A cross-border payment service called Globba has been launched by FNB and Mastercard. It allows customers to send money internationally to more than 120 countries.

A cross-border payment service called Globba has been launched by FNB and Mastercard. It allows customers to send money internationally to more than 120 countries.

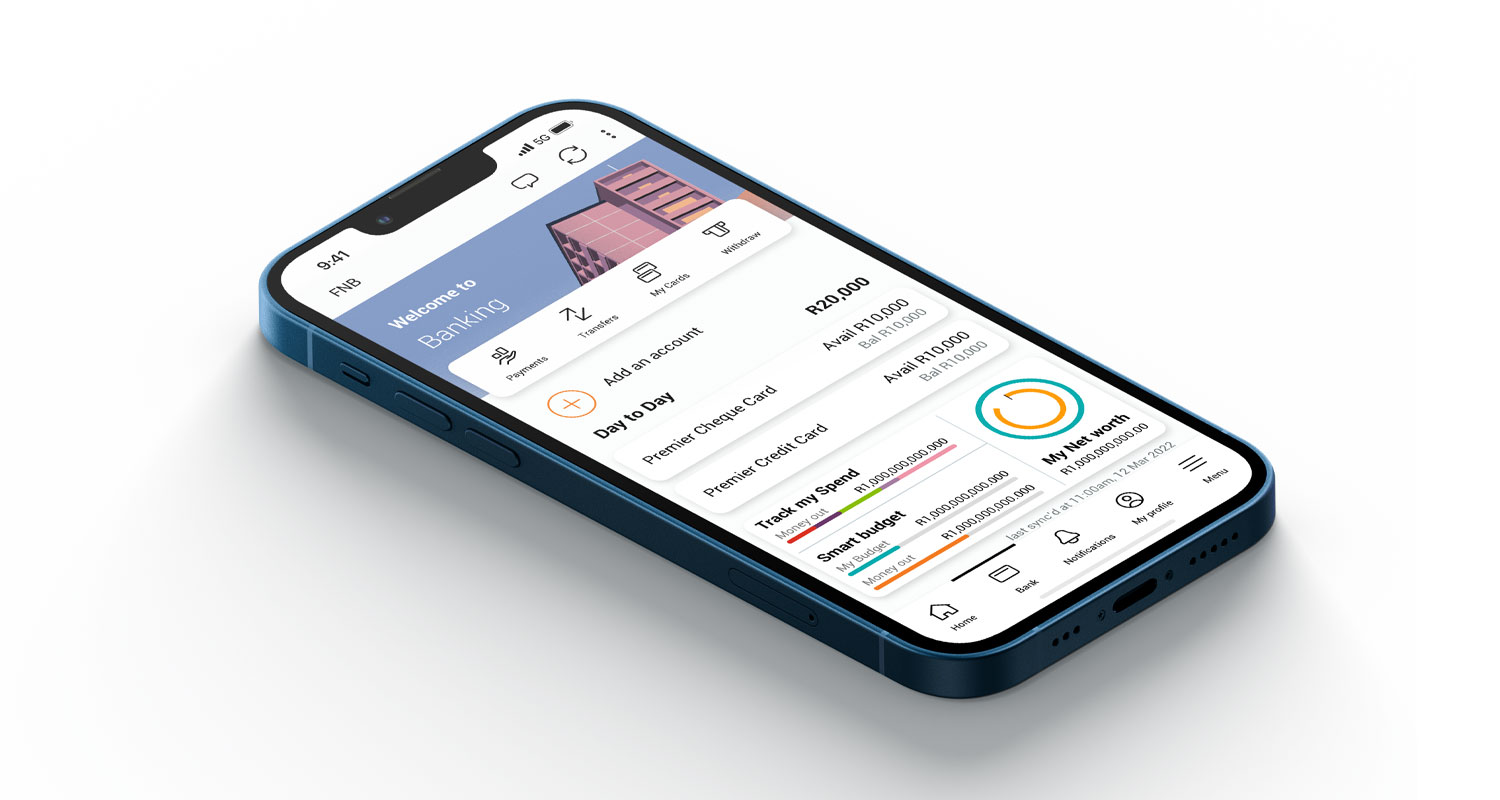

The service has multiple payment options – bank account, mobile wallet and cash pick-up locations. It is available in the FNB banking app. Fees start at R30 and beneficiaries will receive the funds in near real time.

Lytania Johnson, CEO of FNB South Africa’s personal segment, told a launch event in Johannesburg on Tuesday that the service is about customers and addressing financial inclusion.

“The challenge is the underserved. So… we considered the cost perspective and assessed what the competitors are actually charging customers out there for these type of solutions. Before the launch of Globba, we actually charged at a minimum of R100 for people to send money across borders,” she said.

“It’s truly starting to create this global financial ecosystem. Because, think about it, through a solution like this, you can send money, low cost, instant and secure to 120 countries, across currencies,” Johnson said.

Globba, which is aimed at low-value remittances, is also available through the RMB private banking app. It leverages Mastercard Move, Mastercard’s portfolio of global money movement capabilities.

Cornerstone

According to a Mastercard-commissioned report, the digital payments economy is expected to reach US$1.5-trillion by 2030.

Onur Kursun, Mastercard executive vice president, commercial and payment flows for Eastern Europe, the Middle East and Africa, said: “Cross-border payments are the cornerstone of Africa’s digital economy, connecting families, fuelling SMEs and supporting regional trade. This enhances transparency and builds confidence in cross-border transactions, ensuring South Africans can fully and securely participate in the digital economy.”

Read: Work under way to make Sadc payments faster and cheaper

The service has been a year on the making. FNB and Mastercard said they will expand the offering across FNB’s network in Africa, subject to regulatory approvals. Key remittance corridors include Zimbabwe, Malawi, Mozambique and Ghana. – © 2025 NewsCentral Media

Get breaking news from TechCentral on WhatsApp. Sign up here.