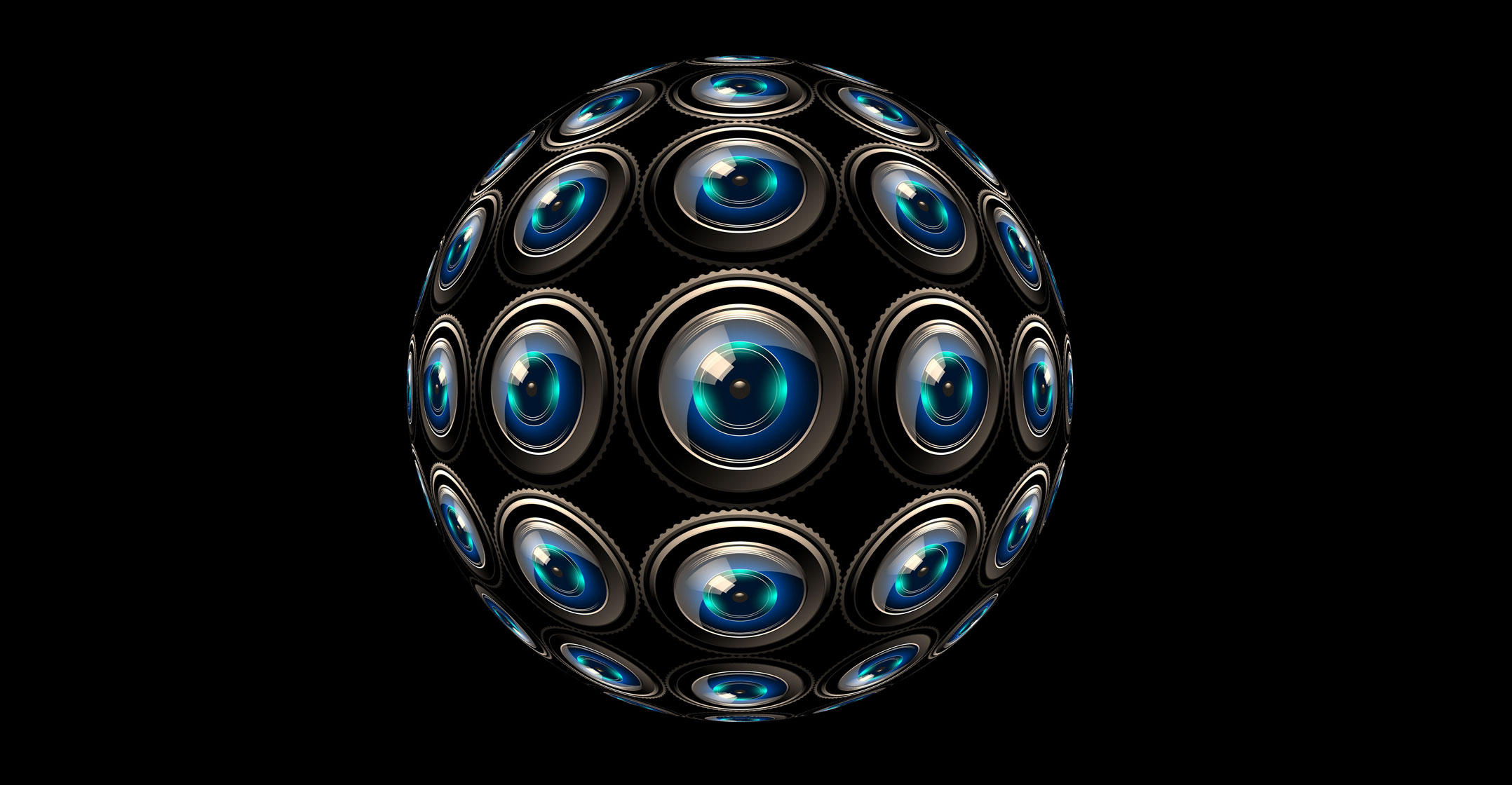

Hikvision warned it may lose customers in overseas markets because of its US blacklisting, underscoring the extent to which curbs on the sale of American technology may hurt the world’s largest video surveillance business.

Hikvision warned it may lose customers in overseas markets because of its US blacklisting, underscoring the extent to which curbs on the sale of American technology may hurt the world’s largest video surveillance business.

Executives at the Chinese camera provider, which reported profit in line with estimates on Friday, said however the company was large enough to withstand US sanctions and develop its own technology in the longer term. Its own market remains a rich source of revenue even though the US business is also shrinking, a trend that may persist for a while, Huang Fanghong, a Hikvision senior vice president, said on an earnings call on Saturday.

Hikvision found itself in the cross-hairs of the Trump administration this month after it joined other Chinese companies — including Huawei — on an Entity List that prevents American firms from supplying it with components and software. The seller of video cameras used around the world in surveillance was accused of involvement in human rights violations against Muslim minorities in the far western region of Xinjiang.

Hikvision executives say they had anticipated the action and stockpiled enough key parts to keep operations going for some time. The company has said it didn’t foresee a major impact on its business as a result of the ban.

In Huawei’s case, for instance, some suppliers including Intel and Micron Technology developed workaround solutions to the prohibition. Most of Hikvision’s American suppliers are continuing to do business with it, while abiding by export regulations and without the need for special licences, according to Huang.

“We have made a great deal of preparations, from a year ahead of the ban,” said Huang. “There’s no way for us to fully discuss the impact from the entity list in 10 days. We need more time to talk to our suppliers and customers. A steady component supply is key in this process, no matter if we decide to use original materials or a replacement design.”

New direction

The US decision, which came on the eve of sensitive trade negotiations, takes President Donald Trump’s economic war against China in a new direction: the first time his administration has cited human rights as a reason for action. It deals a potentially heavy long-term blow against Hikvision, which has steadily switched to Chinese-made components in recent years but still relies on the likes of Intel, ON Semiconductor and Texas Instruments, particularly for higher-end chips.

Still, as much as 80% of Hikvision’s sales are insulated from the US ban, analysts Charles Shum and Simon Chan of Bloomberg Intelligence wrote in an 8 October note.

“Hikvision’s sales may continue to rise over the next year despite the Trump administration’s decision,” they wrote. “It can also source alternative parts, though with a weaker performance, from local suppliers in the medium term.”

Hikvision reported on Friday that net income grew 17% to 3.81-billion yuan (US$538-million) in the September quarter, while revenue grew 23%. The company forecast growth of 5% to 20% in net income this year. Its shares are still up 18% this year despite a 5% loss this month.

Hikvision reported on Friday that net income grew 17% to 3.81-billion yuan (US$538-million) in the September quarter, while revenue grew 23%. The company forecast growth of 5% to 20% in net income this year. Its shares are still up 18% this year despite a 5% loss this month.

Hikvision was added to the Entity List alongside SenseTime Group and Megvii Technology, two giant enterprises Beijing is counting on to spearhead advances into a revolutionary technology. Hikvision doesn’t play as out-sized a role in China’s ambitions but it’s a key partner to Beijing as well as governments around the world. Its cameras are used from Paris to Bangkok and Urumqi, and are considered pivotal to crime prevention as well as helping build “smart cities” or networked urban environments.

Longer term, US sanctions threaten to crimp some of the explosive growth Hikvision has managed this decade, in large part due to China’s effort to put in place the world’s largest surveillance and monitoring network. The company may find itself short of the components it needs to build advanced systems, unless Chinese chip makers succeed in developing more advanced chips — another of Beijing’s stated policy ambitions in tech.

Thanks to cheap but capable cameras, the Chinese company has enjoyed double-digit growth over the past eight years. Demand for its surveillance cameras, video storage and data analysis services has boomed particularly in its home market. Overseas, the company competes against Canon, Hanwha Techwin and Bosch. — (c) 2019 Bloomberg LP