The shock suspension of Ant Group’s US$35-billion initial public offering is just the beginning of a renewed campaign by China to rein in the fintech empire controlled by Jack Ma.

Authorities are now setting their sights on Ant’s biggest source of revenue: its credit platforms that funnel loans from banks and other financial institutions to millions of consumers across China, according to people familiar with the matter.

The China Banking and Insurance Regulatory Commission plans to discourage lenders from using Ant’s platforms and has already asked some to ensure their portfolios are compliant with stringent draft regulations announced on Monday, said the people, who asked not to be identified discussing private information.

The proposed measures, which call for platform operators to provide at least 30% of the funding for loans, would render many of Ant’s existing transactions non-compliant. The company currently keeps about 2% of loans on its own balance sheet, with the rest funded by third parties or packaged as securities and sold on.

The full scope of China’s plans for Ant are unclear, and it’s possible that lenders will continue to work with the company once it complies with regulators’ requests. Any suggestion that banks would stop using its platforms is “unsubstantiated,” Ant said in a response to questions. “Ant will continue to support bank partners to make independent credit decisions and leverage Ant’s technology platforms to serve consumers and small businesses.”

The CBIRC didn’t immediately respond to a request for comment.

Abruptly halted

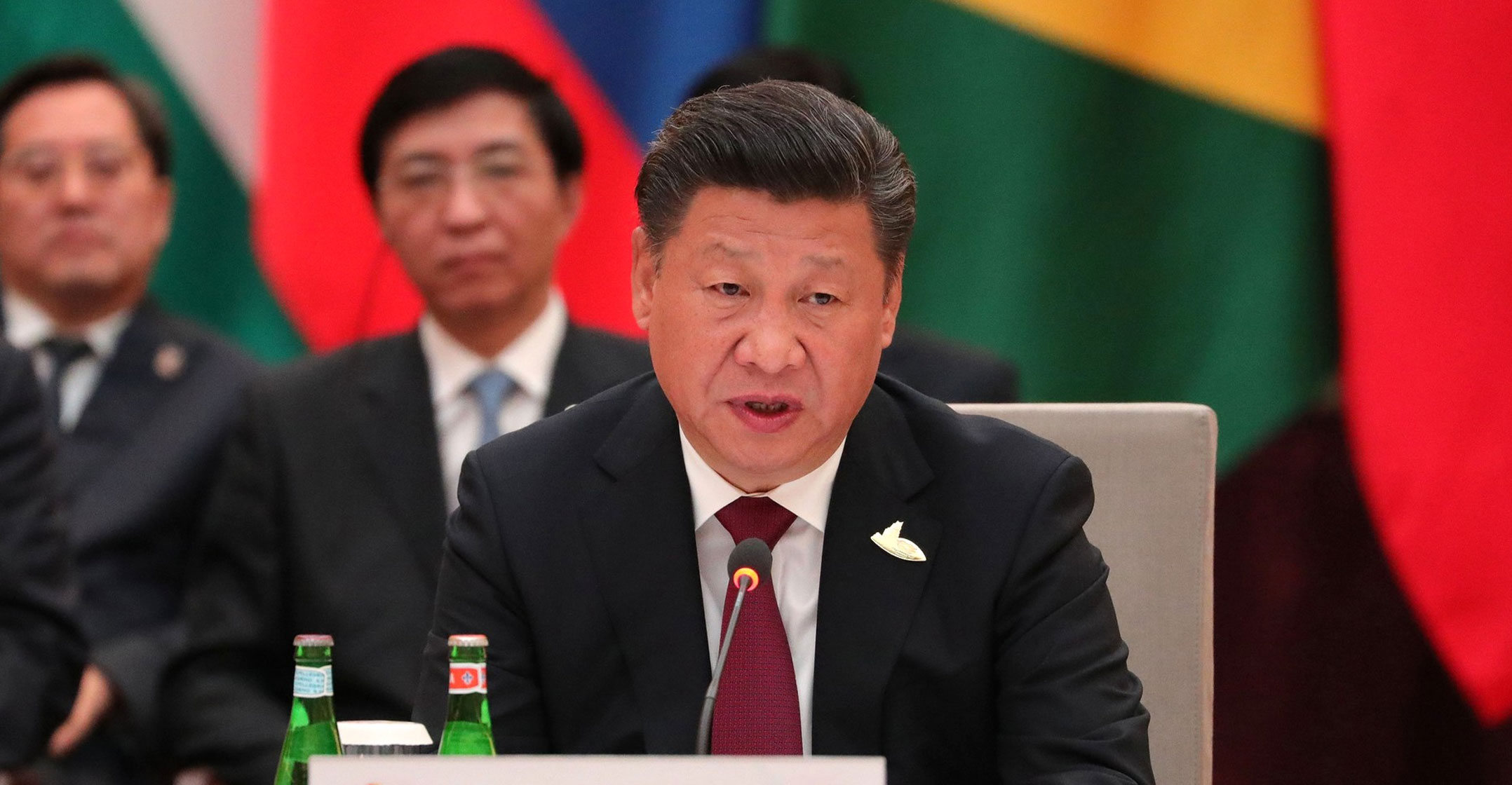

China abruptly halted Ant’s IPO after summoning Ma to a meeting earlier in the week to outline an array of concerns and new regulations. President Xi Jinping’s government is tightening controls on Ant and other fast-growing financial conglomerates after years of allowing them to operate without capital and leverage requirements imposed on banks.

Authorities haven’t yet provided much detail about what prompted the turnabout on the IPO, beyond saying it couldn’t go ahead because of a “significant change” in the regulatory environment. The halt comes after Ma blasted the nation’s financial system and questioned global regulatory models at a high-profile conference last month, calling banks “pawn shops”. China is still a “youth” and needs more innovation to build an ecosystem for the healthy development of the local industry, Ma said.

Any funding curbs could deal a major blow to Ant. After getting its start in online payments, lending is now the firm’s biggest business. It has underwritten about 1.7-trillion yuan ($253-billion) in consumer loans and 422-billion yuan in small business loans for about 100 banks and other financial institutions Revenue from its CreditTech unit jumped 59% to 29-billion yuan in the first six months of the year, accounting for 40% of the total.

Ant helped provide small unsecured loans to about 500 million people over the past year through two platforms: Huabei (Just Spend) and Jiebei (Just Lend). The former focuses on quick consumer loans for small purchases, while the latter finances everything from travel to education. Ant typically charges annualised interest rates of about 15% to consumers. Its more than 20 million small business borrowers pay an average lending rate of about 11%, almost double the average 5.94% small borrowers can get from banks.

Guo Wuping, head of consumer protection at the CBIRC, said in a commentary on Monday that Ant’s Huabei service was similar to a credit card but with higher charges. Financial technology firms use their market power to set exorbitant fees in partnerships with banks, which provide most of the funds required, he said.

Ant would have to set aside 95-billion yuan in capital to comply with the draft rules issued by the CBIRC on Monday, or 2.7 times the current capital for its two micro-lending arms, according to estimates from Jefferies Financial Group. — (c) 2020 Bloomberg LP