Welcome to part 2 of Revix’s series designed to help you understand “alt seasons”, a stage in the crypto price cycle when altcoins outperform bitcoin.

Welcome to part 2 of Revix’s series designed to help you understand “alt seasons”, a stage in the crypto price cycle when altcoins outperform bitcoin.

It’s an exciting time for the crypto investor, and given the amount of evidence suggesting that an alt season may be coming, getting up to speed will place you in good stead to make the most of it.

In part 1 of the series, we discussed the fact that alt coins now account for US$1.3-trillion worth of the total crypto market cap of $2.2-trillion.

We examined how entire ecosystems of software and applications have been developed on top of the key altcoin technologies like ethereum, solana and BNB, and we promised to show you some key indicators to look out for when trying to decide if an alt season is on the cards. In this article, we’ll do just that.

Bitcoin dominance

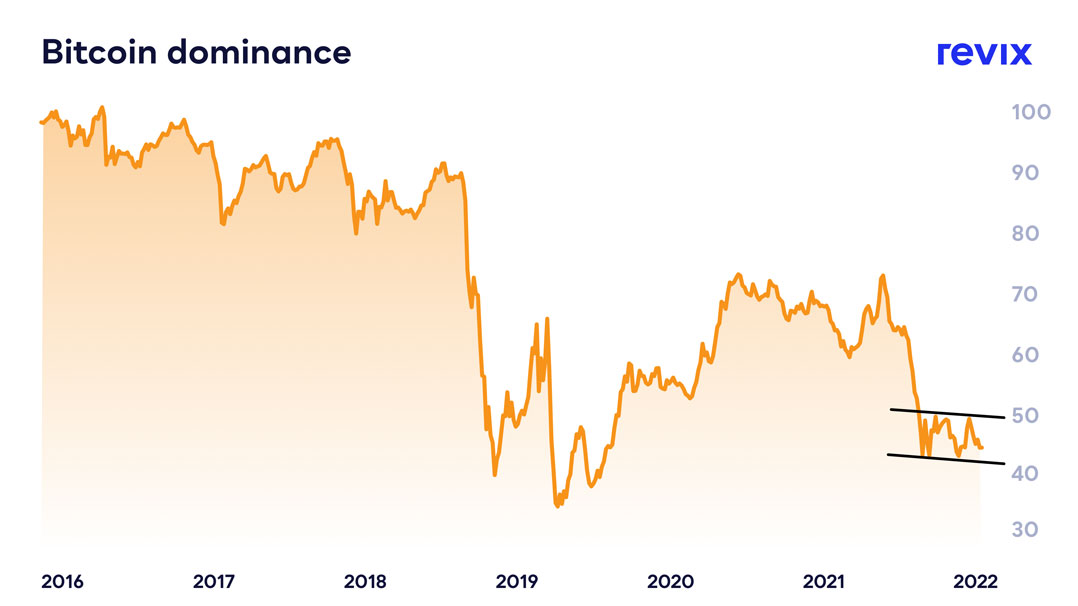

While bitcoin remains the biggest cryptocurrency by market cap, and by a sizeable margin, it is no longer as dominant a force as it once was in the market. Bitcoin dominance is a relatively simple metric, but one that is critical in helping to predict an incoming alt season. Bitcoin dominance is simply a measure of how much of the total market cap of crypto is in bitcoin.

As the graph above shows, bitcoin dominance has broken down notably towards the end of 2022. The most important driver of this is the fact that investor interest in other blockchain technologies is at an all-time high. Decentralised finance, projects that support the creation and trade of NFTs and crypto gaming, have all seen unprecedented global media attention in the past year. With money flowing into those projects, bitcoin loses its ability to dictate market-wide price movements. This, as you may have guessed by now, is a strong indicator that an alt season may be around the corner.

Fear and greed

Keeping emotions out of your investment decisions is one of the most challenging obstacles that investors face. The fact is, though, despite their best efforts, very few crypto investors are able to effectively do this. The volatility that characterises the current crypto market creates more than its fair share of emotionally charged situations.

For centuries now, investors have understood that market sentiment swings between two emotional poles: greed and fear. In an oversimplified definition, greed can cause investors to buy even when an asset’s price may be overinflated, whereas fear can cause investors to sell at a loss, even when the asset is undervalued.

The bitcoin fear and greed index gives us an idea of where investor sentiment currently stands on a scale of extreme fear to extreme greed.

Many analysts believe that bitcoin’s dramatic price drop may be the result of a market flush by institutional investors

The savvy investor understands how fear and greed drive investor behaviour, and consequently, price action. It stands to reason that when the market enters a state of fear and prices drop, that is a prime opportunity to buy into that asset. By the time the bitcoin fear and greed index enters “extreme fear” territory, where it currently stands, there is a deluge of retail investors panic selling their bitcoin in an attempt to negate further losses. This increases the supply of bitcoin, driving the price down further. Meanwhile, holders of less volatile altcoins like ether will be holding, helping to stabilise its price. It’s in this situation where Warren Buffett’s quote rings true: “Be fearful when others are greedy and greedy when others are fearful.”

In the case of the crash we’ve just experienced, though, Buffett’s wisdom must be taken with a grain of salt. This crash is almost entirely atypical of crypto market crashes of the past. Traditionally, bitcoin has acted as a “safe haven” for crypto investments, so the fact that this wasn’t the case in this weekend’s crash is leading many analysts to believe that bitcoin’s dramatic price drop may be the result of a market flush by institutional investors and not the result of genuine fear. Regardless of whether you understand any of the words in that sentence, the key takeaway is this: Tread carefully until a clearer picture emerges.

Ethereum as a catalyst

In the past, it has taken a major price rally by a large-cap altcoin to trigger the explosion of media coverage and investor attention that invariably leads to an alt season. While it now has more legitimate competitors than ever, ethereum has taken up that call in the past.

As a result, investors looking to predict the arrival of an alt season will keep a keen eye on any signs indicating a potential ETH price breakout.

The graph above indicates a pattern which traders call a bull flag, as illustrated by the two red lines. When a price forms this pattern, it can break through the bottom line, which suggests that it will keep dropping in the foreseeable future. If, however, it breaks above the top line as it has in the graph, that is a powerful indicator to support an incoming price rally.

Combined with the other metrics we looked at above, an ethereum rally may just be the catalyst for the 2021/2022 alt season that these signs seem to be pointing to. There are a host of other valuable indicators that can help to predict the arrival of an alt season, but for the long-term crypto investor, these are some of the most important.

So, that covers some of the most effective ways of predicting an incoming alt season, but what’s the best investment strategy for an alt season? Should you go all-in on the altcoin that everyone’s talking about, or focus on diversifying? We’ll answer these and other burning questions in part 3 of this series – look out for it!

Meanwhile, why not wear your bitcoin on your sleeve?

Whether you’re new to crypto investing or someone who has paid for a pizza with bitcoin, the original cryptocurrency’s legendary status won’t be lost on you. So you’ll be excited to discover that Revix, a Cape Town-based crypto investment platform, is running a competition to win a prize that will make it easy to show the world that you’ve taken the crypto revolution seriously.

Predict what you think the bitcoin price will be on 3 January 2022 at midday (South African time), and make an investment of R500 or more in bitcoin via Revix’s platform, and you could win one of three exclusive pairs of Tateossian Blockchain Cufflinks. Follow the instructions on this link to enter.

Predict what you think the bitcoin price will be on 3 January 2022 at midday (South African time), and make an investment of R500 or more in bitcoin via Revix’s platform, and you could win one of three exclusive pairs of Tateossian Blockchain Cufflinks. Follow the instructions on this link to enter.

- This promoted content was paid for by the party concerned