Vodacom’s revamped Smart+ and Red+ integrated packages have seen increases in data, voice and SMS allocations across the board. And, in the case of its Smart packages — ranging from the R199 (200MB) to R699 (1GB) level — this additional “value” has come with monthly subscription price increases of at least 30%. But how do these stack up to offers from competitors?

Vodacom’s revamped Smart+ and Red+ integrated packages have seen increases in data, voice and SMS allocations across the board. And, in the case of its Smart packages — ranging from the R199 (200MB) to R699 (1GB) level — this additional “value” has come with monthly subscription price increases of at least 30%. But how do these stack up to offers from competitors?

Key to this analysis are two vectors: price per month excluding a handset (and the below comparisons try to cluster these within a narrow band in each segment) and data allocation (after all, these integrated plans are targeted squarely at smartphone users).

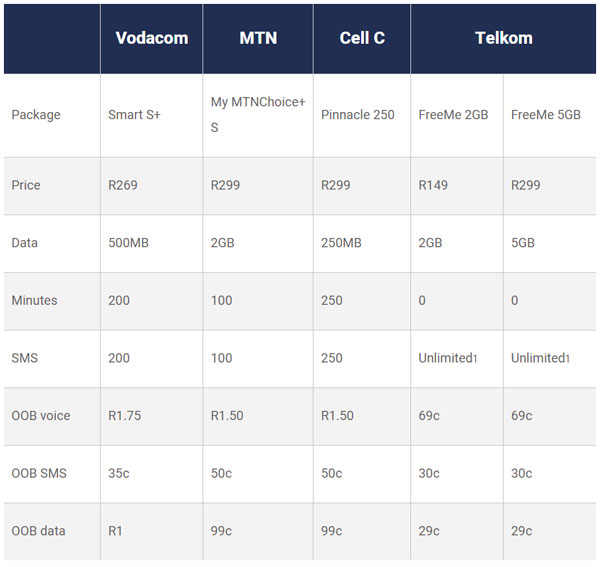

Entry level

On entry-level packages (Smart XS+ with a paltry 200MB/month bundled is excluded), Vodacom now at least compares more favourably with rivals and offers better value than Cell C’s Pinnacle 250 (double the data with almost the same amount of minutes and SMSes).

If one excludes Telkom’s FreeMe contracts, which typically make the competition look laughable, MTN shines in this segment. Its My MTNChoice+ S package offers four times the amount of data as Vodacom (and eight times that of Cell C), and even compares reasonably favourably with Telkom.

It must be noted that, with the exception of the two top-end plans, Telkom’s FreeMe contracts do not come with bundled voice minutes. If you add the price of 200 minutes (or 100 in the case of MTN) of calling (at 69c/minute) to the FreeMe 2GB subscription price, it still compares favourably with both Vodacom and MTN’s plans.

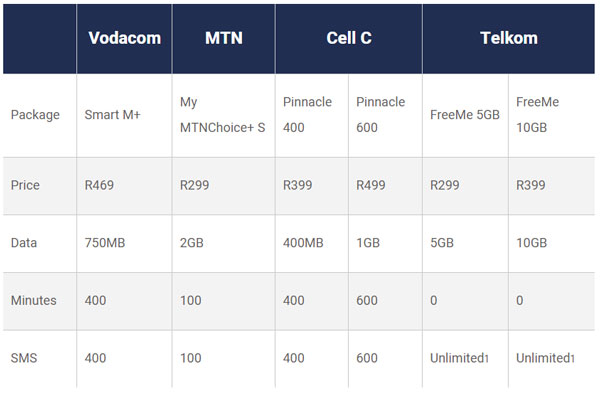

Mid-level

This is a useful segment to compare as it covers the average usage per smart device on the Vodacom network, currently at 667MB/month (as at December 2016). For R200 more (than the S+ plan) per month, Vodacom offers double the allocation of voice minutes and SMSes, and an additional 250MB of data.

MTN’s MyMTNChoice+ S plan has such a generous allocation of data that it is included in this tier as well (there is a big jump to its next price plan at R699/month). Cell C’s Pinnacle 400 package, with only 400MB of bundled data, looks downright strange when compared to others in this category, especially its own Pinnacle 600 plan (more than double the data at R100/month extra).

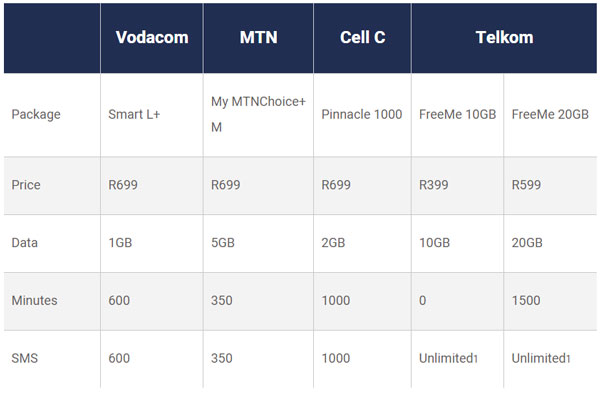

‘Realistic’ level

I’ve termed this the “realistic” level as I would argue strongly that the bare minimum of bundled data anyone with a smartphone should consider is 1GB.

Again, Vodacom looks far better than it used to (it used to include 500MB of the Smart L plan, at R529/month), but the comparison is still unfavourable.

At the same price points, Cell C’s Pinnacle 1 000 offers double the data and more bundled voice and SMSes, while MTN shines again, with five times the data and (while lower) a still realistic voice and SMS allocation.

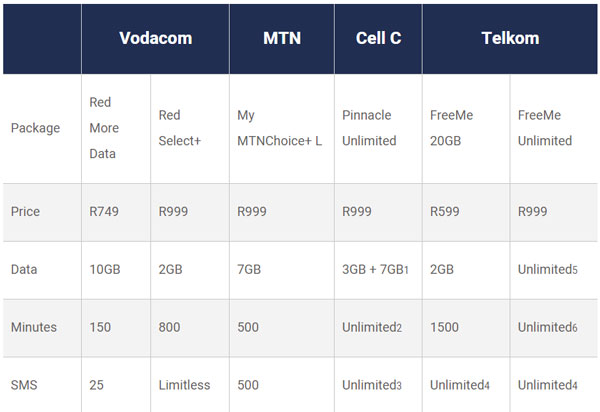

Heavy usage

This comparison is probably where many readers of this site would start (with plans centred on at least 2GB of data (in most cases, higher) and around the R1 000/month mark).

Again, the call that needs to be made here is how many voice minutes you use in a month. If you are not a heavy voice user, Vodacom’s Red More Data is by far the most attractive price plan (but, it is worth bearing in mind that a 10GB data bundle will cost R599 on Vodacom, so you’re paying R150 for 150 minutes and a handful of SMSes).

Both Vodacom and MTN have a number of price plans in the no-man’s land between R999/month and the top tier (R2 099/R2 499), but these seem to target very specific heavy voice users and aren’t too competitive on a bundled data basis. These are excluded from this analysis.

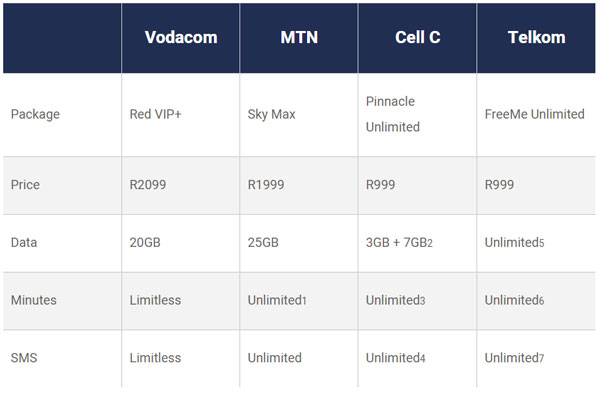

Top tier (‘unlimited’)

At the very high end (contracts with unlimited calls), Vodacom’s Red VIP+ package is finally relevant in 2017. It is an absolute travesty that, until August last year, this premium plan only had 5GB of bundled data! However, this remains the only plan in this bracket that actually includes limitless calls and SMSes — that is, without a stated fair usage limit (the operator reserves its right in the case of “extreme usage”).

Cell C maxes out at a 10GB allocation on its R999 Pinnacle Unlimited plan (with caps on both voice and SMSes).

On Telkom’s FreeMe Unlimited option, Internet speed is throttled (but not cut) when customers hit 25GB of usage.

On the whole, Vodacom’s post-paid price plans still don’t compare well with those from rivals, especially MTN and Telkom. The operator will likely argue that many of the FreeMe comparisons are not constructive as all but the top two Telkom plans don’t offer any bundled voice minutes. It might also argue that it’s not all about price. Across its Red plans, Vodacom is hoping to further differentiate on other things, like a priority helpdesk and like-for-like loan devices (and free Super Rugby jerseys).

It is strange that the market-leading operator in South Africa and the one which pioneered integrated price plans back in 2013 now lags rivals so obviously.

Somehow, though, it’s managed to convince its 5,2m post-paid customers that its plans represent good (adequate?) value. Of course, contract customers are — by definition — sticky: they don’t typically switch from network to network. The other important thing Vodacom has in its favour is the size and quality of its network. It is the largest in the country, and the “best” on many measures. Some customers are justifiably willing to pay a premium for this.

My advice? Start with the amount of data you currently use and accept that you will use more over time. There are a few more things to consider, but you should’ve read this already.

- Hilton Tarrant works at immedia

- This column was originally published on Moneyweb and is used here with permission