The markets may be experiencing a volatile start to the year, but 2022 is gearing up to continue the adoption pace of crypto that 2021 set.

The markets may be experiencing a volatile start to the year, but 2022 is gearing up to continue the adoption pace of crypto that 2021 set.

Looking to the future, crypto is experiencing some exciting developments in the redefining of ownership and value transfer. With these advancements, specific sectors are catching the attention of investors. with certain cryptos being in the spotlight.

Comparing the boom of the Internet to the adoption of crypto

The adoption of cryptocurrency into everyday life isn’t a frightening or even unusual thing. Just look back at similar innovations in human history and you’ll see a pattern repeating. In fact, the adoption of crypto can be compared to one of the most ground-breaking innovations: the Internet.

Cryptocurrency users are growing at a rate of over 100%/year. This is well ahead of the adoption rate that the Internet saw back in the 1990s and early 2000s. If this rate of adoption slows to 80%, cryptocurrency will still hit a billion users by 2024. That means one in every eight people on the planet will be interacting or using crypto in some way or another.

It’s expected that this pattern will steadily continue into 2022.

Why the market has a volatile reputation

Humans, by nature, love getting caught up in the hype of a narrative. We see this in politics, personal views and society. The markets aren’t any different. In fact, it happens more so with a narrative, like crypto, that flips daily.

To get a more accurate representation of volatility, investors in crypto should rather take a longer-term view. Instead of looking at the daily flip-flop narratives, zooming out and getting the bigger picture offers a much more insightful representation of the market.

Bears vs bulls: who will win?

Adoption of crypto was everywhere in 2021. With institutional interest, the rise of the NFT market and new retailer investors entering the scene, we’ve seen waves of fresh support spill into the cryptocurrency space. As much as we’d like it, the numbers simply can’t go up forever and there will always be pullbacks in a healthy market. But as cryptocurrency adoption increases, these cycles will extend past the current four-year cycle to a more macroeconomic cycle (10 years) and, with that, the crypto market volatility will become less of an issue.

Cryptocurrency beyond payment — blockchain expansion in 2022

Cryptocurrencies are more than just a payment method like PayPal or Visa; they present trustless, decentralised and immutable systems for transferring value.

Let’s break that down and look at the implications:

- Trustless: Not relying on any third party to ensure the functionality of the protocol;

- Decentralised: Having no central point of failure – that is, not storing data on a single computer that could crash and bring the system down; and

- Immutable: Unable to be changed; no one person can alter the data.

Value doesn’t just mean money. Value can represent a multitude of things, from a house to art to owning rights to something. Cryptocurrencies (as well as new concepts like NFTs) are bringing a different type of value to the world. Blockchain systems allow for this value to be transferred, stored and recorded on a verifiable ledger.

Blockchain technology and the value in true ownership

Outside of money, blockchain technology can revolutionise systems and improve efficiency across all industries. From Internet solutions to gaming, digital documents to art, blockchains offer the potential to build, record and store assets in a decentralised way where peer-to-peer has the power and not intermediaries.

What this means

Individuals have control of their crypto and full ownership of their blockchain-based assets. They don’t need to rely on banks, lawyers or any other centralised entity to be a part of that ownership.

Furthermore, areas such as insurance, lending and borrowing, cloud storage, Internet access, advertising, governance and healthcare are all using blockchain technology to advance their offerings and make them accessible to the world. These systems are going to continually grow as the technology is used more widely. We’ll start seeing more and more opportunities emerge from functional blockchain technology beyond the financial.

The big cryptocurrencies we should look out for in 2022

“When looking to the future of the market, it can be difficult to point out the exact cryptocurrencies that will take off and see tremendous growth. We can speculate based on trades and historical trends, but ultimately, I think investors should first focus more on sectors rather than individual cryptocurrencies. You need to identify if the problem these sectors are solving creates value,” says Brett Hope Robertson, head of investments at cryptocurrency firm Revix.

This way it is easier to see which areas are of most interest to solving an issue and helping a market become more efficient. It puts functional use ahead of flash-in-the-pan investments and allows the market to develop around projects that are focusing on the use-case. Based on this, the sectors of interest this year lie within:

- Decentralized finance (DeFi) and platforms and projects in that space

- Gaming/Metaverse tokens

- Web3

- The smart contract battle

The smart contract battle is increasingly interesting and worth watching. Ethereum has grown by over 75% in the last year and is working to improve its protocol. As the mechanism upgrades, the network will see increased transaction speeds and reduced fees. The much-anticipated improvements will very likely generate a fresh wave of increased attention focused on ethereum. At the same time, other smart contract protocols like solana, which experienced a massive 2 311% increase over the past year, are highlighting how valuable these blockchains can be from both a functional perspective and as an investment opportunity.

Trying to choose which cryptocurrency to invest in, whether smart contract or payments protocol, can be difficult. Luckily, it’s possible to invest in a diverse selection of top-performing cryptocurrencies without having to predict which one might be the best.

Revix’s cryptocurrency bundles such as the Top 10 Bundle, the Smart Contract Bundle and the Payments Bundle, offer a way to invest in the leading cryptocurrencies as a basket that is weighted and adjusted each month according to the top-performing cryptos. They’re a way to diversify your portfolio and enjoy passive investing without having to worry about active trading, volatility and market watching.

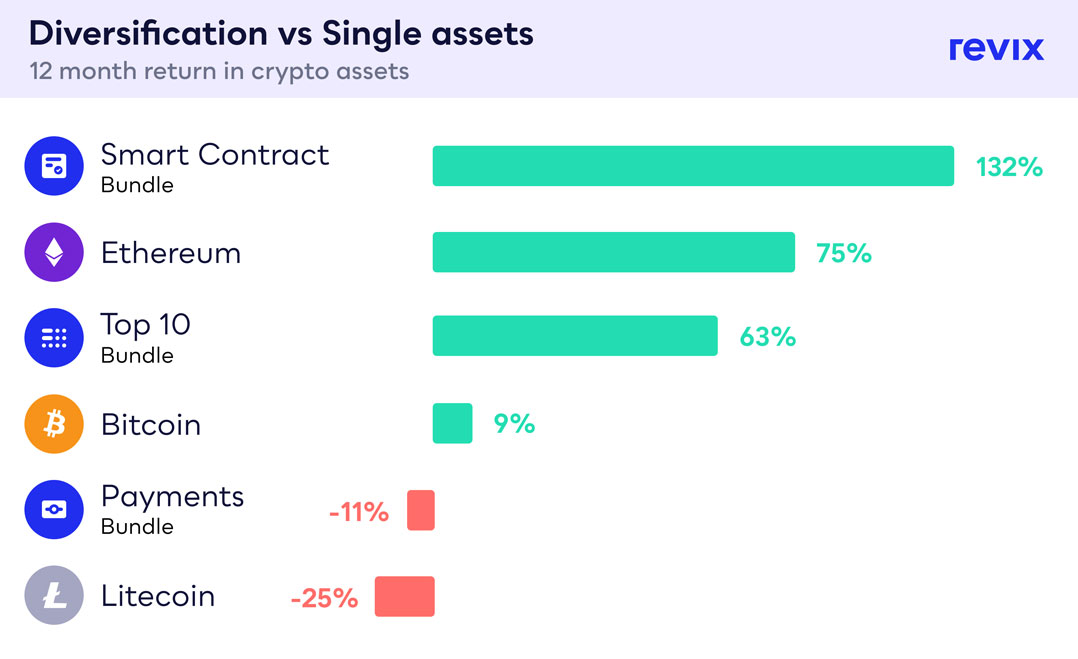

As we can see, the Revix Bundles have outperformed their sector counterparts while also producing a less volatile investment vehicle.

- The Smart Contract Bundle has outperformed the top smart contract player ethereum by over 55%.

- The Top 10 Bundle has outperformed the biggest cryptocurrency, bitcoin, by over 50%.

- The Payment Bundle has outperformed one of the largest payment tokens, litecoin, by over 10%.

This proves the true power of diversified bundles.

What are these bundles made up of?

Revix offers its customers access to three ready-made crypto bundles that hold the most reputable cryptocurrencies in each sector. These bundles automatically rebalance every month to make sure your bundle is up to date with the fast-changing world of cryptocurrencies.

The Top 10 Bundle is like the JSE Top40 or S&P 500 for crypto. It provides equally weighted exposure to the top 10 cryptocurrencies that make up more than 75% of the crypto market. This bundle has significantly outperformed bitcoin over the last 12 months.

The Smart Contract Bundle provides equally weighted exposure to the top five smart contract-focused cryptocurrencies such as ethereum, solana and polkadot. These cryptocurrencies allow developers to build applications on top of their blockchains, similar to how Apple builds apps on top of its iOS operating system.

The Payment Bundle provides equally weighted exposure to the top five payment-focused cryptocurrencies looking to make payments cheaper, faster and more global. These cryptos include the likes of bitcoin, ripple, stellar and litecoin.

With Revix, it’s simple. Sign up, start investing and kick off your crypto journey from as little as R500/month.

January head-start promotion

January head-start promotion

We’re making investing even more rewarding!

Get R500 added to your account when you invest R5 000 or more in any Revix product and hold it for a month.

Just sign-up using the promo code “REVIX500”, verify your account, deposit and invest R5 000 or more in one of our investable products holding it for a month, and we will reward you with R500.

Terms and conditions apply. This promotion is valid from the 21-31 January 2022.

About Revix

Revix brings simplicity, trust and great customer service to investing. Its easy-to-use online platform allows anyone to securely own the world’s top investments in just a few clicks.

Revix guides new clients through the sign-up process to their first deposit and first investment. Once set up, most customers manage their own portfolio but can access support from the Revix team at any time.

For more information, please visit www.revix.com.

Disclaimer

This article is intended for informational purposes only. The views expressed are not and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any of the assets or securities mentioned herein. You should not invest more than you can afford to lose and, before investing, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

- This promoted content was paid for by the party concerned