With many crypto investors jealously watching on as gold and equity investors’ assets keep climbing, is it possible that cryptocurrencies have just hit the turning point that many have been waiting for?

With many crypto investors jealously watching on as gold and equity investors’ assets keep climbing, is it possible that cryptocurrencies have just hit the turning point that many have been waiting for?

The crypto market has shed over 50% in recent months, with many worried that a bear market was in full swing and that an 80% loss in value was looming.

People tend to think the worst, but then again, crypto always finds a way to surprise us, and this time being no different. Bitcoin is currently up over 30% from its lows, happening shortly after rumours of potential Amazon payment method adoption, as well as the recent B Word conference featuring Twitter’s Jack Dorsey and Tesla’s Elon Musk, which included praise for the crown cryptocurrency across the board.

When it rains, it pours

The FUD (fear, uncertainty and doubt) was coming from all directions, whether it be the China crackdown, mining hashrate halving, Tesla stopping bitcoin payments, the energy usage of mining being too high, or even the view that Grayscale premium had diminished, dramatically impacting investor demand — these last couple of months have been FUD Central.

All this news hit the surface during a flood of bad press, yet all of it can be explained to represent a positive for long-term growth; you just need to know what’s going on behind the curtain and not take clickbait at face value.

China crackdown and mining hashrate drop

It’s no secret that bitcoin mining in China accounts for 66% of global bitcoin production. This has led to concerns that bitcoin mining was too concentrated in one region of the world, which would expose the network to the risk of outages and political interference.

Positive outlook: This migration will start to decentralise the previously centralised bitcoin hashrate. It’s one of the most significant steps bitcoin has taken towards true decentralisation, and it will allow for the fear of hashrate concentration to be put to bed.

Musk and green energy

Elon Musk added fuel to the fire by saying Tesla would no longer accept bitcoin payments due to its energy use being too high and dependent on dirty coal.

Positive outlook: This has pushed a green movement in bitcoin and crypto like never before, with most miners actively seeking ways to reduce their carbon footprint and increase the chances of a clean mining process for the future. This will inherently reinforce crypto’s longevity and induce more ESG (environmental, social and corporate governance) investment in the future.

Grayscale premium is negative

During this pullback, the Grayscale Bitcoin Trust (GBTC) premium went negative, which many saw as a bad sign — assuming institutional demand was dropping at a rapid rate. But what if the opposite is true?

Positive outlook: More bitcoin options, such as ETFs in Canada, means that Grayscale is not the only option out there for investors to use to get exposure to bitcoin. Therefore, while demand for its product may be coming off a bit, demand for bitcoin investment options is increasing. Also, the fact that GBTC shares are becoming more liquid due to the decreased lockup time from one year to six months means that premiums could be coming down due to more accurate pricing of the shares.

It’s not over; it never was

Let’s take a step back and look for the signs that the crypto market is back on track.

Stock-to-flow – Are we in July 2013?

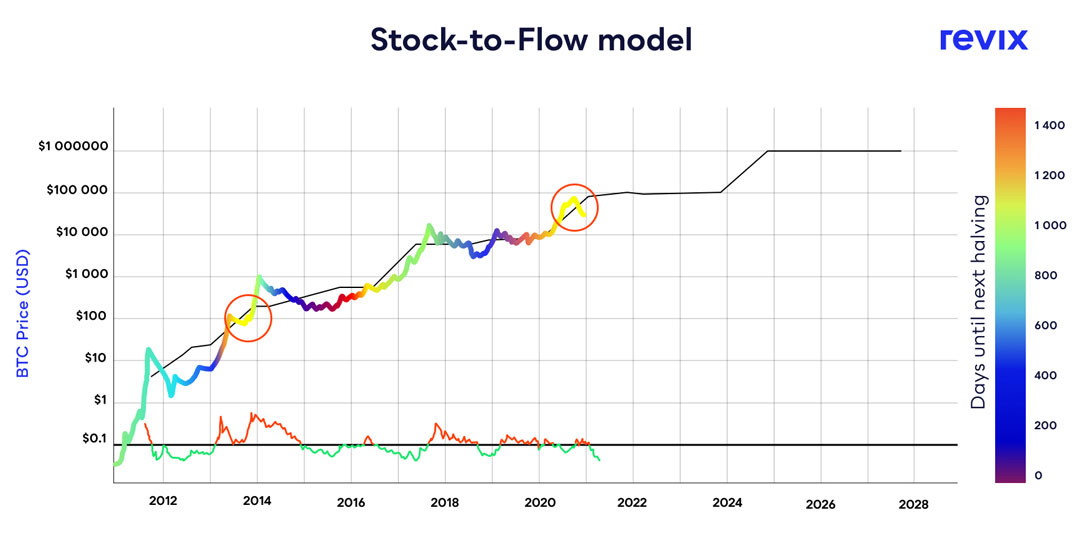

The stock-to-flow model (S2F) was developed as a simple model to value scarce commodities like gold. The S2F ratio shows the current stock of a commodity (current total supply) against the new production flow (amount mined that specific year). For store of value (SoV) commodities like gold, platinum and now bitcoin, a high ratio indicates they are mostly not consumed. Instead, the majority is stored as a monetary hedge, thus driving up the S2F ratio.

In the chart below, the bitcoin price is overlaid atop the S2F ratio line. We can see that the bitcoin price has continued to follow the S2F of bitcoin over time. The theory, therefore, suggests that we can project where the price may go by observing the projected S2F line, which can be calculated as we know the approximate schedule of future bitcoin mining.

The similarities with 2013 are prominent, with a mid-cycle pullback in July 2013 that went on to form a new all-time high in December that year. This year is looking startlingly similar, with both showing dips below the projected line around a thousand days before the next halving.

The similarities with 2013 are prominent, with a mid-cycle pullback in July 2013 that went on to form a new all-time high in December that year. This year is looking startlingly similar, with both showing dips below the projected line around a thousand days before the next halving.

If 2021 is to follow the 2013 shape, we could see bitcoin overshoot the US$100 000 mark by the end of the year.

Log chart – 2021 is copying 2013 to the week

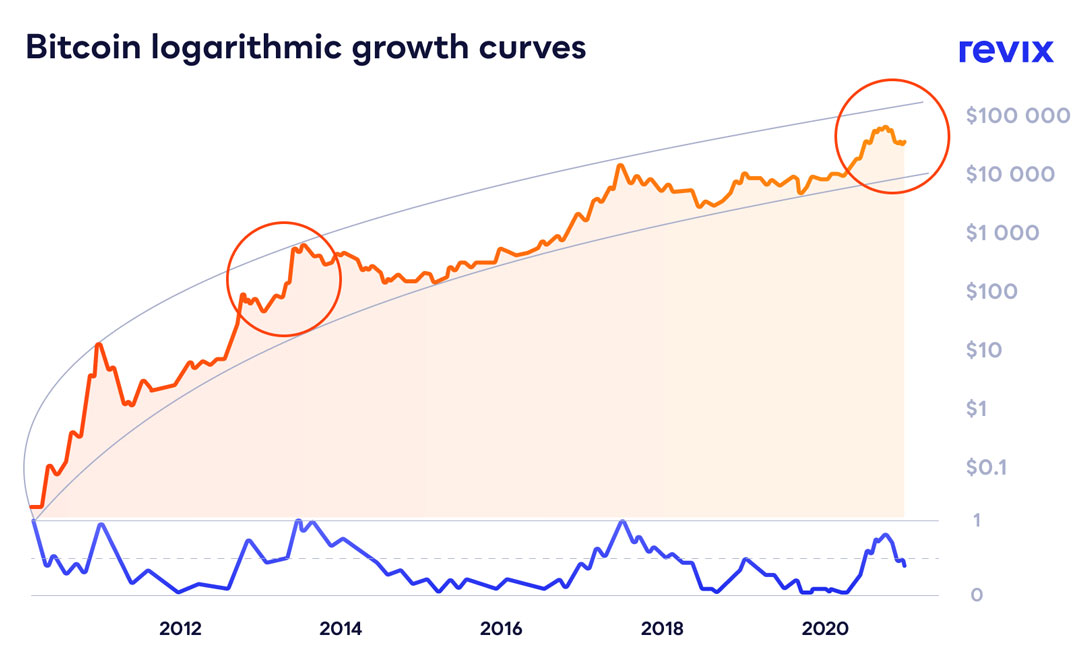

It’s always a smart idea to look at long-term price data using a log graph — for the simple reason that price changes are hard to display on a linear scale and can be misleading over an extended timeframe.

We can see the similarities between 2013 and today with a mid-cycle pullback that happened just before the major rally into the end of 2013.

There are similarities that are startlingly close:

There are similarities that are startlingly close:

- The year 2013 saw its mid-cycle high on the week of 8 April, while the 2021 mid-cycle high was a week later in the week of 12 April.

- The 2013 bottom was locked in on the week of 1 July, while it seems the 2021 bottom got locked in on the week of 19 July.

This could be just a coincidence, but the case for this 2021 weakness being a mid-cycle pullback is growing. If 2021 were to play out like 2013, we could see a run-up in the price of bitcoin to the $138 000 level by December 2021.

B Word – The future is bright

It is believed that this could be the turning point the crypto market needed. After months of bad news, some of the most respected people in the world of business came together to speak about the state of cryptocurrencies and what the future holds.

The B Word conference was the most hotly anticipated crypto debate to date, with arguably three of the biggest names in the corporate crypto space sitting down to talk about the future of crypto. The conference didn’t disappoint, as Elon Musk, Jack Dorsey and Cathie Wood all expressed increased enthusiasm and hope for the asset classes future. This finally put to bed any speculation over Elon Musk’s view on the asset class, as well as Tesla and SpaceX’s holdings and if they would sell – which he stated they won’t.

How do I gain exposure?

At investment platform Revix, you can gain access to ready-made “crypto bundles”. These bundles allow you to own an equally weighted basket of the world’s largest and, by default, most successful cryptocurrencies.

You don’t have to try to guess which up-and-coming cryptocurrencies will become the next bitcoin since you’ll own a diversified basket of cryptos that gets automatically updated every month based on how the crypto market has performed.

Diversification works in every asset class in the world. It should come as no surprise that it works in crypto as well.

For more information about Revix’s USDC Savings Vault, crypto bundles, or a direct way to invest in bitcoin, ether, Pax Gold or USDC, visit Revix.

- This promoted content was paid for by the party concerned