Just 10 days ago, I noted that Taiwan Semiconductor Manufacturing Co.’s earnings and outlook served as proof that it’s truly the global king of chips. Since then, the company has grown even stronger, but more good news also increases the burden and will likely draw far more attention than it’s comfortable with.

Just 10 days ago, I noted that Taiwan Semiconductor Manufacturing Co.’s earnings and outlook served as proof that it’s truly the global king of chips. Since then, the company has grown even stronger, but more good news also increases the burden and will likely draw far more attention than it’s comfortable with.

Being bigger and more indispensable sounds like a great position to be in. Yet that could also irk competition regulators, clients and governments that, amid a tech Cold War, worry that one company may have become too powerful.

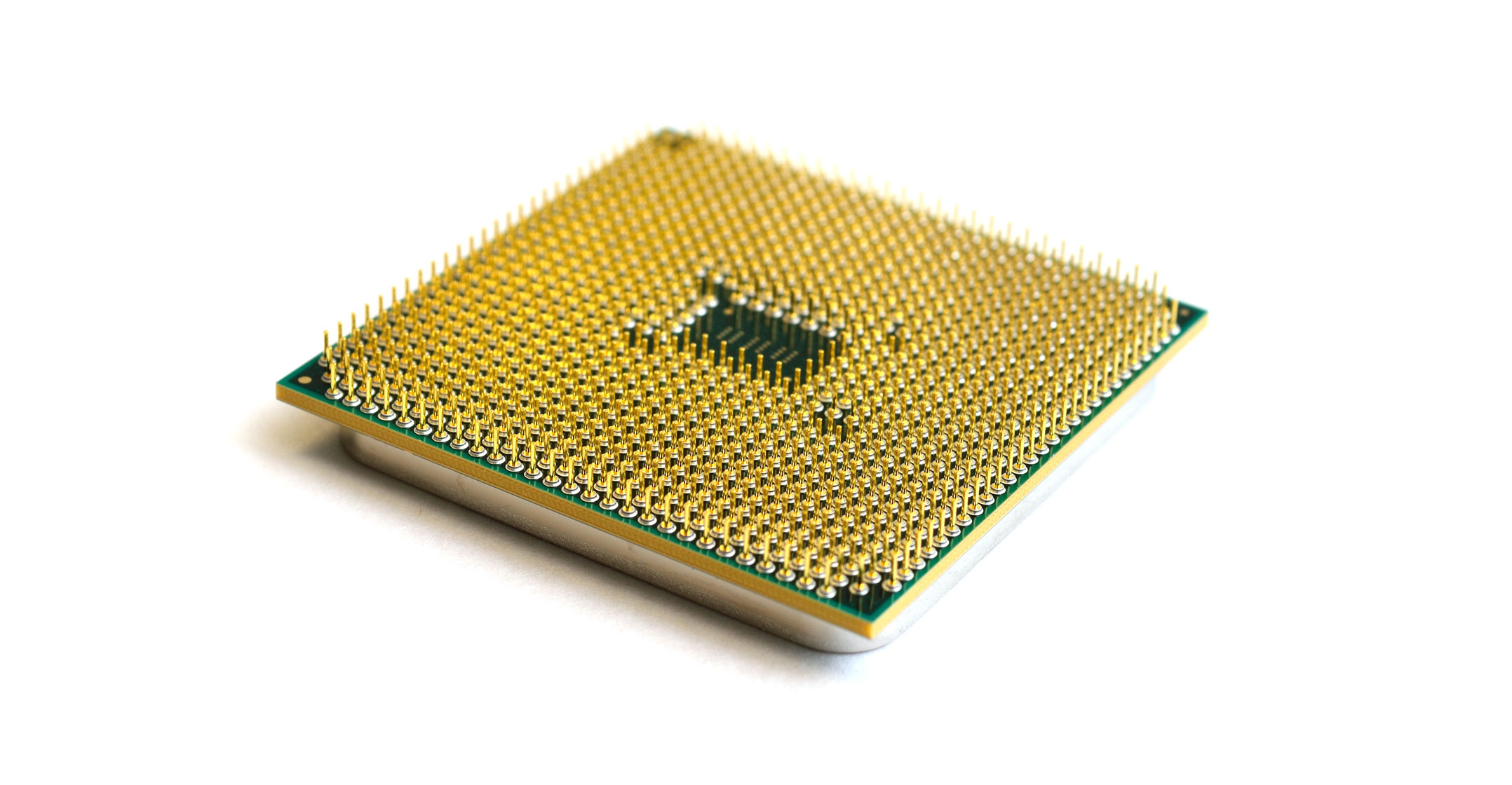

The way that TSMC brushed off the pending loss of orders from Huawei Technologies to raise its spending plan for the year is what had recently impressed me. Then last week, Intel revealed that its next, most advanced chips would again be delayed, sending the American company’s stock down 16%. As colleague Tae Kim noted, investors have seen this movie before. Intel has slipped up too many times in recent years, allowing rival AMD to take market share, and spurring Apple to drop Intel processors in favour of designing its own.

CEO Bob Swan’s statement that manufacturing the chips could be outsourced made it worse. Once the global leader in both design and production, Intel would be eliminating its biggest competitive advantage against AMD — whose chips are made by TSMC — in their tussle over processors used in laptops, PCs and servers.

The power shift was confirmed on Monday morning. TSMC jumped by its 10% daily limit in Taiwan to a record high after the Taipei-based Commercial Times newspaper reported that Intel has placed an order for its 6-nanometre chips for next year. Not only would this be an unprecedented development for both client and supplier, the reported size of the contract — 180 000 wafers — is almost as large as that for long-time client AMD (200 000 wafers), which raised its own order.

Fully booked

As a result, according to the newspaper, the manufacturer’s leading-edge capacity is fully booked for the first half of next year. A report in Taipei’s Economic Daily News meanwhile says that Apple will set up a display R&D plant within TSMC. Recent advances are starting to merge flat-screen display and semiconductor technologies, and the chip maker finds itself at the centre of the action.

These new developments are where the responsibilities of TSMC’s crown will begin to weigh.

It has a long list of clients whose needs must be met. Beyond Apple and Intel, global leaders including Nvidia, Qualcomm, MediaTek and Broadcom all rely on TSMC to churn out chips for the planet’s electronics devices. Great, except that expanding takes years and billions of dollars. Overbuild and you’re left with idle capacity that’s quickly depreciating and burning a hole in your income statement.

Another thing to keep in mind is that for all of Intel’s woes, TSMC isn’t perfect, either.

In 2012, Qualcomm struggled to supply a new line of chips to its own clients, smartphone brands, because the Taiwanese company was having trouble delivering on time. That spurred a search for alternative suppliers. Two years ago, a malware attack and a separate incident involving poor chemical quality at TSMC both caused delays. By all accounts, clients forgave, but probably won’t forget.

Then there are regulators. The company told investors in 2017 that it was under preliminary investigation by the European Commission “concerning alleged anticompetitive practices… in relation to semiconductor sales”. The implication was that TSMC — holding more than 50% of the global contract-manufacturing market — is too big and powerful, with reports at the time suggesting that the US Fair Trade Commission was also taking a look. While it seems both probes are on hold, there’s every chance that either could be dusted off and restarted should concerns increase.

The company has only grown bigger since, and become an unwilling player in the US-China tech Cold War. It has sought to ease concerns that so much American semiconductor prowess and supply sits offshore by announcing that it will build a factory in Arizona. Former Intel executive Peter Cleveland and US Chamber of Commerce policy director Nicholas Montella have been hired to beef up its US lobbying team.

After decades behind the scenes, TSMC is taking an ever-bigger share of the spotlight as one of the most famous and powerful technology companies in the world. So far, it’s managed to outsmart competitors, skirt antitrust regulators and survive early rounds of the Washington-Beijing chill. This may make it a hero to investors and the ruler of its sector, but also creates a huge target. — By Tim Culpan, (c) 2020 Bloomberg LP