Snap, the parent company of Snapchat is looking to go public with an initial public offering in March 2017. Snap has filed its intentions secretly with the US Securities and Exchange Commission (SEC) and it is expected to be valued at between US$20bn and $25bn. Snap’s current earnings are not publicly disclosed but because its filing with the SEC was private, they are thought to be less than $1bn/year.

Snap, the parent company of Snapchat is looking to go public with an initial public offering in March 2017. Snap has filed its intentions secretly with the US Securities and Exchange Commission (SEC) and it is expected to be valued at between US$20bn and $25bn. Snap’s current earnings are not publicly disclosed but because its filing with the SEC was private, they are thought to be less than $1bn/year.

There was a time when the public’s enthusiasm for social media companies was such that Snap’s valuation would never have been questioned. When Twitter listed on the stock market, it was valued at $25bn, a price only made believable by the optimistic view that it would eventually find a business model that would drive phenomenal growth. It didn’t do that of course, and three years later its value is 50% of that initial value, it is laying off staff and it recently couldn’t persuade anyone that it was worth buying.

Twitter is now a company with few prospects and facing enormous challenges to put in place meaningful ways of generating revenue.

Given how hard it is to find ways to make money from social media outside of advertising, it is not clear how Snap intends to make the sort of money that would justify its very high valuation. Facebook has succeeded so far with advertising because the platform is ideally suited to finding out a great deal of information about users that can then be used to deliver targeted ads in multiple formats. But even Facebook is starting to find that there is a limit to how many ads they can load onto someone’s news feed.

Twitter and Snapchat are at an immediate disadvantage as advertising platforms because they have far less capacity to find out meaningful information about their users but also far fewer options of how to present them ads. Both Snapchat and Twitter are hoping that they can transform themselves into media companies and get their users to consume video from companies through their platform. However, in the media space, they are up against much better competitors such as Google, Facebook, Amazon and even Apple.

Snap has recently branched out into hardware with the launch of Spectacles, sunglasses that are fitted with a camera that can take short videos to store and publish through Snapchat. Although Snap’s Spectacles are certainly less geeky than Google’s Glass glasses, they may suffer from the same social stigma that ended Google Glass as a consumer product. It is also not clear why people would want to wear glasses with camera on the off chance that there was something worth filming for 10 seconds. Even if “Specs” is a successful product, it still would only generate a tiny fraction of the revenues that Snap will have to make to justify its price.

The other challenge Snapchat faces is in its core functionality and the battle for users’ time. Snapchat’s features have been largely duplicated by Facebook’s Instagram. Instagram also has twice the number of daily active users than Snapchat.

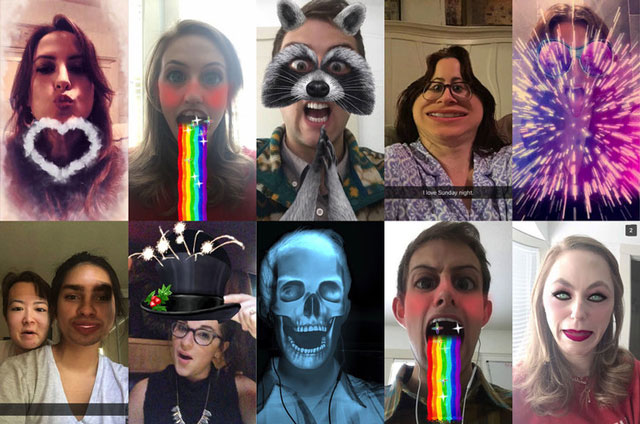

The difference between the two services is in the type of communication that each allows. Snapchat’s original focus was on disappearing messages that could be used for “sexting”. Although this has become a smaller part of the reasons why people use Snapchat, the ephemeral nature of Snapchat messages is really about humorous, but essentially trivial, types of communication.

Other apps like Facebook Messenger and WhatsApp also now allow secure and private communication making Snapchat less unique.

Unlike Snapchat, Instagram tends to encourage photos that are more considered, encouraging a broader range of quality and communication. This is mostly because the photos are enduring and intended for larger audiences. At the end of the day, a social network is where your friends are and all of them are likely to be on Facebook, far less likely to be on Snapchat.

There is an overwhelming sense that Snap is trying to raise money for its service now, because it can. Seeing Twitter’s struggles must be a sharp reminder that staying relevant as a social media platform is not a given, despite early success. Snap will also find that being public and having its performance constantly scrutinised is going to be extremely tough going.

For shareholders and investors, IPOs are known as an “exit strategy”, a way of realising the gains on your investment or unlocking the value of your shares as one of the founders or employees. An exit strategy may be appropriate in the case of Snap given that it will be incredibly hard to maintain revenue growth when your principle audience is young and fickle.![]()

- David Glance is director of the UWA Centre for Software Practice, University of Western Australia

- This article was originally published on The Conversation