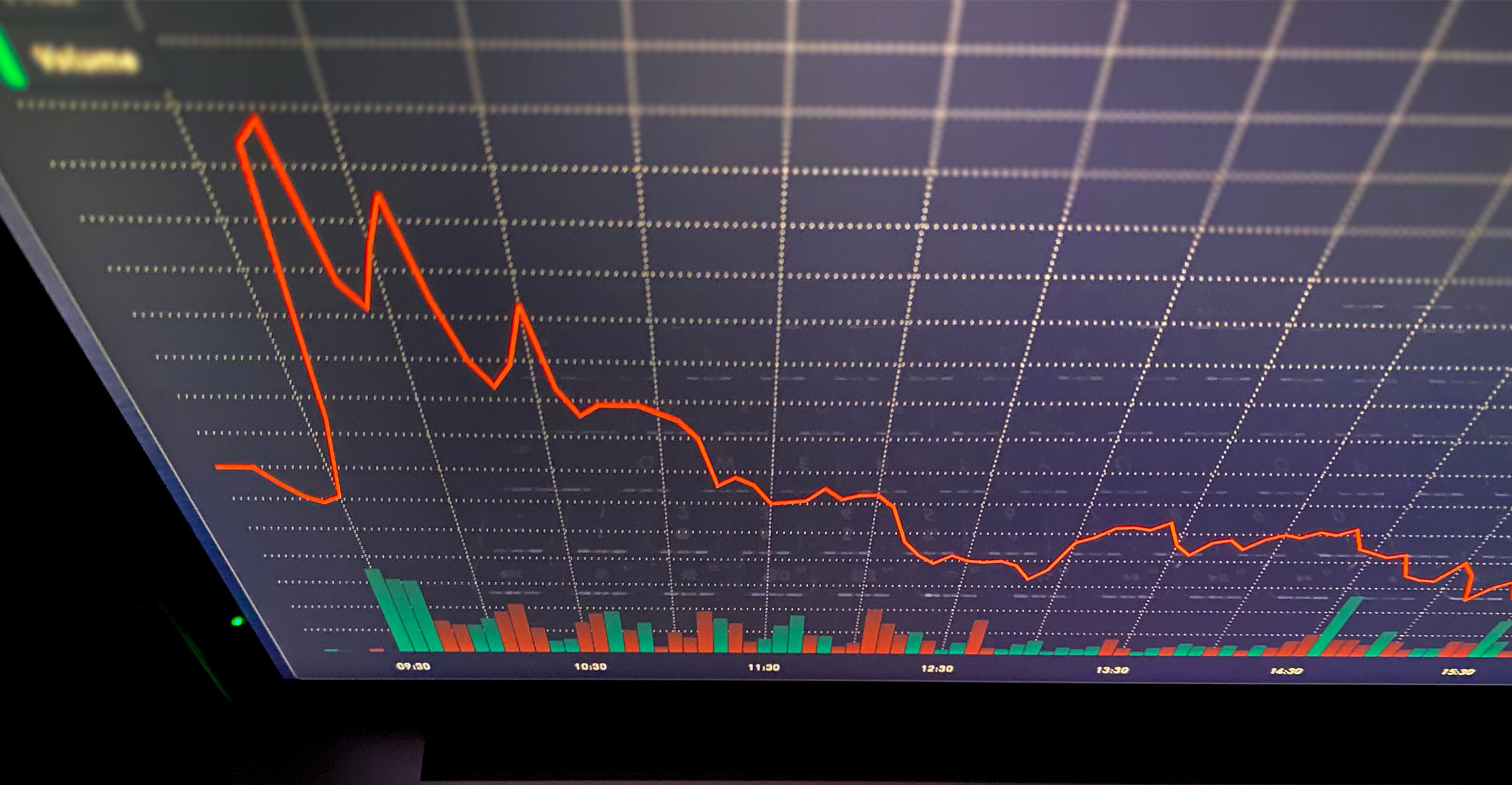

Shares in JSE-listed electronics group Ellies Holdings plunged as much as 44% on Friday after it issued a weaker-than-expected trading update.

Shares in JSE-listed electronics group Ellies Holdings plunged as much as 44% on Friday after it issued a weaker-than-expected trading update.

It said expects to report a headline loss per share for the six months ended 31 October 2021 of 4,36c compared to headline earnings of 2,37c/share in the same period a year ago.

Also impacting earnings per share is the fact that Ellies issued 185 million subscription shares to facilitate a new black economic empowerment transaction, which had a dilutive effect.

“The trading results for the period have been disappointing, with revenues declining by 24.6% compared to the six months ended 31 October 2020 when Ellies benefitted from increased revenues as a result of an easing of lockdown restrictions,” the company said in a statement to shareholders.

“The general trading environment in this period has remained constrained in the wake of the ongoing Covid-19 pandemic, the unrest and related looting, and supply-chain constraints.”

However, Ellies said it is optimistic about a recovery in the second half of the year. “Improved forecasting and higher levels of stockholding on fast-moving stock will help mitigate supply-chain delays.”

Nokia deal

It pointed to its new agreement to distribute Nokia multimedia products as an example of where revenue recovery could come from in the second half.

The second-half trading performance is also already being boosted by demand for uninterrupted power supplies and alternative energy solutions, driven by the recent round of Eskom load shedding.

“Load shedding will remain for the foreseeable future and, together with the potential 20% Eskom tariff increase in April, Ellies is confident of increased demand in this category and is gearing itself to meet this demand.”

Ellies said it expects to publish its interim results on 15 December. – © 2021 NewsCentral Media