The South African Reserve Bank has released a position paper outlining how it intends carrying out its national payments ecosystem modernisation programme.

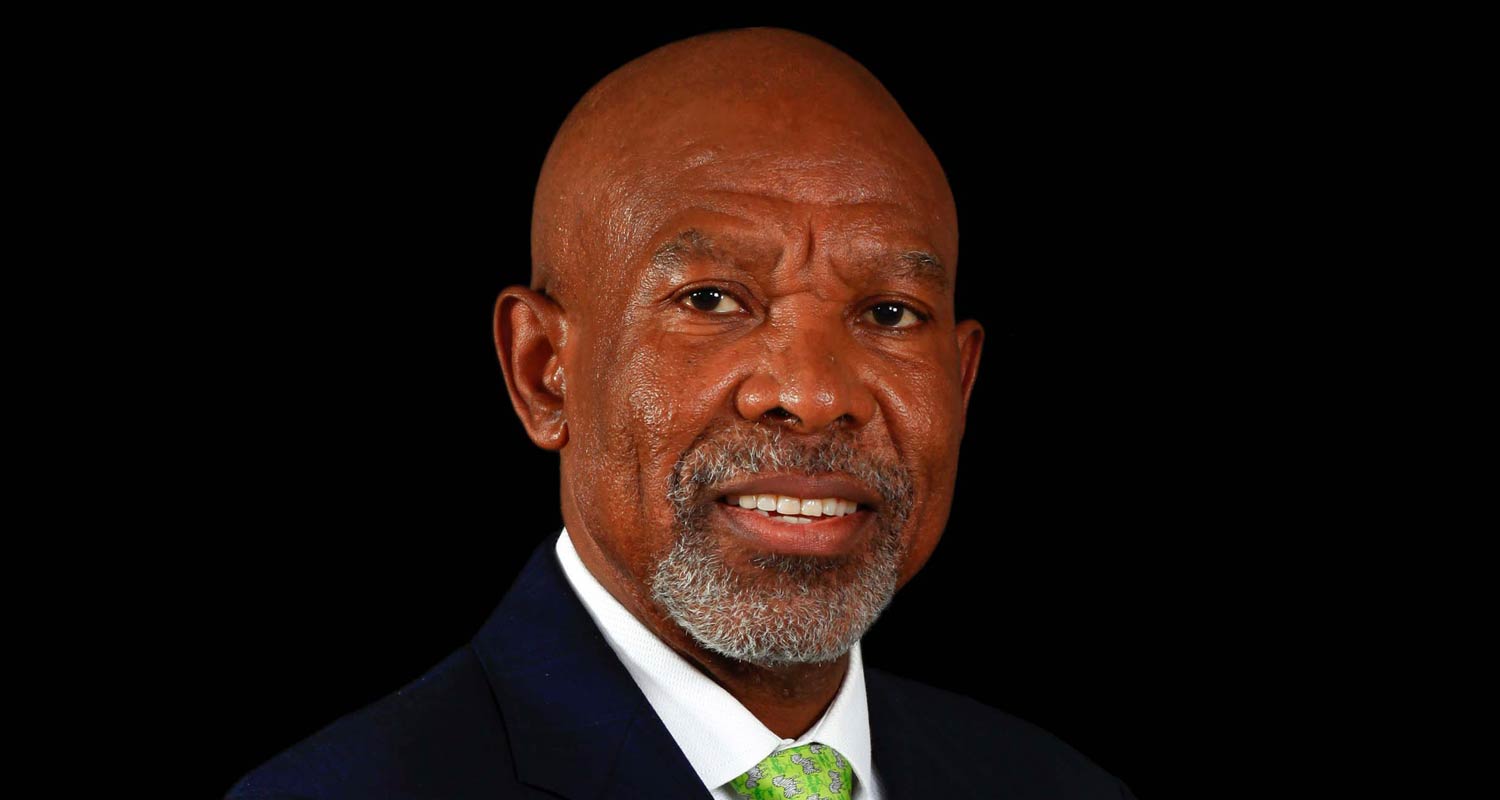

According to Reserve Bank governor Lesetja Kganyago, the programme’s objectives include developing and establishing a national payments utility, increasing competition, and ensuring cash is no longer the only option available for transactions – which is still often the case.

“In our Sarb 2030 strategy, we outlined three priorities that will guide us into the future, one of which is modernising South Africa’s national payments system,” Kganyago said in the document. “The payments ecosystem modernisation programme is the tangible expression of this priority – a bold step towards transforming how money moves within our economy.”

In the document, the Reserve Bank acknowledged that although South Africa has historically been a payments pioneer, developments have slowed significantly in recent years compared to the advances made by emerging market peers such as India and Brazil.

The implementation of rapid payment facilities in the form of the BankservAfrica-built PayShap system was meant to catapult South Africa’s payments system into modernity. However, low adoption rates – especially among people in the lower LSMs – have contributed to South Africa falling behind its peers, despite modern technologies being made available to the public. The cost of digital payment rails, including PayShap, is still too high for mass market adoption, according to the Reserve Bank.

To directly address the cost factor, the Bank plans to develop a national payments utility (NPU) that financial service providers can use to facilitate real-time payments across a variety of cash-equivalent methods, including bank-to-bank, bank-to-wallet (and vice versa), wallet-to-wallet and more.

Fragmentation

Another driver behind the planned changes is the fragmentation resulting from private sector players developing proprietary payment solutions that do not interoperate. This fragmentation contributes to prices being higher for consumers, creating an additional barrier to adoption.

“This modernisation is not just about updating systems or technology, it is about ensuring that every person – no matter their financial situation, location or familiarity with digital tools – has access to payment options that are affordable, fast, safe and dependable,” said Kganyago.

Read: Cash addiction is costing South Africa billions

The modernised system will necessitate the deprecation of legacy systems and will likely lead to facilities like EFT (electronic funds transfer) – used for decades in South Africa – no longer being needed, the Reserve Bank said.

The Bank’s plans are not confined to South Africa’s borders. The same functionality targeted at South Africans (and foreign visitors) is expected to be rolled out for the broader South African Development Community (Sadc) region as well.

Payments across Sadc are currently facilitated via the South African Multiple Option Settlement (Samos) and Sadc Real-time Gross Settlement (RTGS) systems. The Reserve Bank plans to update Samos and RTGS to extend their lifespan, while a modernised RTGS system is being developed that will eventually replace both systems.

Payments across Sadc are currently facilitated via the South African Multiple Option Settlement (Samos) and Sadc Real-time Gross Settlement (RTGS) systems. The Reserve Bank plans to update Samos and RTGS to extend their lifespan, while a modernised RTGS system is being developed that will eventually replace both systems.

The reasons for implementing rapid payment solutions regionally are identical to those at home. The digitisation of cash decreases the cash burden across the economy, which currently costs South Africa north of R30-billion/year.

At a regional level, reducing cash risk is just as important for stimulating higher rates of trade between Sadc nations. There is also a massive remittances market that relies on cash being moved across borders.

Speaking to the TechCentral Show last December, Reserve Bank head of payments Tim Masela said there were complexities regarding exchange rates that made real-time cross-border payments a challenge.

Central to the Reserve Bank’s modernised payments infrastructure is the concept of a “digital financial identity”, which the Bank said it will develop alongside the department of home affairs’ work to create a national digital identity system.

Digital identity is core to platform security as it will enable electronic know-your-customer (eKYC) processes and the ability for users to sign financial documents securely using their smartphone or PC.

‘Cash smart’

The Reserve Bank said modernising South Africa’s payments ecosystem will move the country to a “cash smart” environment, enhance payment efficiency and create new opportunities for economic participation.

“This is not a journey the Sarb can undertake alone, and I feel strongly about the need for collaboration. It will require genuine collaboration across government, private sector players, banks, non-banks, established companies and emerging innovators,” said Kganyago. – © 2025 NewsCentral Media

Get breaking news from TechCentral on WhatsApp. Sign up here.