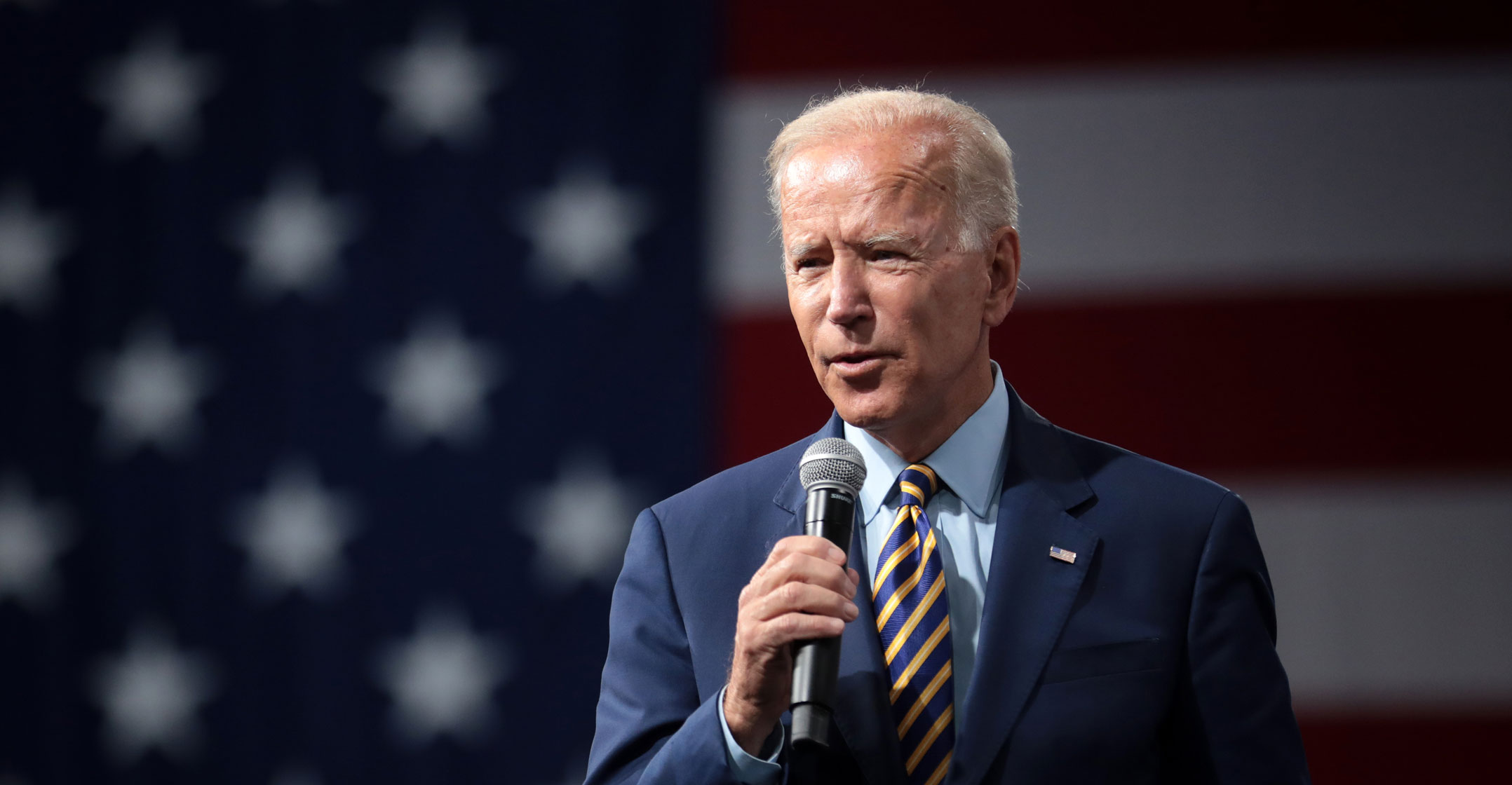

The Biden administration will soon have to settle a bitcoin fight it didn’t even start, and its decision could have far-reaching implications for the cryptocurrency industry.

The Biden administration will soon have to settle a bitcoin fight it didn’t even start, and its decision could have far-reaching implications for the cryptocurrency industry.

The battle concerns last-minute rules proposed by the Trump administration that would create new requirements for financial services firms to record the identities of cryptocurrency holders.

The measures are meant to smother attempts to use bitcoin and other cryptocurrencies for money laundering or to finance illegal activities. If adopted, they could cause cryptocurrency prices to plummet, according to some analysts.

Heavyweights from both K Street and Wall Street have mobilised against the rule, including the US Chamber of Commerce, mutual fund giant Fidelity Investments and venture capital firm Union Square Ventures. Cryptocurrency players like the Winklevoss twins, the Blockchain Association and Coinbase are also fighting the measures.

After President Donald Trump lost the election, the US treasury department raced to issue the rules, which fell under its Financial Crimes Enforcement Network, or FinCEN. The move generated thousands of negative comments and drew the threat of a lawsuit by a crypto trade group — prompting a last-minute reprieve that pushed the final decision to the Biden administration and treasury secretary Janet Yellen. There’s no timetable for when a decision will be made.

Big call

The proposal threatens what some view as bitcoin’s strongest feature: the ability to send money without the government watching. Users whose wallets now are only identified with codes would have their true identities recorded with the financial institutions they zealously avoided.

If Yellen moves forward with the rules, crypto proponents say some virtual currency services will become more costly and some uses of such currencies could disappear completely. If she doesn’t, some fear criminals will be free to circumvent US surveillance to hide money or finance terrorism.

If adopted, the regulations could cause a sharp fall in the prices of virtual currencies like bitcoin, said Matthew Maley, chief market strategist for Miller Tabak & Co, adding that he thinks bitcoin’s price will continue to rise in the long term. On Thursday at 5pm in New York, one bitcoin cost US$47 919, up 5.7% from the end of February, but still nearly 18% below its peak on 21 February.

“Bitcoin is very risky and very volatile and it’s going to continue to be that way. If you add something like a new regulation, it’s going to be very vulnerable to a correction,” Maley said.

At issue is a FinCEN proposal meant to make it harder for bitcoin users to hide their identities. One part of the rule would require banks and money services businesses, like cryptocurrency exchanges, to file a report to the US treasury when a customer moves at least $10 000 worth of virtual currency into a wallet not hosted at an exchange. Those so-called unhosted wallets can be kept offline and are hard to track. Banks send such reports under anti-money laundering rules when customers withdraw $10 000 in cash.

The second part of the regulation would require banks and exchanges to keep a record whenever their customers send $3 000 worth of virtual currencies to someone else’s unhosted wallet. The record would have to include the identity of the counterparty, something that bitcoin advocates said would be expensive and sometimes impossible to verify.

Normally, such rules undergo a lengthy public process that involves months of feedback and revisions. But when FinCEN published the rule on 18 December, it said it wanted to move swiftly and allowed only 15 days for comments — during a time period that included both Christmas and New Year’s Eve. As a rationale, FinCEN officials said the lack of oversight on some transactions was a national security threat.

The truncated comment period took bitcoin advocates by surprise, said Kristin Smith, who leads the Blockchain Association, a cryptocurrency trade group. Smith said she had expected the US treasury to take several months, but it suddenly became an “all-hands-on-deck situation”. The organisation in December threatened to sue the treasury for rushing the process.

Rushed

Crypto advocates flooded FinCEN with comments, arguing that the process was rushed and the rules were unworkable. FinCEN to date has received about 7 600 public comments.

The US Chamber of Commerce wrote that the rule would have “unintended long-term consequences” on the cryptocurrency industry. Hedge fund manager Mike Novogratz’s Galaxy Digital Holdings also submitted comments excoriating the proposal.

Gemini, a crypto exchange founded by Cameron and Tyler Winklevoss — the twins who settled a long-running dispute with Facebook founder Mark Zuckerberg over who had the idea for the social media network — wrote that FinCEN’s proposal could actually increase money laundering by encouraging criminals to move all of their crypto activities to unregulated markets outside the US.

Republican lawmakers, including former representative Cynthia Lummis, who is now a Wyoming senator; Arkansas senator Tom Cotton and Democratic representative Tulsi Gabbard of Hawaii, also reached out to Mnuchin in letters and phone calls to criticise the rule and short comment period.

Fight for the Future, a digital rights advocacy group, set up a website, called “Stop Financial Surveillance”, that said FinCEN’s proposal would “facilitate extremely intense financial surveillance on an unprecedented scale”. The site included a Web form for users to easily send a comment to the treasury, which product director Dayton Young said has been used more than 3 000 times.

Some individual cryptocurrency owners who didn’t give their names told FinCEN the rule would unfairly expand surveillance of American citizens.

The treasury department in January yielded to the pressure and ultimately extended the comment period to the end of March, leaving the matter to the Biden administration, which could make a decision later this year.

That for us was our moment of victory,” said Smith. “Crypto won.”

The Biden administration plans to keep a close eye on bitcoin’s rise in the market. Gary Gensler, Biden’s pick to chair the Securities and Exchange Commission, at his confirmation hearing on Tuesday said the SEC under his watch would ensure cryptocurrency markets “are free of fraud and manipulation”.

Wary

Last week, Yellen echoed some of the fears expressed by her predecessor, Steven Mnuchin.

“I don’t think that bitcoin — I’ve said this before — is widely used as a transaction mechanism,” said Yellen at an online event. “To the extent it’s used, I fear it’s often for illicit finance.”

Regulators have long been wary that virtual currencies are used to skirt sanctions or finance terrorism. Crypto exchange Coinbase in a securities filing last week disclosed that it had responded to subpoenas and voluntarily disclosed information on some transactions to the treasury’s sanctions enforcement agency.

Mnuchin personally pushed hard to try to ensure that the new rules would be in place before the end of the Trump administration, despite the hesitancy of some staff members inside FinCEN, said two people familiar with the matter. Mnuchin said in response to a request for comment that the interim rule was supported on an interagency basis. He said he briefed Yellen on the proposal as she took over the department. A treasury spokesman didn’t respond to requests for comment.

Mnuchin personally pushed hard to try to ensure that the new rules would be in place before the end of the Trump administration, despite the hesitancy of some staff members inside FinCEN, said two people familiar with the matter. Mnuchin said in response to a request for comment that the interim rule was supported on an interagency basis. He said he briefed Yellen on the proposal as she took over the department. A treasury spokesman didn’t respond to requests for comment.

Now, cryptocurrency associations and executives are trying to convince FinCEN staff to eliminate parts of the rule, said the Blockchain Association’s Smith, adding that they are unsure when Yellen or other Biden appointees will decide how to proceed.

Beyond lobbying, organisations like Fight for the Future are holding public events on Reddit and YouTube to try to convince more cryptocurrency enthusiasts to weigh in and run up the comment count at FinCEN even more.

“We’re trying to spread the news so people recognise the gravity of the situation,” said Peter van Valkenburgh, director of research at Coin Center, a nonprofit virtual currency advocacy organisation. — Reported by Joe Light, (c) 2021 Bloomberg LP