Vodacom Group earlier this week released a trading update for the quarter ended 31 December 2021 that showed its subscriber base in South Africa had grown to 45.8 million, from 44.3 million a year ago.

Vodacom Group earlier this week released a trading update for the quarter ended 31 December 2021 that showed its subscriber base in South Africa had grown to 45.8 million, from 44.3 million a year ago.

But how does South Africa’s largest mobile operator by subscribers stack up against the country’s other telecommunications providers?

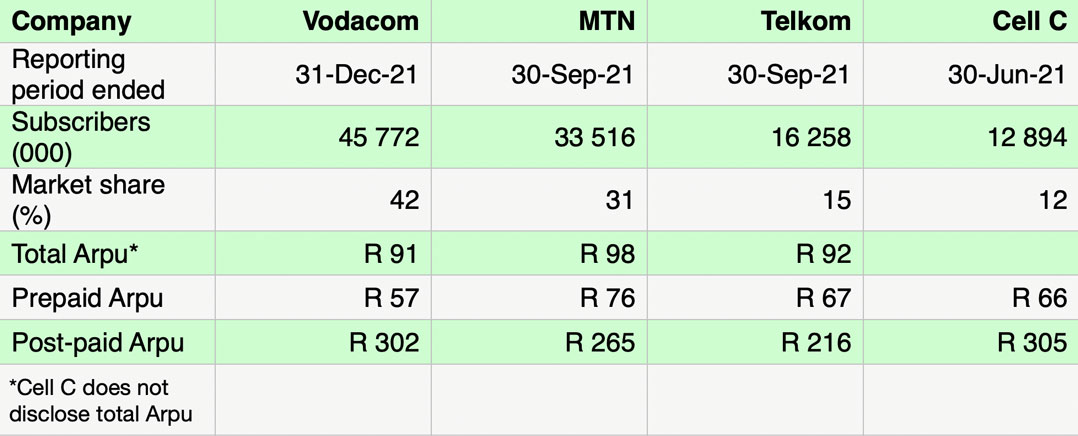

To find out, TechCentral analysed the most recent reports of the four biggest players in the market – Vodacom, MTN, Telkom and Cell C – to see how they compare.

As is clear from the table below, Vodacom remains well ahead of next-nearest rival MTN, with a commanding market share of 42%. This compares to MTN’s 31%.

Telkom, though it has made significant market share gains in recent years, has a share of just 15% of the market by subscribers, while Cell C – which until last year was the third largest player – is now in fourth place with 12%.

However, subscriber numbers and market share only tell a portion of the story. Another closely watched number – by investors, anyway – is the Arpu line, or the average revenue per user.

Here, MTN is the winner, with a total (or “blended”) Arpu of R98, ahead of Telkom with R92 and Vodacom with R91. Cell C didn’t disclose its blended Arpu in its most recent set of financial results – the six months to 30 June 2021 – and declined to provide the number when asked for it by TechCentral for this article.

Cell C did, however, disclose its contract (post-paid) and prepaid Arpu numbers, and these came in at R305 (the highest in the market) and R66 (the third lowest). Vodacom’s contract Arpu was second highest at R302, while Telkom’s was lowest at R217.

One caveat to note when looking at these numbers is that they don’t relate to the exact same reporting periods but rather show the most current data available from the operators (Vodacom being most current and Cell C least current). However, the figures do provide a reasonable basis for comparison. — Additional reporting by Duncan McLeod, (c) 2022 NewsCentral Media