InstaPay, a cutting-edge new merchant application, has been launched to transform the payments landscape in South Africa. This innovative solution offers unique functionality and competitive rates that surpass traditional card providers, setting a new standard in the industry.

InstaPay, a cutting-edge new merchant application, has been launched to transform the payments landscape in South Africa. This innovative solution offers unique functionality and competitive rates that surpass traditional card providers, setting a new standard in the industry.

InstaPay is the result of combined expertise and technology between Omnea and Amber Pay, two industry leaders committed to driving innovation in the payments sector. Enabled by Omnea’s API Integration Hub, a leading fintech enablement platform in Africa, and developed by global payment software specialist Amber Pay, InstaPay is not only feature-rich but is built on a foundation of expertise and reliability.

“InstaPay is not just another payment solution; it’s a comprehensive platform designed to meet the diverse needs of merchants of all sizes. With industry-leading features, InstaPay provides merchants with the tools they need to manage their businesses more efficiently using Omnea’s API Integration Hub,” says Omnea CEO Deon Tromp.

Merchants can access low rates through our platform, manage their business operations via an intuitive mobile application and web portal, and leverage instant settlements for real-time cash flow management. This includes paying suppliers, managing stock, processing payroll, and making individual or bulk payments, all in real time, he explains.

“The integration of digital value-added services aligns merchants with the broader trend of digital transformation. As consumers increasingly adopt digital payment methods and online services, merchants who offer digital value-added services can stay relevant and meet evolving customer expectations. This alignment can also streamline operations and reduce costs associated with manual processes,” says Amber Pay CEO Ekaterina Savadia.

“InstaPay democratises the payment industry by providing small and medium-sized businesses with access to feature-rich services at rates usually reserved for the large enterprise counterparts. This commitment to equality ensures that all merchants, regardless of size, benefit from high-quality services and support.”

Digital onboarding, enhanced CX

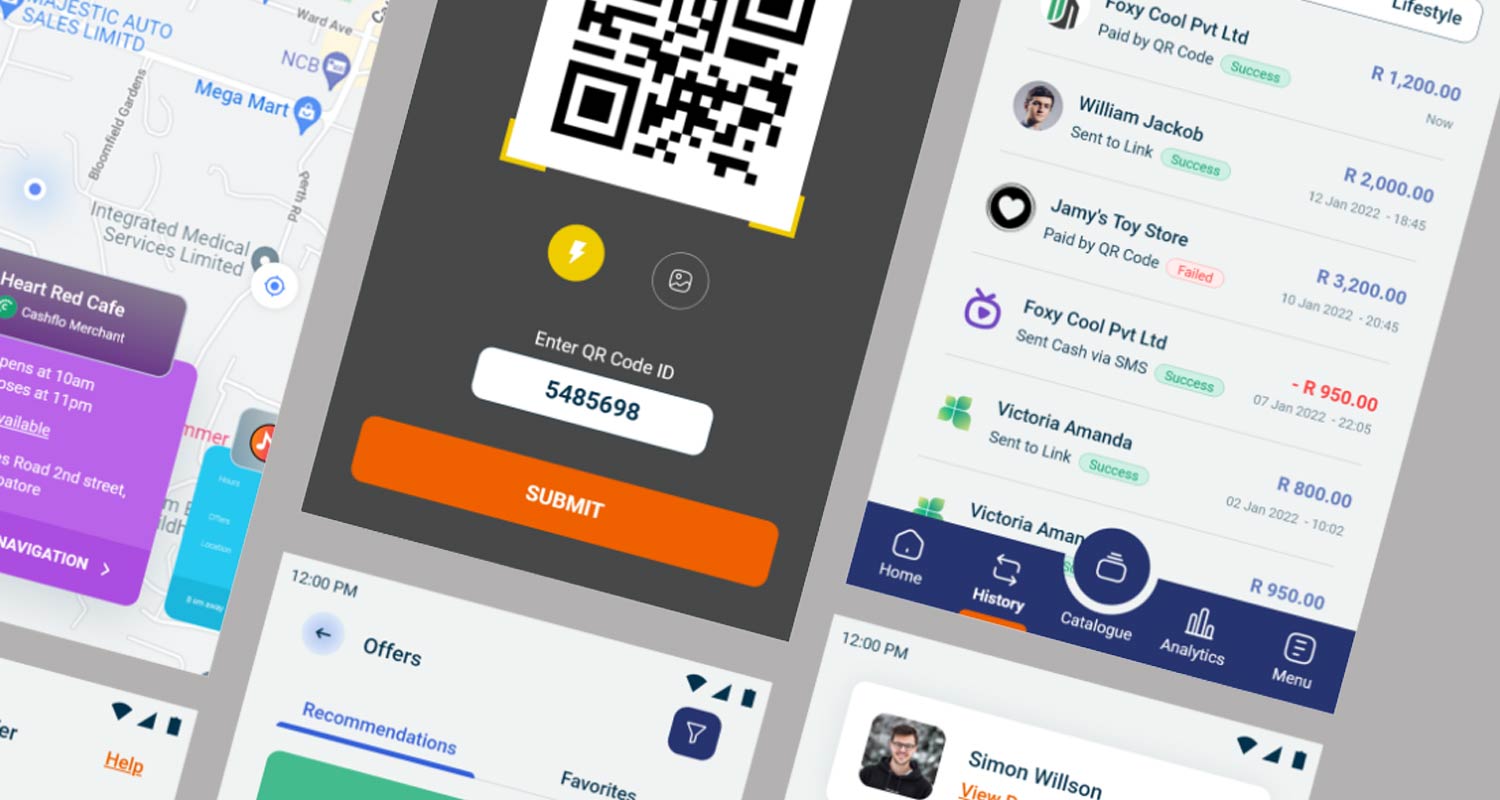

Merchants can digitally onboard and start accepting payments in under 24 hours directly from their smartphones. This quick and seamless setup process ensures that businesses can begin operations with minimal downtime.

InstaPay also includes a consumer application that acts as a safe custody account for the storage of funds. Merchants can create instant offers for consumers through the in-app marketing tool, further enhancing engagement with their customers.

Consumers also benefit from loyalty rewards and cashback from participating partners such as Checkers, Pick n Pay, Shoprite and many others when using the InstaPay application, which functions as a digital wallet.

In-store and online payment acceptance

In addition to smartphone capabilities, InstaPay offers robust point-of-sale (POS) devices running on the same software. These devices speed up payment transaction times, providing a fast and efficient in-store payment experience.

InstaPay supports both in-store and online transactions, enabling merchants to accept secure online payments and ensuring comprehensive support for various business models. It also offers omnichannel capabilities, arming merchants with the flexibility they need to manage their operations seamlessly across a wide range of platforms and devices.

Value-added services

Value-added services

Merchants can generate additional revenue by earning commissions on the sale of value-added services such as airtime and electricity sales.

Security and compliance

InstaPay ensures robust security measures to protect user information and transactions, along with features that help merchants stay compliant with regulatory requirements. Given the complexities of today’s threat landscape, where cyberattacks are increasingly sophisticated, robust security is more critical than ever.

InstaPay not only prioritises advanced encryption and fraud detection but also aligns with the Protection of Personal Information Act (Popia), ensuring that user data is handled with the highest standards of privacy and integrity. Compliance with Popia and other regulatory frameworks is vital for maintaining trust and avoiding legal repercussions.

By integrating these comprehensive security and compliance features, InstaPay provides merchants with a reliable and secure platform to conduct their transactions confidently.

Empowering businesses

InstaPay is a dynamic force in the payments industry that provides innovative and accessible payment solutions. Its mission is to empower small businesses by offering them the same high-quality services and support that large enterprises enjoy at a fraction of the cost.

With state-of-the-art technology and a commitment to customer success, InstaPay is paving the way for a more inclusive and efficient payments ecosystem in South Africa.

“As we launch InstaPay, we are excited to see how this innovative application will elevate the payment experience for both merchants and consumers. Our goal is to continually push the boundaries of what’s possible in the payments industry, and InstaPay is a testament of our commitment to excellence and customer satisfaction. We invite businesses across South Africa to experience the unique benefits of InstaPay and join us in shaping the future of payments,” concludes Angelo Laidlaw-Tyler, executive head of marketing.

For more information, visit www.instapay.co.za.

- Read more articles by InstaPay on TechCentral

- This promoted content was paid for by the party concerned