In the dynamic world of finance, mid-sized companies often turn to trusted advisors to help optimise their investment strategies. As these advisors seek secure and flexible investment solutions on behalf of their clients, Sasfin emerges as a compelling choice. In this article, we will explore how Sasfin’s notice and fixed deposit products can provide stability, growth and attractive returns for companies looking to enhance their business growth.

In the dynamic world of finance, mid-sized companies often turn to trusted advisors to help optimise their investment strategies. As these advisors seek secure and flexible investment solutions on behalf of their clients, Sasfin emerges as a compelling choice. In this article, we will explore how Sasfin’s notice and fixed deposit products can provide stability, growth and attractive returns for companies looking to enhance their business growth.

Sasfin’s notice deposit: flexibility meets attractive returns

Sasfin’s notice deposit product empowers advisors, such as fund and investment managers, to strike a balance between flexibility and profitability for clients. Here’s why it’s an enticing choice:

- Competitive annual effective rates: Sasfin proudly offers highly competitive interest rates, with annual effective rates that can significantly boost your clients’ returns. For example, they can enjoy a 9.11% return on a 32-day notice deposit or a remarkable 9.71% return on a 120-day notice deposit.

- Easy access to capital: We understand that maintaining access to funds is important, which is why with Sasfin’s notice deposit, you can withdraw with a notice period as short as 32 days, allowing clients to seize investment opportunities and adapt to market fluctuations swiftly.

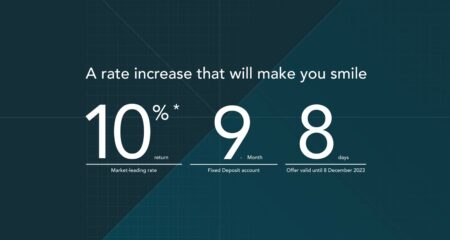

Sasfin’s fixed deposit: predictable returns for strategic planning

For companies with a focus on long-term strategic planning, Sasfin’s fixed deposit product provides stability, predictability and attractive returns.

- Fixed interest rates: A fixed deposit offers a steady and predictable interest rate for the specified term, enabling companies to plan their financial strategies with confidence.

- Customised term options: Sasfin offers a range of term options, allowing for a tailored investment strategy that aligns precisely with clients’ financial objectives.

- Portfolio diversification: Incorporating fixed deposits into an investment portfolio can diversify risk and enhance overall stability, safeguarding your clients’ financial interests.

Personalised solutions

Sasfin understands that each company has unique investment goals and risk tolerance levels. That’s why we offer customised solutions designed to meet your clients’ specific requirements. Whether your clients aim to maximise returns, minimise risk or strike a balance between the two, Sasfin’s experienced team can help you craft the ideal investment strategy.

Expertise and support

By choosing Sasfin, you gain access to a team of seasoned financial professionals committed to helping you and your clients succeed. Sasfin’s experts provide invaluable insights, market analysis and guidance to inform your investment decisions. Regular updates and reports keep you well-informed about your clients’ investments.

Why choose Sasfin?

Sasfin stands out as the preferred choice for trusted advisors serving mid-sized companies for several compelling reasons:

- Trust and reputation: With a storied history dating back to 1951, Sasfin has earned a reputation for financial stability and unwavering commitment to its clients.

- Personalised client services: At Sasfin, we prioritise delivering exceptional, tailored client services. Our dedicated team works closely with you to understand your clients’ unique needs and objectives, ensuring a personalised and attentive approach to their financial success.

- Tailored solutions: Sasfin understands that one size does not fit all, and its solutions are precisely tailored to meet the unique needs of each client.

- Cutting-edge technology: Sasfin leverages state-of-the-art technology to provide seamless and efficient investment solutions, freeing you to focus on your core responsibilities.

- Long-term partnership: Sasfin is dedicated to building lasting relationships with its clients, providing continuous support and guidance throughout your investment journey.

Embrace the potential of Sasfin’s products today and take your clients one step closer to a more secure financial future. With competitive annual effective rates, Sasfin’s solutions are the key to unlocking growth and profitability for your clients’ investments. For investment inquiries, contact [email protected] today.

About Sasfin

Sasfin contributes to society by going beyond a bank to enable entrepreneurs and investors to grow their businesses and global wealth, supporting job creation and sustainable socio-economic development as well as a culture of savings. Our personal touch, digital platforms and agility allow us to compete effectively. Sasfin was listed on the JSE in 1987 and is a bank-controlling company that comprises three business pillars: Asset finance, business and commercial banking, and wealth. The group has regional offices in four South African provinces and eight cities. Sasfin is a B-BBEE Level 1 contributor.

- Read more articles by Sasfin on TechCentral

- This promoted content was paid for by the party concerned