According to research firm BMIT’s latest South Africa ICT market sizing and overview report, revenue in the ICT sector grew almost 5% in 2022. However, growth across different segments was uneven, with some areas seeing exceptional growth while others declined.

According to research firm BMIT’s latest South Africa ICT market sizing and overview report, revenue in the ICT sector grew almost 5% in 2022. However, growth across different segments was uneven, with some areas seeing exceptional growth while others declined.

BMIT MD Chris Geerdts said the industry performance could have been far better if not for the “triple whammy of load shedding, which hit businesses hard, impacting on the reliability of ICT services and pushing up costs, as service providers had to increase their battery backup investments and also burn diesel for hours each month.”

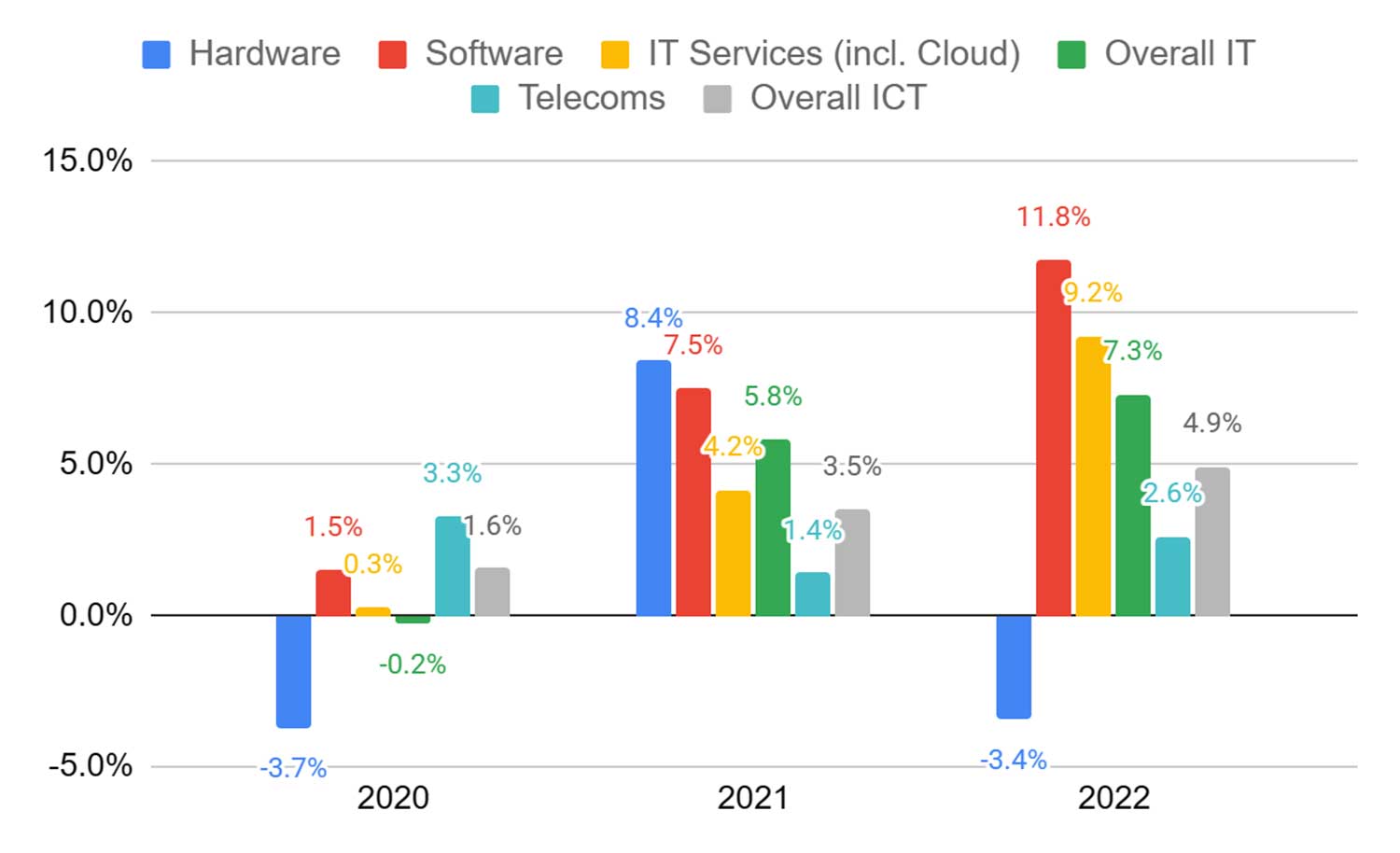

The performance breakdown is given in BMIT’s market summary chart for the last three years, which also highlights the uneven growth per sector:

The sector as a whole grew a healthy 7.3% in 2022, although most of this growth came from IT software and services, and especially public cloud services, which has seen a revenue increase of almost 40%/year for two years running.

Geerdts said that cloud solutions had enabled organisations to retool rapidly to ensure business continuity when lockdowns were put in place, and there has been a strong ongoing preference for cloud-first solutions.

However, he warned that local players that provide traditional IT services have been put under pressure, while hyperscale players – companies such as Amazon Web Services, Microsoft and Huawei Technologies – continue to reap the rewards of their local investment in cloud infrastructure and services.

Ironically, load shedding has sped up the move to cloud but also increased the overall downtime of the connections that businesses need to access those cloud services.

Security

The need for information security is a primary driver of growth in South African IT services, including concerns regarding data security and privacy, which combine as a top priority for many companies, BMIT said.

Enterprises are presenting a massively expanded cyberattack surface as they undergo digital transformation, with commensurate increases in remote work and cloud and internet of things technologies, and more data kept online. The increase in frequency and severity of cyberattacks is forcing companies to reappraise their approaches at a fundamental level, going beyond merely “securing the perimeter” and aligning security more closely with business objectives.

BMIT’s own survey of enterprises showed that a zero-trust security framework and secure access service edge (SASE) are the top newer technologies larger organisations have implemented, with another 30% of these respondents indicating their intention to use these technologies.

Artificial intelligence

BMIT said AI is rapidly becoming mainstream, with natural language-based AI including large language models such as ChatGPT further accelerating this trend. They are assisting in many areas of professional activity, including software development and as an aid to creativity in many areas, including marketing.

Hardware vendors are constantly enhancing automation, delivering solutions and making strategic acquisitions. Large cloud providers now bake AI into many of their cloud solutions. AI also enhances cybersecurity and is enhancing data analytics, providing insights that traditional approaches would not have identified.

BMIT forecasts the growth outlook for 2022 – 2027 at 12.3% (compounded annually) for cloud services and other IT services combined.

Hardware slowdown

Hardware sales, on the other hand, have slowed down dramatically following the surge in demand for PCs during the pandemic and further overall hardware refresh spending in 2021. It appears that the move to Windows 11 has failed to drive demand for new PCs, while the education sector is one of the few areas still showing positive demand. BMIT’s research identified government procurement processes as an ongoing challenge to growth in the hardware market.

Telecommunications

Telecommunications

Revenue growth in the telecommunications sector was more modest than for IT, but positive nevertheless at 2.6% year on year.

The business segment saw a slight bounce-back in 2022 following softening of the market in 2020 and 2021. The load shedding “triple whammy” was particularly evident in this segment, where businesses require highly reliable links for their mission-critical applications, and even more so now that their applications have been migrated to the cloud where security depends on connectivity to monitor for and respond to threats.

Business fixed-data services growth also continues to be dampened by the move to lower-cost broadband connectivity and substitution of traditional virtual private network services by SD-WAN (software-defined wide-area networks), even though overall demand for connectivity is increasing.

The fibre-to-the-home market was a strong driver of growth, despite consumers feeling the pinch, as working from home remains popular and the spirited fibre “land grab” has continued apace, shifting from leafy suburbs (which are now all but covered) to smaller towns.

There is also a widespread shift in focus down the pyramid to lower-income suburbs, where some interesting deployment models based on pay-as-you-go (and even “pay-as-you-can-afford”) principles are emerging. These could expand rapidly if they prove to be feasible and scalable. Nevertheless, coverage gaps remain a barrier for those in underserved areas, where fixed-wireless services continue to be an important gap filler.

Mobile operators are being forced to adjust their businesses as voice revenues decline while the rate of growth in data services moderates. The shift from voice to data is expected to continue. Meanwhile, operators are successfully unlocking new revenue streams from content and financial services.

Mobile operators are investing heavily to increase the uptime of their sites during load shedding, while battling battery theft. – © 2023 NewsCentral Media