Nvidia, the world’s largest chip maker by market value, gave an upbeat forecast for the fourth quarter, fuelled by its expansion into data centre semiconductors and other markets.

Revenue in the period will be about US$7.4-billion, the company said Wednesday. That compares with a $6.86-billion average analyst estimate. The shares rose as much as 3.9% in late trading after the report was released.

Nvidia, whose roots are in graphics chips for gaming systems, has pushed into processors that run servers — the powerful machines used by cloud computing and corporate networks. Revenue from that segment jumped 55% last quarter to $2.94-billion, well ahead of the $2.69-billion estimated by analysts. Sales to the car industry, though, were disappointing — hurt by supply constraints.

Nvidia has averaged about 57% revenue growth over the last eight quarters. That performance has helped push its market capitalisation above $730-billion, making it more than three times the size of Intel, a company that has triple Nvidia’s annual revenue. Nvidia is now one of the top 10 companies by market value in the S&P 500 Index.

Even before the post-market rally, Nvidia’s shares had more than doubled this year.

Its performance has helped push its market capitalisation above $730-billion, making it more than three times the size of Intel

Nvidia posted record sales of $7.1-billion in the third quarter, topping the $6.81-billion average prediction from analysts. Earnings came in at $1.17/share, excluding some items, compared to an estimate of $1.11.

Meanwhile, Nvidia is more than a year into the process of trying to acquire ARM, a designer of chips used in smartphones and myriad other technologies. It’s still trying to obtain regulatory clearance for the deal in multiple jurisdictions around the world.

The US Federal Trade Commission has expressed concerns about the purchase, Nvidia said on Wednesday.

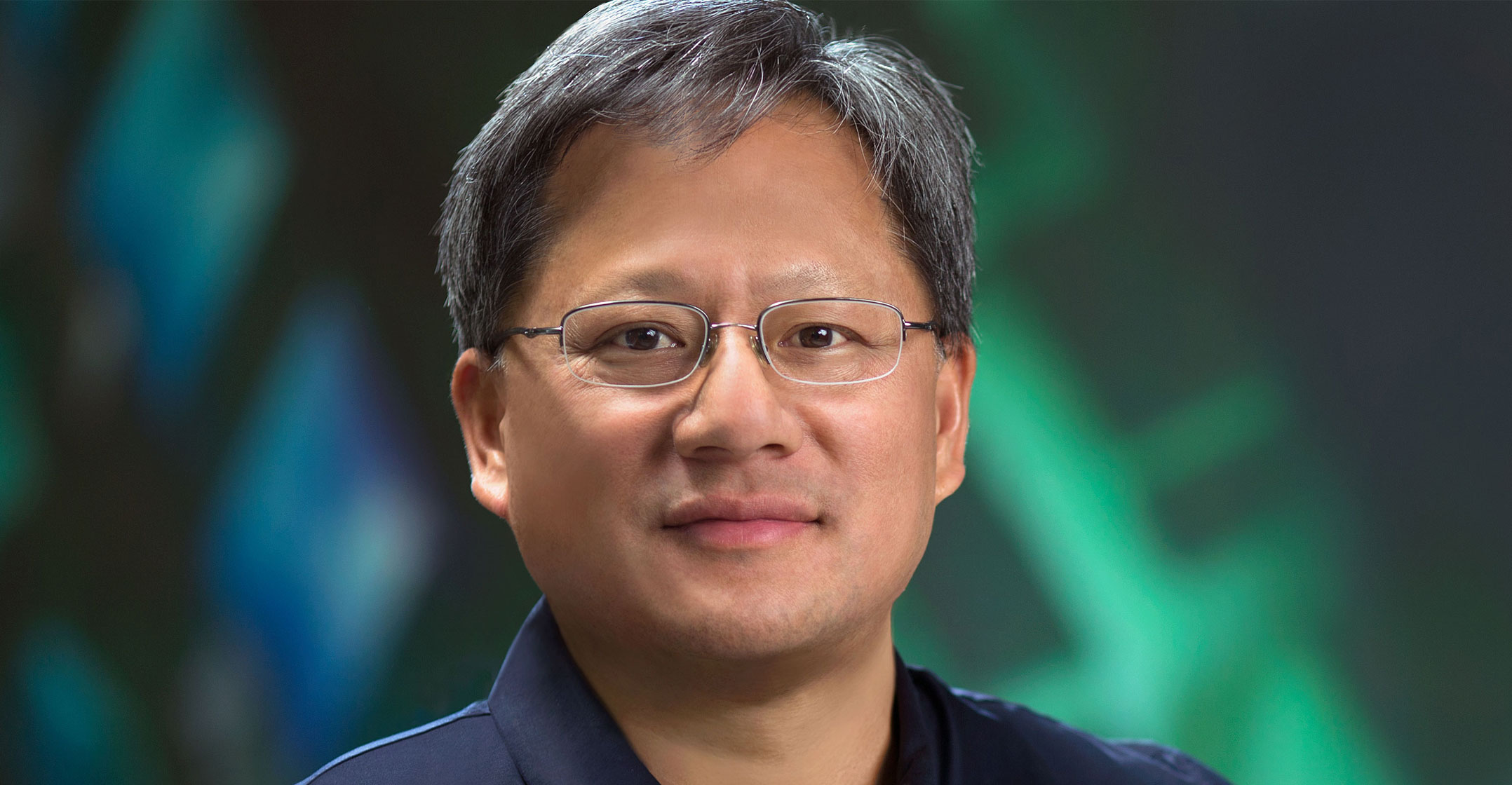

The transaction would give Nvidia CEO Jensen Huang the most widely used underlying technology in the chip industry and spread the company’s reach into many devices, including smartphones. But several of ARM’s major customers, and Nvidia’s competitors, have voiced their opposition to the purchase because of potential conflicts it might create. SoftBank Group currently owns ARM. — (c) 2021 Bloomberg LP