MultiChoice South Africa CEO Calvo Mawela is confident the pay-television broadcaster can arrest the decline in the number of lucrative DStv Premium bouquet customers on its books.

Speaking to TechCentral on Tuesday following Naspers’s announcement that it will unbundle MultiChoice to shareholders and list the company on the JSE, Mawela said the rate of decline is already falling — from roughly 100 000 disconnections in the 2017 financial year to about 40 000 in 2018. This rate of decline, which includes people downgrading to cheaper bouquets, will fall further, he predicted.

The company will stop the haemorrhaging, he said, by improving the content offering and improving its online products. These include improvements the company is making to Showmax — which is available free of charge to Premium subscribers — and to DStv Now, its online streaming option that provides live channels and Catch Up content.

“There is a lot of focus and investment going into our online offering to ensure we keep people in our ecosystem,” he said. This includes developing an online-only option — a “dishless product” as Mawela calls it — which will be launched in 2019. It will also continue to make enhancements to its various platforms to make it easier for viewers to surface content they’re interested in. This will include harnessing artificial intelligence technology.

MultiChoice is constantly evaluating the make-up of its bouquets, Mawela added, but said he is confident that the “mix at the moment seems to be the right balance” and “provides the best value for our customers”.

“If you look at Netflix versus DStv Premium, there’s no way you can compare them. Some people say Netflix is better, but it has no sport, no local content and no news. There are a whole lot of things people don’t factor into the overall mix. It is not a fair comparison. We have the best product in the market… I still believe we still have a better offering than any other player in the market.”

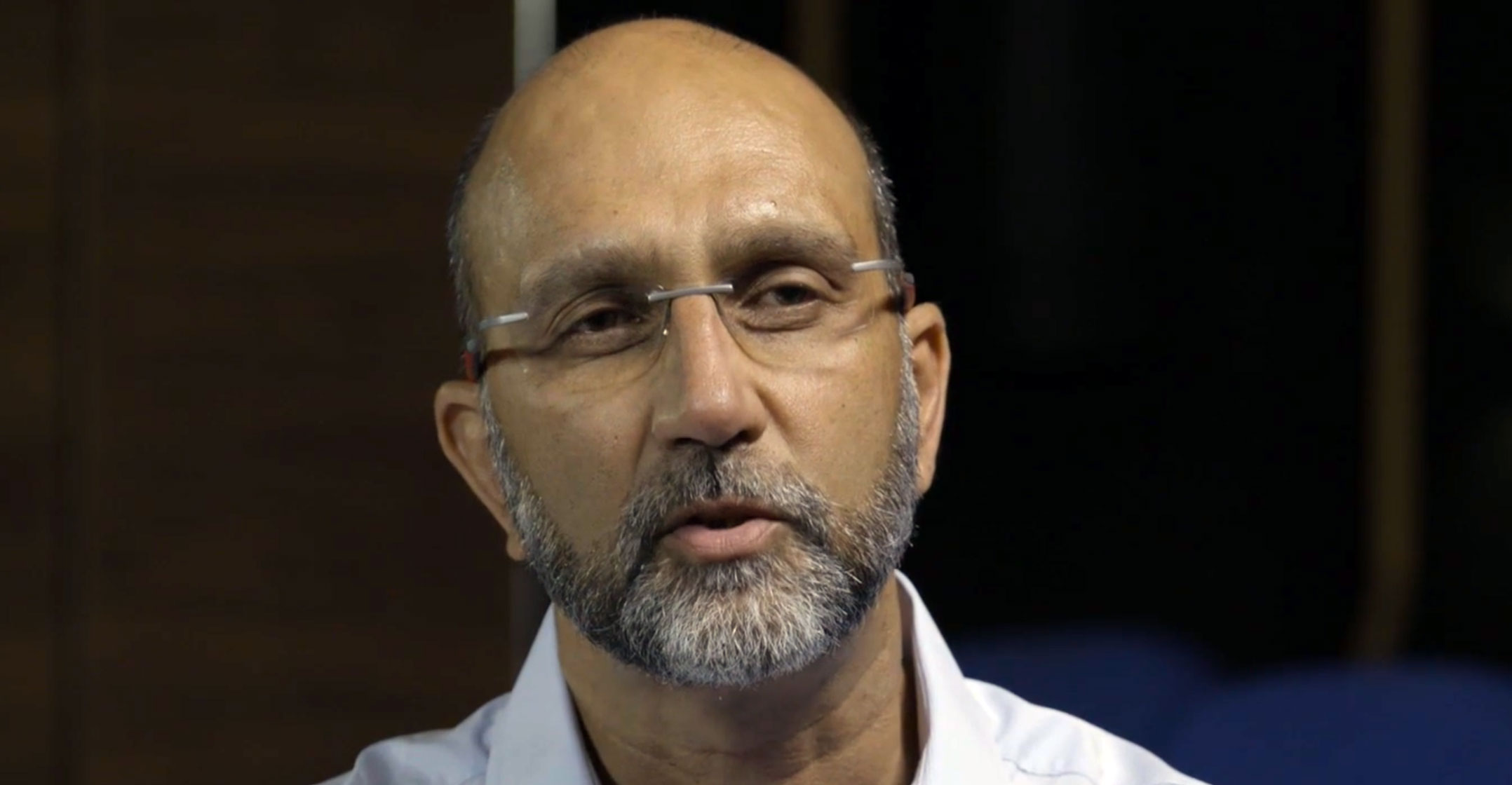

Imtiaz Patel, CEO of Naspers’s video entertainment unit — which houses MultiChoice — said the company is always evaluating its bouquets. “Everything is on the table. We are looking at various options,” he said.

‘Configurations’

“Calvo’s team is looking at configurations for the bouquet structure. You could add a sports offering onto your Showmax offering,” Patel said. “There are a number of things that are available to the business in the future. We have the capability and the content; it’s about timing and opportunity.”

Despite Naspers’s decision to unbundle MultiChoice — it will not have a stake in the business after the listing — Patel denied that the group is exiting while the going is still relatively good. He said it’s important to Naspers that MultiChoice continues to be successful.

There are plenty of opportunities to grow the pay-TV base, especially in the rest of Africa, he said. “We have grown the subscribers by 50% in the past two-and-a-half years. That’s no mean feat. We think there is strong upside for us in the rest of the continent.”

Although MultiChoice has lost DStv Premium subscribers in South Africa, Patel said this is a function of the weak economy and the fact that some sports, such as rugby, have not done well on the field, crimping consumer enthusiasm for them. However, “affordability is a big issue and some people have down-traded”.

MultiChoice has become more efficient and needs to get more efficient still, Patel said. But growth opportunities remain, including in online streaming where the company will be able to leverage its content and know-how to deliver a compelling product. “We feel quite bullish about that … though (the price of) data is still a massive barrier.” — © 2018 NewsCentral Media