In a year when populist voters reshaped power and politics across Europe and the US, the world’s wealthiest people are ending 2016 with US$237bn (R3,3 trillion) more than they had at the start.

Triggered by disappointing economic data from China at the beginning, the UK’s vote to leave the European Union in the middle and the election of billionaire Donald Trump at the end, the biggest fortunes on the planet whipsawed through $4,8 trillion of daily net worth gains and losses during the year, rising 5,7% to $4,4 trillion by the close of trading on 27 December, according to the Bloomberg Billionaires Index.

“In general, clients rode through the volatility,” said Simon Smiles, chief investment officer for ultra-high-net-worth clients at UBS Wealth Management. “2016 ended up being a spectacular year for risk assets. Pretty remarkable given the start of the year.”

The gains were led by Warren Buffett, who added $11,8bn during the year as his investment firm Berkshire Hathaway saw its airline and banking holdings soar after Trump’s surprise victory on 8 November. Buffett, who’s pledged to give away most of his fortune to charity, donated Berkshire Hathaway stock valued at $2,6bn in July.

The US investor reclaimed his spot as the world’s second-richest person two days after Trump’s victory ignited a year-end rally that pushed Buffett’s wealth up 19% for the year to $74,1bn.

“2016’s been event-driven with global news driving prices rather than fundamentals,” said Michael Cole, president of Ascent Private Capital Management, which has about $10bn of assets under administration. “The belief that Trump is going to come in and deregulate big parts of the economy is driving the markets right now.”

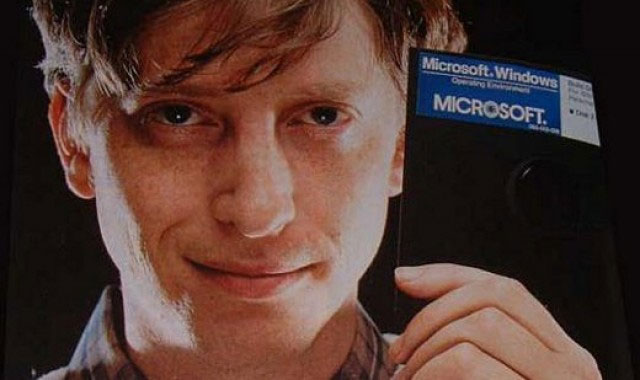

The individual gains for the year were dominated by Americans, who had four of the five biggest increases on the index, including Microsoft co-founder Bill Gates, the world’s richest person with $91,5bn, and oilman Harold Hamm.

The country’s richest were largely opposed to a Trump presidency during the election, including Dallas Mavericks owner Mark Cuban, who told the media in May that stocks could fall as much as 20 percent if Trump were to win the election.

US billionaires — including Buffett — favoured Trump’s rival Hillary Clinton. Still, they profited from his victory when they added $77bn to their fortunes in the post-election rally fuelled by expectations that regulations would ease and American industry would benefit.

The New York real estate mogul is building a cabinet heavy on wealth and corporate connections, and light on government experience, a mix that hedge fund billionaire Ray Dalio said last week would unleash the “animal spirits” of capitalism and drive markets even higher. Dalio is the world’s 63rd richest person with $14,1bn.

Investors and executives welcomed Trump’s picks, including billionaire Wilbur Ross to lead the department of commerce and former Goldman Sachs executive Steven Mnuchin as his treasury secretary, who have a combined net worth of at least $5,6bn, according to the index.

“You know, I was not opposing Trump as much as most people,” Saudi Arabian billionaire Mohamed Bin Issa Al Jaber said in an 11 December interview. “He’s capable and — as a businessman — he’s shrewd about the bottom line. The people he’s surrounding himself with have baggage but they’re also successful and shrewd.”

France’s Bernard Arnault was the sole non-American representative among the five best performers, adding $7,1bn to take his fortune to $38,9bn. His LVMH Moet Hennessy Louis Vuitton said the Chinese luxury goods market is improving.

Gates remained the world’s richest person throughout the year. Amancio Ortega, Europe’s richest person and founder of the Zara clothing chain, was in second place on the index for most of the year until he ceded it to Buffett in November. Ortega, who dropped $1,7bn in 2016, is the world’s third richest person with $71,2bn.

Wildcatter Hamm’s fortune was propelled by a strengthening oil price and expectations a Trump administration will slash fossil fuel regulations. Hamm added $8,4bn to more than double his fortune to $15,3bn. He led the 49 energy, metals and mining billionaires, who were the best-performing category on the ranking, adding $80bn and reversing the $32bn fall they had in 2015.

Billionaire brothers Charles and David Koch each dropped $2bn after Koch Industries reported on its website that annual revenue is estimated to be “as high as $100bn”, compared with the estimate of “as much as $115bn” that the conglomerate published on the site previously. Company spokesman Rob Carlton stated in a 17 November e-mail that Koch revenue fluctuates with the price of commodities.

Technology fortunes were the second best performing on the ranking, with 55 billionaires adding $50bn to their fortunes over the year, despite worries that a Trump presidency might introduce policies that could hurt their companies.

“I think we’ll have to see what the policies of the administration are,” Google co-founder Sergey Brin told the media gathered on the red carpet of the annual Breakthrough Prize gala in Silicon Valley in December. “I certainly hope they will be pro-science, pro-technology and all the things this world has really benefited from.”

Amazon.com founder Jeff Bezos, who doubled his fortune to $60bn in 2015, led gains among technology executives again this year, rising $7,5bn in 2016 on robust sales growth at the online retailer. He was followed by Facebook co-founder Mark Zuckerberg, who added $5,4bn.

Hidden wealth

Some of the industry’s biggest relative gains went to the founders of the world’s leading start-ups, such as Uber Technologies’ Travis Kalanick and Snap’s Evan Spiegel. The so-called “unicorn” billionaires, which include Spotify co-founder Martin Lorentzon, who was identified as a billionaire for the first time in 2016, secured a series of mammoth funding rounds while moving closer to testing their fortunes on the public markets.

Other billionaires uncovered by the Bloomberg index in 2016 included the father and son behind Jose Cuervo tequila, New York real estate developer Axel Stawski and Kosovo construction tycoon Behgjet Pacolli.

The index also unveiled 11 surviving family members of reclusive Thai entrepreneur Chaleo Yoovidhya, the inventor of Red Bull, whose heirs share a combined $22bn net worth, the world’s largest energy-drink fortune. Three billionaires emerged in Argentina, including the country’s first technology billionaire Marcos Galperin, as markets rose on enthusiasm for President Mauricio Macri’s finance-friendly economic policies.

Most fortunes outside of the US didn’t get the same boost from Trump’s victory, and were hurt by fluctuating commodities prices and the rise of the dollar, the currency used for the Bloomberg ranking. Nine of the 10 biggest decliners in 2016 were from outside the US, led by China’s second richest person, Wang Jianlin, who lost $5,8bn. Wang ended the year as the world’s 21st richest person with $30,6bn.

Nigeria’s Aliko Dangote, the richest person in Africa, lost $4,9bn or one-third of his wealth as the combined effect of falling oil prices and the June devaluation of the naira pushed him to number 112 with $10,4bn. Dangote was the world’s 46th richest person in June.

Saudi Arabia’s Prince Alwaleed Bin Talal Al Saud fell $4,9bn, a 20% drop. Alwaleed said in November that all of his stakes in public companies including Citigroup are potentially for sale, reversing a longstanding policy that some of his most prized shareholdings were “forever.”

Chinese downturn

Wealth creation in China turned negative for the first time since the inception of the Bloomberg index five years ago, with the country’s richest losing $11bn in 2016 amid a slump in the Shanghai Shenzhen CSI 300 index and a 7% decline for the yuan against the dollar.

Alibaba Group founder Jack Ma closed the year with $33,3bn, adding $3,6bn in 2016. He dropped in and out of his place as Asia’s richest person for the first four months of the year before claiming it for good in May after Alibaba’s finance affiliate, which is laying the groundwork for an initial public offering expected as soon as next year, completed a record $4,5bn equity fundraising round.

China has 31 billionaires on the index with $262bn, trailing the US, which has 179 billionaires who control $1,9 trillion, and Germany, whose 39 individuals have $281bn. Russian billionaires also began to put the negative effects of US and European sanctions behind them, reversing the combined $63bn declines for 2014 and 2015 and adding $49bn in 2016.

Wealth managers for the world’s richest are girding themselves for similarly frenetic start to 2017 as the seismic changes voters demanded this year start to take shape.

“Expect the unexpected,” said Sabine Kaiser, founder of SKadvisory, which advises family offices on venture capital and private equity. “I don’t think family offices are overly concerned or getting too nervous but after Brexit and Trump they’ve resigned themselves to market volatility.” — (c) 2016 Bloomberg LP