector funding of the project cannot be increased to 33%, he said.

“The first is that the economic growth recovers prior to the start of capital expenditure and targeted private sector funding is available. The second is that economic growth is delayed, and the third is that it does not recover in the foreseeable future to pre-Covid 19 levels.

“We consider scenario three unlikely but, in this case, the project would obviously require significant restructuring and descoping.

“Scenario two would cause delays to the project and possibly descoping. Scenario one would not require any descoping or restructuring,” he said.

Construction

The Gautrain as it currently exists is one of the largest public-private partnerships launched in South Africa.

Bombela, as the concessionaire, contracted various subcontractors to develop and operate the Gautrain system, including the Bombela Civil Joint Venture (BCJV), which was responsible for the design and construction of the entire Gautrain system. Murray & Roberts (45%), Bouygues (45%) and Strategic Partners Group (10%) are the shareholders of BCJV.

However, since the Gautrain was built, M&R has disposed of its Southern African construction and civil engineering business.

M&R group CEO Henry Laas said in February this year the initial contract to build the Gautrain was problematic and the group lost about R2-billion as part of its share in the contract, with its joint venture partners losing the same amount.

Laas was lukewarm about M&R’s involvement in the construction of Gautrain 2 and doubts there is any construction company in South Africa with the capacity to undertake the project.

M&R also has a 50% stake in the Bombela Concession Company, which holds the 15-year concession for operating and maintaining the Gautrain.

Dachs said the GMA could not comment on M&R’s views about the capacity of the domestic construction industry to undertake Gautrain 2 but admitted the GMA is concerned about the state of the construction industry in South Africa.

“Covid-19 isn’t assisting at all as cash flows dry up along the construction industry supply chain.

“Part of the bigger, more systemic problem is the ‘boom and bust’ cycle of infrastructure roll-out and Gauteng’s rail extensions alone will not be a panacea for the problems.

“We can only put the project forward as part of a long term, well-planned and continuous roll-out of infrastructure, as envisaged in the National Development Plan.”

Mix of contractors

“We are watching the work being done in the presidency under Dr Kgosientso Ramokgopa with great interest and are ensuring that our planning feeds through the various structures that he is coordinating,” he said.

Dachs added the GMA hopes it is neither acceptable nor necessary to consider a solely foreign contractor to build Gautrain 2.

He said part of the economic justification of large infrastructure projects lies in the stimulation of local businesses and supply chains, job creation, skills development and local ownership of companies. Dachs said a lot of those benefits will fall away without local consortia being involved in a substantial manner.

“We found the mix of foreign and local contractors in Gautrain 1 to be ideal. There was a good mix of foreign skills and innovation with local expertise. Another reason we would hate to see a solely foreign contractor is the move away from rand-denominated contracts, with all the risks that come with that.

“It is a requirement of government’s supply chain management (SCM) policy to make local participation a requirement of construction contracts, and this will also be the case with the SCM process of Gautrain 2,” he said.

Dachs added that it is too early to speculate on the contracting conditions for Gautrain 2, and the conditions that may be imposed on any foreign based or international contractor awarded the contract, other than to say the socioeconomic development requirements imposed on the initial Gautrain contractors led to massive local benefits.

“We would certainly look to replicate these,” he said.

Dachs said some headline numbers from Gautrain 1 development phase are:

- About R5.45-billion in value was procured from, or subcontracted to, black entities, with about 390 black entities benefitting from the project during this period.

- About R1.42-billion was procured from, or subcontracted to, small, medium and micro enterprises, with about 310 SMMEs benefitting from the project during this period.

- By the end of June 2012, an estimated total of 121 800 direct, indirect and induced jobs had been created.

- About R3.59-billion of South African materials, plant and equipment was procured up to the end of June 2012.

- For every R1 spent on Gautrain, R2.60 was added to the Gauteng economy, according to the Hatch Report released in 2019.

The Competition Commission, when it released its findings and recommendations to its public transport market inquiry in February, said the Gautrain was a big policy mistake and there is no justification in a country like South Africa for the government to subsidise the middle class.

This possibly has the ability to derail the Gautrain 2 expansion project. However, Dachs said the GMA had engaged the commission directly after the release of the report.

“MEC Jacob Mamabolo and the GMA had a very fruitful meeting with the commissioner in early March to explain the view of the Gauteng provincial government that investments in rail, like Gautrain and the proposed extensions, are essential.

“We made the point that the Gautrain is much more than moving people out of cars and that the notion of Gautrain as a ‘middle class subsidy’ project is misguided.

“The provincial strategy is about making long-term investments that support economic growth and changing the spatial form of Gauteng.

“We could also explain that Gauteng cannot continue relying on road-based transport, and even if we build every road in Gauteng that is planned in the next 20 years, our population and economic growth is such that congestion on the roads will result in very poor economic, social, transport and environmental outcomes,” he said.

Advanced province

Dachs added that Mamabolo also made it clear that Gauteng strongly supports the commission’s views on improved integrated planning, the devolution of rail functions to the province, and changing the way funding and subsidies are currently managed.

He said the commission and MEC issued a joint statement after the meeting noting that Gauteng is arguably the most advanced province in the country in regard to many of the commission’s recommendations, particularly in terms of attempts at devolution, integration and establishment of a provincial authority.

“The commission also noted the impact the Gautrain has had on the space economy of the province and the efforts it has made in integrating with other modes of transport, especially the minibus taxi industry,” he said.

- This article was originally published on Moneyweb and is used here with permission