On Wednesday, 5 January, the US Federal Reserve released the public minutes of its Federal Open Market Committee meeting that was held in December. Shortly after the release of these minutes, bitcoin slid from US$47 000 to $42 000 (more than 10%).

On Wednesday, 5 January, the US Federal Reserve released the public minutes of its Federal Open Market Committee meeting that was held in December. Shortly after the release of these minutes, bitcoin slid from US$47 000 to $42 000 (more than 10%).

With bitcoin now more than 40% off its highs, many are asking where to next?

But why did this happen, and why should we, as investors, care about the US Federal Reserve? To understand the why, we need to understand the “who”.

As the financial authority in the US, the US central bank, otherwise known as Federal Reserve (the Fed), is responsible for all monetary policies. It supervises and regulates financial systems and maintains financial stability in the country. Basically, it’s the watchdog in the country that exists to get the economy to operate as effectively as possible. As a result, the Fed’s actions (such as setting interest rates or managing money supply) directly impact economic systems and the future economic outlook of the US.

What was so rattling about the Fed minutes?

The most unexpected thing about the Fed minutes was the simple fact that many analysts and market experts had underestimated the hawkish stance that the Fed would take going forward.

Now I know what you are thinking – what does hawkish even mean? Hawkish and dovish refer to the actions taken by the Fed. It is related to a decision by the Fed to either introduce money into the system (dovish) or pull money out of the system (hawkish).

A hawkish stance infers that the Fed is looking to tighten monetary policies by using tools to reduce the amount of money they previously injected into the US economy.

So, what did they actually say?

The meeting minutes displayed that the Fed was clearly worried about the rate of inflation and the US labour market. US Inflation accelerated at its fastest pace since 1982 (currently at 6.8%), and the US labour market is still around three million jobs short of pre-pandemic levels. To counteract these inflationary pressures, the Fed has decided to look at three actions:

- Accelerating interest rates hikes

- Speeding up tapering

- Reducing their balance sheet as a secondary lever

Taper what?

Tapering is just financial speak for reducing the speed at which the fed are purchasing assets – that is, printing money.

While most analysts knew they had begun tapering and were set to raise rates at some point this year, many were caught off guard by the fact that they not only wanted to raise rates earlier than expected (March instead of June) and speed up tapering, but they actually wanted to reduce their balance sheet overall.

Why do these actions affect crypto?

These Fed decisions will make investors think twice about their risk appetite. Over the last 21 months, money printing by the Fed has caused a low interest-rate environment where money has been relatively cheap and easy to borrow.

This low interest-rate environment is one of the key reasons capital has flowed into “riskier” assets like crypto and equities. It is also why we have seen such extreme returns in these asset classes over the last while.

Federal news makes the markets move

Due to the impact of the Fed decision making regarding the economy, all financial sectors – including equities, bonds and crypto – reacted accordingly.

While crypto is widely regarded as early-stage tech investing, it, together with the Nasdaq Composite Index (stock index related to tech companies) and bonds, pulled back on the news of tightening monetary policy. The Nasdaq Composite Index fell over 2.7%, while US 10-year bond yields rose over to 1.7% (a rise in bond rates is a fall in bond prices).

Why crypto is so powerful

While the decision by the Fed could be seen as an adjustment to the macro outlook, the fact is this: regardless of any market environment you look at during bitcoin’s lifetime, the largest cryptocurrency has managed to return more than 27% a year for any five-year period. That’s astonishing.

That means that no matter when you bought bitcoin in its existence — market tops, market bottoms, bear markets, bull markets — history has shown that the minimum return you would have received was 27%/year over a five-year period. This equates to a 230% return over five years.

Compare this to the S&P 500, where the same five-year period analysis had a minimum return of only 1%. This equates to a 6.76% return over five years.

It’s all relative

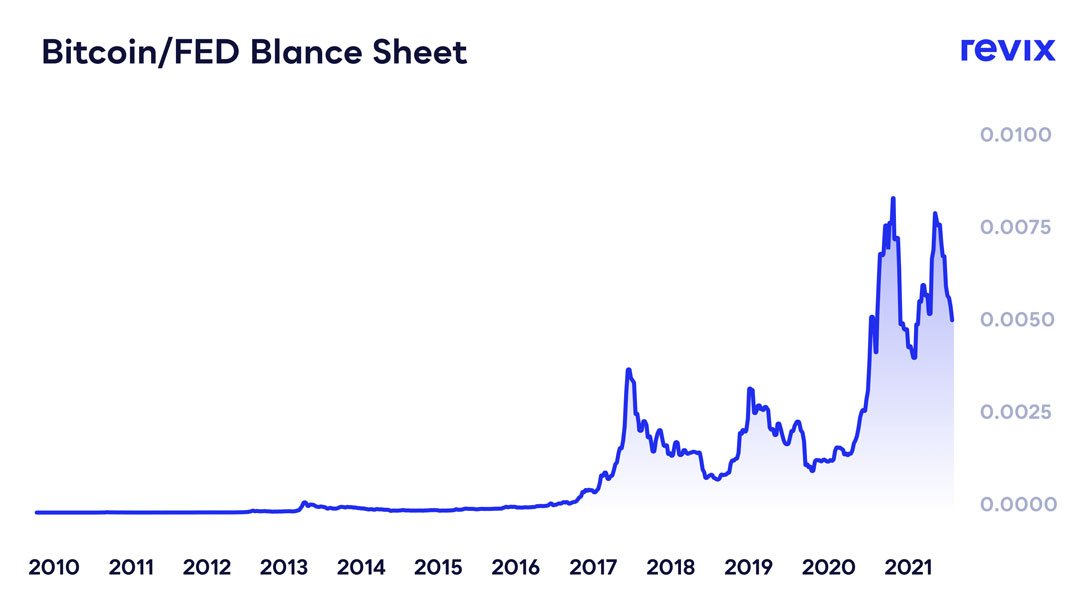

While bitcoin might have taken one of the harder knocks, it is worthwhile knowing that the cryptocurrency sector was one of the few assets to actually beat the Federal balance sheet printing. This means crypto was one of the only asset classes that made you money relative to the amount of money printed by the Fed.

In the graph above, we can see bitcoin has far outpaced the Fed balance sheet growth over the past 12 years. In fact, it has outpaced it by 327% since excessive printing started in March 2020.

In the graph above, we can see bitcoin has far outpaced the Fed balance sheet growth over the past 12 years. In fact, it has outpaced it by 327% since excessive printing started in March 2020.

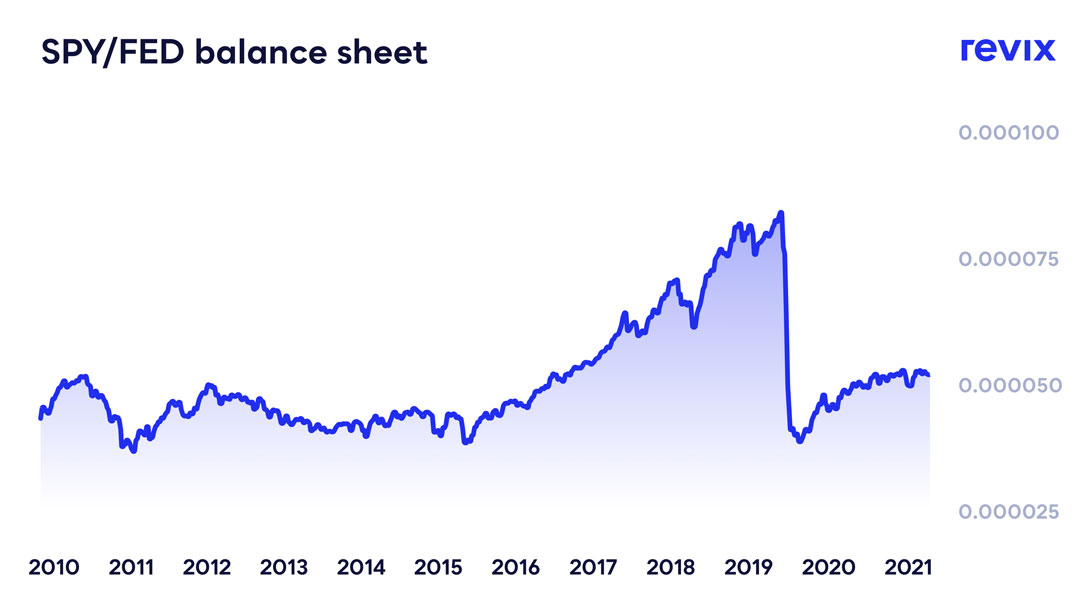

In comparison, the S&P 500 has only outpaced the US balance sheet by 4%, and gold has actually decreased in value when compared to the US balance sheet by -35% since March 2020.

We can see above that the S&P 500 is still yet to get above pre-pandemic levels when compared to the growing size of the Fed balance sheet.

We can see above that the S&P 500 is still yet to get above pre-pandemic levels when compared to the growing size of the Fed balance sheet.

Therefore, despite the sharp pullback in the crypto market, the real value of your crypto investment – when standardised against the Fed balance sheet – has been far greater than the S&P 500 or gold, thus making it a better protector of wealth.

Despite the dip, bitcoin is a good store of value. Depending on your time horizon, crypto has established itself as a good store of value over the long term, with history showing a minimum of a 27% annual return over any five-year period.

While there might be a lot of fear surrounding crypto, the best investors have the ability to cut through the noise and look at the facts history presents them with. In the case of bitcoin, history has shown that any price correction greater than a 35% pullback has proven to be a good buy signal.

Not only this, but it’s also interesting to note that the last time the Fear & Greed index was at this level coincided with the bitcoin market bottom at $29 560 in July 2021.

What is the Fear & Greed index?

In its basic form, the Fear & Greed index shows how scared or ecstatic people currently are about the crypto market. The index is made up of multiple market factors such as volatility, momentum, social media and surveys.

So, if you believe the Fed’s news and economic outlook has now been priced in, coupled with a 40% pullback and a Fear & Greed index that is at the lowest it has been since the market bottom in July 2021, you could see this as an absolute opportune time investment.

One way to take advantage of this good opportunity is with Revix’s crypto bundles.

Worried about the volatility and which crypto to back? Revix has you covered.

While these volatile swings in crypto might have you worried, buying a diversified basket of the top-leading cryptocurrencies is a way to protect against volatility or market swings.

Cape Town-based cryptocurrency investment platform Revix allows you to access to its ready-made crypto bundles that hold the most reputable cryptocurrencies in each sector.

There is no need to pick a single cryptocurrency and run the risk of it not sticking around. With Revix, simply pick the sector you are interested in and they do the rest.

Revix’s empowers users to invest in 3 different theme-based bundles:

The Top 10 Bundle is like the JSE Top40 or S&P 500 for crypto. It provides equally weighted exposure to the top 10 cryptocurrencies that make up more than 75% of the crypto market. This bundle has significantly outperformed bitcoin over the last 12 months.

The Smart Contract Bundle provides equally weighted exposure to the top five smart contract-focused cryptocurrencies like ethereum, solana and polkadot. These cryptocurrencies allow developers to build applications on top of their blockchains, similar to how Apple builds apps on top of its iOS operating system.

The Payment Bundle provides equally weighted exposure to the top five payment-focused cryptocurrencies looking to make payments cheaper, faster and more global. These cryptos include the likes of bitcoin, ripple, stellar and litecoin.

Reap the rewards of financial fitness in 2022

Reap the rewards of financial fitness in 2022

Starting 14 January, we’re challenging Revix investors to commit to their financial fitness. Forget about building biceps; we’re helping you build wealth. Each week, we’ll ask you to perform a number of actions on the Revix platform. Complete them and you’ll unlock rewards.

Investing is a marathon, not a sprint. So join us for the Revix 2022 Financial Fitness Challenge, and by the end of 2022 you’ll have more to show for your dedication to fitness than a forgotten pair of running shoes.

About Revix

Revix brings simplicity, trust and great customer service to investing. Its easy-to-use online platform allows anyone to securely own the world’s top investments in just a few clicks.

Revix guides new clients through the sign-up process to their first deposit and first investment. Once set up, most customers manage their own portfolio but can access support from the Revix team at any time.

For more information, please visit www.revix.com.

This article is intended for informational purposes only. The views expressed are not and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any of the assets or securities mentioned herein. You should not invest more than you can afford to lose, and before investing, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

- This promoted content was paid for by the party concerned