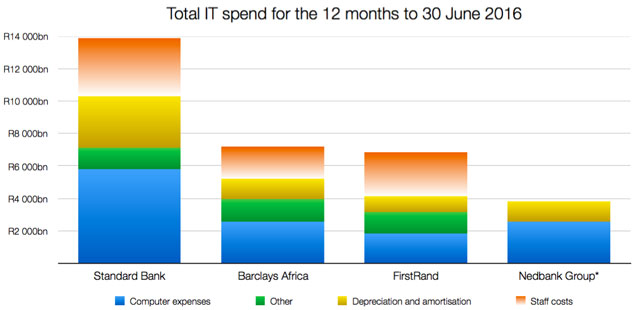

South Africa’s big four retail and commercial banks spent in excess of R30bn on IT in the 12 months to end-June 2016, including the cost of staff involved in this function.

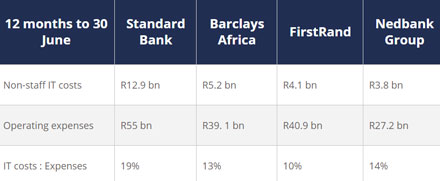

Excluding the cost of people, nearly R15 out of every R100 spent on operations by the country’s big banks is on IT. This includes so-called “computer expenses”, professional fees, depreciation, amortisation and a category labelled “other”, which is not that insignificant. The four banking groups have slightly different ways of disclosing this data, and all but Nedbank provide IT-related staff costs¹.

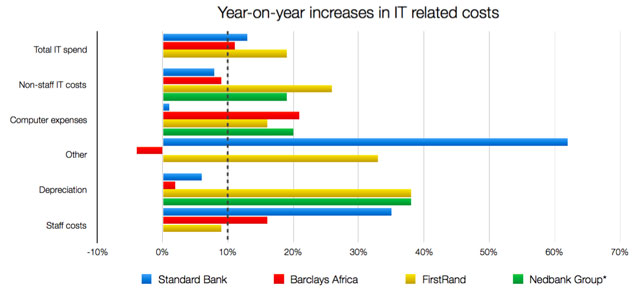

Given its nature, IT-related expense growth is accelerating ahead of the inflation in normal operating expenses. In the 12 months, this spend grew by 12% (for all four banking groups together). Only at Standard Bank did non-staff IT costs grow by less than overall expenses (8% versus 11%). Factor in IT staff costs, and the escalation is 13%.

In the 12 months to end-June, Standard Bank spent nearly R14bn (including staff), equal to the amounts invested by FirstRand and Barclays Africa Group combined (R6,8bn and R7,2bn respectively).

Standard Bank, which has been implementing SAP in its home market and Finacle across the rest of Africa, has previously said it would spend up to R21,5bn on these projects between 2012 and 2017. Excluding staff, it spent R10,3bn in the 12 months to 30 June (the second half of its 2015 financial year and the first half of 2016).

One way of comparing these four more accurately is to look at the relative ratios of IT costs (excluding staff) to operating expenses. In terms of intensity of technology spend, Standard Bank’s is practically double that of FirstRand, which is the lightest of the four. Of course, given the major implementation projects underway, this is not at all surprising. It’s level of spending at this point is likely more cyclical in nature.

It is worth noting that all four banks have multiple legacy and mainframe IT systems which necessitate elevated levels of investment.

A presentation by Nedbank group chief information officer Fred Swanepoel at the Renaissance Capital Banking IT Day in April 2015 provides a fair amount of detail on just how complex banking IT systems are. The bank’s stated strategy is to “rationalise, standardise and simplify” its IT systems over time and it hopes to get the number of core systems down to 60 in future, from 250 in 2010. Over the five years since 2010, it has managed to gradually get that total down to 176 (as at 2014). The implementation of enterprise resource planning software SAP in its shared services units, including finance, human resources and procurement, reduced the number of systems from 43 to just one.

A bank like Capitec, which has no complicated legacy systems to speak of, spends significantly less than its peers. Although it does not break out technology spending (aside from amortisation of computer software of R97,5m), operating expenses for the year to 29 February 2016 totalled R4,6bn.

Discovery’s R1bn it plans to spend on building the digital infrastructure for its entry into banking is also put in perspective when considering the spend by the country’s major banks. Because it’s starting from scratch, it’s able to avoid the cost of supporting (or transitioning away from) hundreds of complicated systems.

As banks continue to look more and more like technology companies, and as the trend by banks to cut pricey branches in favour of automated, digital channels remains intact, one wonders at what level these costs will settle sustainably. In the medium term, it wouldn’t be a stretch to imagine that upwards of a fifth of operating costs will be IT related.

- ¹Total IT-related spending (including staff): Standard Bank R13,9bn, Barclays Africa R7,2bn, FirstRand R6,8bn, totalling R27,9bn. Include Nedbank’s IT spending (excluding staff) of R3,9bn and you get R31,8bn. It is conceivable that Nedbank’s staff costs related to IT are around R2bn, in line with both Barclays Africa and FirstRand. This would bring the total closer to R34bn.

- This article was originally published on Moneyweb and is used here with permission