Listed holding companies with investments in listed subsidiaries used to be common in South Africa – a few decades ago.

The well-known diversified group Rembrandt had several in its pyramid-like structure to retain control of investments, as did Liberty and Anglovaal, to name a few of the larger ones. Unlisted shares with enhanced voting rights often went hand in hand with these structures. Eventually these structures all collapsed, and generally for the same reasons.

The most important was that regulators, stock exchanges, fund managers and investors started thinking that shareholders who put up the money should have as much say for every rand they invested as the few shareholders holding a few of those superpower shares.

It was also expensive to maintain these structures — with multiple listings, annual reports, several boards, different shareholding groups (with conflicting ideas), external auditors, different bank accounts, and inter-company loans that saw money flowing between entities.

Another important reason for the collapse of pyramid structures is that they were inefficient, with every single one trading at a discount to the market value of its underlying interests. Shareholders got an immediate gift whenever these structures were collapsed. The discount to net asset value (NAV) disappeared as soon as a company announced the decision to simplify its control structure.

Unbundling

Interestingly, Naspers listed on the JSE when all the holding companies were busy unbundling, but decided to retain its dual share structure to ensure control. Shareholders have been paying the price ever since, especially due to the enormous growth in its investment in the Chinese group Tencent.

The listing of Prosus in September 2019 – adding another entity between Naspers and Tencent – did little to change the situation. Investors now face two of these “discounts”.

The announcement this week of the latest attempt to narrow the discount at which Naspers trades to its NAV admits that the Prosus listing only solved the problem temporarily.

The document states: “The Prosus listing successfully unlocked US$16-billion of value for shareholders at the time of execution. The Prosus listing also created Europe’s largest listed consumer Internet company, providing a strong platform to attract incremental investor capital to support the Prosus group’s continued growth ambitions.

“Based on the Prosus group’s consistent outperformance, however, it was clear that further action would be required in the future. Since the Prosus listing, Naspers’s weight in the benchmark SWIX index has increased back to 23.3% in April 2021, again contributing to the widening of the discount to NAV.”

Management basically believes that the Naspers share price is too low because “many South African-based investors have single share limits and mandate restrictions, which led to forced selling of Naspers” as the share price increased in line with the group’s growth.

If anything, the listing of Prosus in Europe and its fast growth exacerbated the problem.

“This is as a result of the rapid increase in value of the Prosus group’s portfolio since the Prosus listing and the significant outperformance of consumer Internet companies in 2020 and 2021,” says management.

Naspers and Prosus CEO Bob van Dijk and his sidekick, chief financial officer Basil Sgourdos, listed several reasons why the new proposal will address the problem, unlock the discount for shareholders and add value overall.

‘Quite simple’

Prosus proposes acquiring a significant stake in Naspers, its holding company, in exchange for new Prosus shares. It offers Naspers shareholders 2.27443 Prosus shares for every Naspers share to acquire a maximum (and at the same time a minimum) of 45.4% of the listed Naspers N ordinary shares.

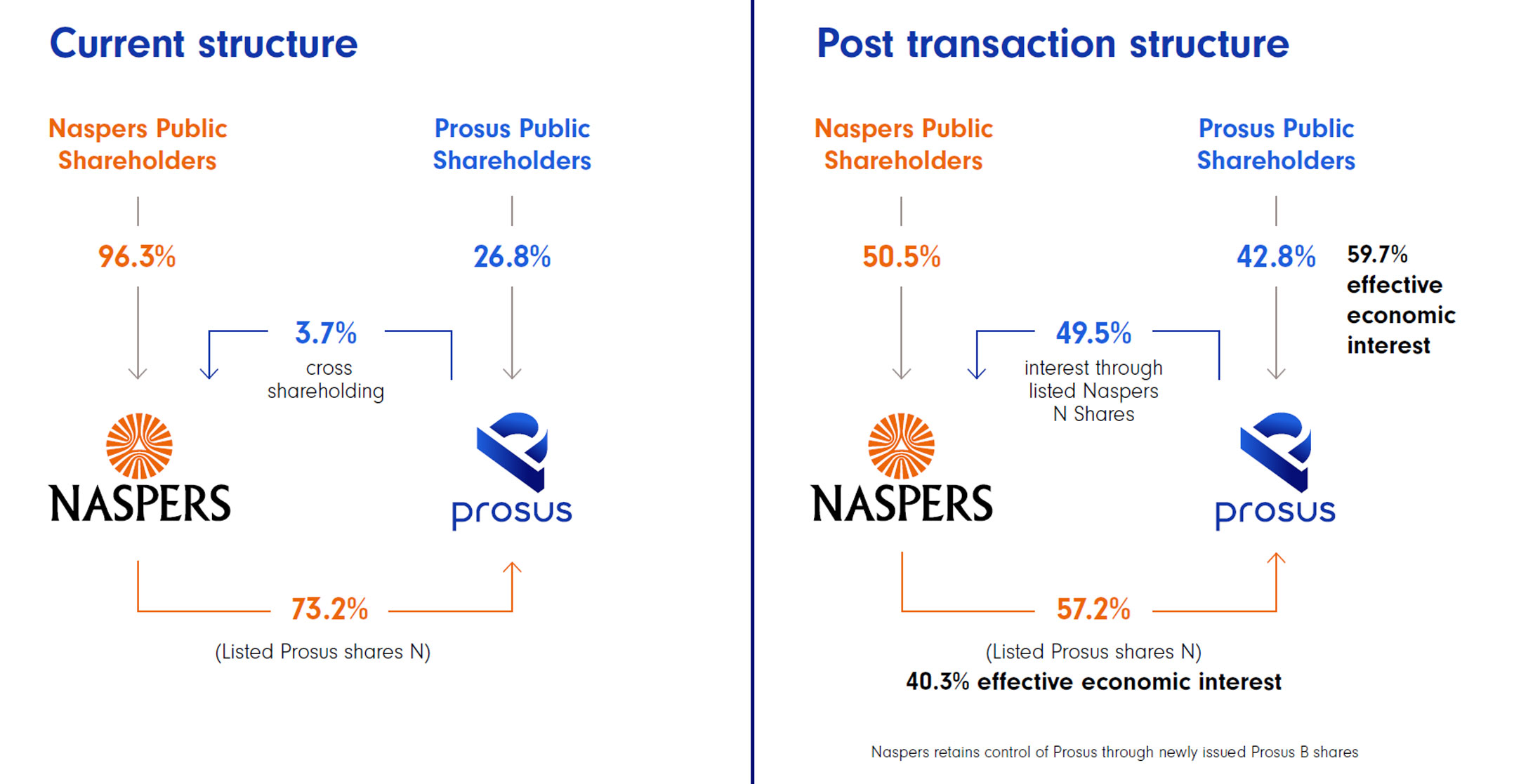

Together with the Naspers shares it already owns, this will increase its stake to 49%, which equates to an economic interest of 49.5% – while Naspers’s interest in Prosus will drop from 73. 2% to 57.2%.

Van Dijk and Sgourdos ventured in a virtual press conference that this solution to the discount problem would be economic, effective and easy to implement. “It looks elaborate, but it’s quite simple,” says Sgourdos.

It doesn’t look simple on the following infographic provided by Prosus:

Pity the analyst who has to explain the structure to their fund manager, or think of the reaction of a fund manager deciding between thousands of shares.

Van Dijk and Sgourdos however say the proposed transaction will create immediate and ongoing value for shareholders. They say the proposal will unlock immediate value by lowering the discount between Naspers and Prosus, with the share ratio of 2.27 divvying up the value between Naspers and Prosus shareholders.

“The exchange ratio reflects a sharing of value creation between existing Naspers shareholders (72.6%) and existing Prosus free float shareholders (27.4%) consistent with their existing ownership of the underlying NAV of Prosus and Naspers,” according to the announcement.

“Assuming that Prosus ordinary shares trade at the same discount to NAV after the proposed transaction, the value creation for existing Naspers shareholders is a function of moving underlying value or NAV from the higher discount to NAV Naspers N ordinary shares to the lower discount to NAV Prosus ordinary shares,” it says.

Management made a point of saying that nothing will actually change concerning Naspers’s ownership and control of Prosus. Prosus will simply issue more of a new class shares to Naspers to ensure control.

Neglible

The new Prosus B share will not be listed on any stock exchange, and while it will have the same voting rights per share as ordinary Prosus shares, it will have negligible economic rights. The announcement mentions that it will have only a millionth of the economic right compared to ordinary shares, implying that Naspers will get a lot of these to retain voting control.

“The number of Prosus ordinary B shares to be issued to Naspers as part of the proposed transaction, and from time to time, will be such that Naspers will continue to hold 72% of the aggregate number of issued equity shares in Prosus,” according to the announcement.

Shareholders have not started their celebrations yet. The Naspers share price showed no indication that there is a windfall of a narrowing in the discount to NAV in the offing. Naspers fell sharply just before the close of trading on Wednesday to reverse earlier gains, enlarging its discount to Prosus and indicating that shareholders are not keen on this plan at all.

Naspers would have jumped sharply when the JSE opened for trade if investors believed the proposal would unlock any of the discount to NAV. The value of the Prosus shares offered to Naspers shareholders was still barely higher than the current market price of Naspers.

The market predicts no change.

Effectively, Naspers and Prosus are still in a tight spot. The problem is that the discount to its ultimate valuable investment, Tencent, is still very much an issue. The only way to unlock this discount is to unbundle or sell the interest in Tencent. This is not viable as long as Tencent remains a good investment or as long as Naspers and Prosus need that annual dividend to fund their other ventures.

The alternative is that shareholders learn to live with the discount – and that management ignores any complaints about it and focuses on growing all those other investments.

- This article was originally published on Moneyweb and is used here with permission