Revix enables people to invest in crypto like Warren Buffett wants you to invest in stocks: over the long term through buying a low-cost diversified basket of the largest cryptocurrencies that automatically updates every month with the fast-changing cryptocurrency market.

Revix enables people to invest in crypto like Warren Buffett wants you to invest in stocks: over the long term through buying a low-cost diversified basket of the largest cryptocurrencies that automatically updates every month with the fast-changing cryptocurrency market.

Cryptocurrency is revolutionising the way value is transferred throughout the world. It’s no mystery that crypto itself is difficult to understand, not to mention the underlying blockchain technology that it operates on — and how to invest in it safely isn’t yet well understood. Yet demand for cryptocurrencies is increasing at an accelerated rate after Tesla recently bought US$1.5-billion worth of bitcoin.

Examples of mainstream institutional adoption in crypto markets in 2021 continue to abound. From global banks such as Goldman Sachs, Fidelity and Bank of New York Mellon bucking the trend to dozens of corporations like MicroStrategy now holding cryptoassets on their treasury balance sheets in the billions as a reserve. In fact, you can’t turn on the TV or open the newspaper without the latest on some wealthy individual or blue-chip corporation adopting crypto assets or the latest climb in bitcoin price.

Sean Sanders, the founder of crypto investment platform Revix, which is backed by JSE-listed Sabvest, says: “You can pick individual cryptocurrencies to invest in, but even experienced traders struggle to choose individual/specific cryptocurrencies that consistently outperform the overall market. By buying a bundle – rather like a unit trust – takes the guesswork out of it.”

So, it is perhaps no surprise that the simple and low-cost solution of diversified crypto Bundle investing through Revix, which tracks the broader crypto market, has become such a hit with investors. By buying a slice of bitcoin, ethereum, litecoin and cardano all in one, you reap the rewards of their successes without getting dragged down too much when any single cryptocurrency pulls back sharply.

Like the Top40

This is a similar approach to buying the JSE Top40 index, but just for crypto, and it’s a proven way to spread risk through diversification and profit from the returns of the largest cryptocurrencies. Sign-up is quick and simple, the platform offers bank-grade security, the minimum investment is only R500 and there are no monthly fees. You can sell your crypto investment at any time after purchasing and withdraw your funds: There are no lock-up periods like with other investment funds.

The Top 10 Bundle spreads your investment equally over the 10 largest cryptocurrencies – which covers about 85% of the crypto market when measured by market capitalisation – with each having a 10% weighting. By default, you are buying the 10 biggest success stories in the crypto space. The weightings are adjusted monthly to ensure that no single cryptocurrency exceeds a 10% weighting.

While bitcoin accounts for about three-quarters of the total crypto market cap, it only accounts for 10% of the weighting in the Top 10 Bundle. And while it’s true that bitcoin has been the star crypto performer in recent months, it’s actually underperformed the broader crypto market over nearly all longer-term time horizons.

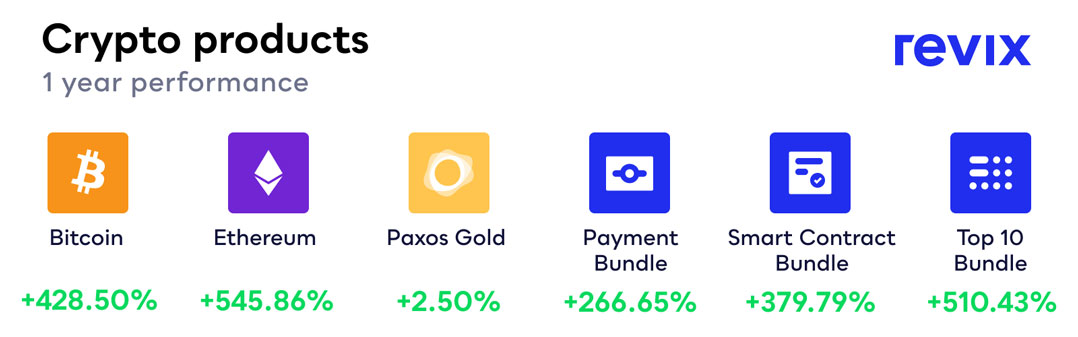

In fact, while bitcoin is up nearly 430% in the last 12-months, ethereum, polkadot, litecoin and chainlink are all up well over 500%, having significantly outperformed bitcoin on a relative basis. This resulted in Revix’s Top 10 Bundle returning 509% over the last 12 months.

In addition, Revix offers two theme-based crypto bundles which provide exposure to groups of cryptocurrencies that have similar functionality and objectives.

The Payment Bundle provides exposure to the five largest payment-focused cryptocurrencies looking to compete with government-issued fiat currencies to make digital payments cheaper, faster and more global. These cryptos include bitcoin (BTC), ripple (XRP), litecoin (LTC), bitcoin cash (BCH) and stellar (XLM).

The Payment Bundle provides exposure to the five largest payment-focused cryptocurrencies looking to compete with government-issued fiat currencies to make digital payments cheaper, faster and more global. These cryptos include bitcoin (BTC), ripple (XRP), litecoin (LTC), bitcoin cash (BCH) and stellar (XLM).

The Smart Contract Bundle tracks those cryptocurrencies that aim to offer an open-source, public network without any downtime, fraud, control or interference from third parties. Smart contracts use the blockchain to allow peer-to-peer transactions without the need for third-party verification. This bundle comprises cryptocurrencies like ethereum that enable developers to build applications on top of their blockchains, much like how developers build mobile apps on top of the Apple iOS. The cryptos in this bundle include ethereum, cardano, tron, neo and EOS.

Revix is accessible to everyone. Whether a R500 investment or R1-million, the online platform is ideal for people who want to get started in crypto but are not sure how or where to begin. Sanders says: “Our main focus at Revix is to make investing easier so that many more people have access and can take advantage of the massive opportunities in today’s markets.”

“Our crypto bundles are unique in that they automatically rebalance once a month, so that customer investments stay up to date with the latest crypto market developments. Top-performing cryptocurrencies are included in our bundles while the poor performers are removed,” said Sanders.

After signing up for an account on www.revix.com, you can then transfer rand and, within minutes, you can invest. You can also purchase bitcoin, Ethereum, USDC (a US dollar “stablecoin”) and Pax Gold which is an asset-backed token backed 1:1 by physical gold bars held in London Brinks Vaults.

For more information, visit Revix.

Disclaimer: This article is intended for informational purposes only. The views expressed are not and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any of the assets or securities mentioned herein. You should not invest more than you can afford to lose, and before investing please take into consideration your level of experience and investment objectives, and seek independent financial advice if necessary.

- This promoted content was paid for by the party concerned