We all know investing can be intimidating at the best of times, what with multiple asset classes and millions of stocks, bonds and commodities within them. It’s a good reason why most people choose to invest in index products that track the JSE Top40 or S&P 500 to navigate this complex landscape.

We all know investing can be intimidating at the best of times, what with multiple asset classes and millions of stocks, bonds and commodities within them. It’s a good reason why most people choose to invest in index products that track the JSE Top40 or S&P 500 to navigate this complex landscape.

Index investing allows individuals to eliminate the stress that comes with hours of research identifying top-performing assets and reduces the need to constantly stay updated with the ever-evolving investment landscape.

But how can you apply this time-tested and successful investment strategy to the realm of cryptocurrencies?

Altify, a Cape Town-based alternative investment platform backed by JSE-listed speciality investment group Sabvest, has just rolled out 13 innovative Crypto Bundles that function similarly to exchange-traded funds (ETFs) that you would see in traditional markets. This move marks a significant leap in bringing index-based investing into the crypto world.

What is a Crypto Bundle?

Think of a Crypto Bundle as the crypto world’s answer to an index fund where you can diversify across the crypto market or a specific crypto sector through just one investment.

Designed for a wide range of investors – from beginners to professionals – these bundles allow you to invest in the broader future of crypto, not just individual coins. Investors can get started by investing with as little as just R150.

Altify’s Crypto Bundles are tailor-made for the crypto market, offering round-the-clock trading. This means you can enter or exit your Crypto Bundle investment anytime.

Altify’s Crypto Bundles are fully automated, rules-based and passive. This strategy mirrors the successful approaches in traditional assets like stocks, where investors can rest assured that their portfolio is aligned with clear, objective standards, ensuring a disciplined and steady exposure to the crypto market.

Whether it’s tracking top cryptocurrencies by market cap, focusing on particular sectors, or exploring themes like DeFi or the metaverse, Altify’s Crypto Bundles keep a consistent investment focus. Plus, their passive nature means lower costs, making it a savvy choice for investors.

Limited time promotion

Interested in exploring Altify’s Crypto Bundles? Now may be an opportune moment.

Interested in exploring Altify’s Crypto Bundles? Now may be an opportune moment.

Altify is offering zero buy fees on all Crypto Bundles until 31 December 2023. Dive in and invest fee-free – with no promo codes, just pure savings. Altify’s promotional terms are accessible here.

Buy the haystack

At a glance, the crypto market can be overwhelming, especially for those not well-versed in it. With over 20 000 cryptocurrencies, each with its own sector focus and unique use case, comprehending the underlying technology and grasping the full scope of their applications requires countless hours of research and expertise.

This leads to the fundamental question: why search for the needle in a haystack when you can just buy the haystack?

By investing in a broad Crypto Bundle, you can eliminate the need for an extensive understanding of each individual cryptocurrency. This approach removes the guesswork from investing as investors gain exposure to the broader crypto market, eliminating the risks associated with investing in one crypto that may or may not work out.

Why invest in a Crypto Bundle?

- Automated monthly rebalancing: Your Crypto Bundle automatically updates every month so it always includes the most valuable cryptocurrencies and any poor performers are taken out.

- Maximise returns, minimise risk: Our Crypto Bundles offer a balanced mix of well-established cryptocurrencies like bitcoin and promising, up-and-coming coins. This approach spreads your investment across leading cryptocurrencies, ensuring no single asset dominates your portfolio.

- Get rand hedge exposure: As all crypto assets are valued in US dollars, they are not tied to the South African economy. This means investing in any of Altify’s Crypto Bundles acts as a safeguard against the rand’s fluctuation – when the rand weakens, your investment gains value.

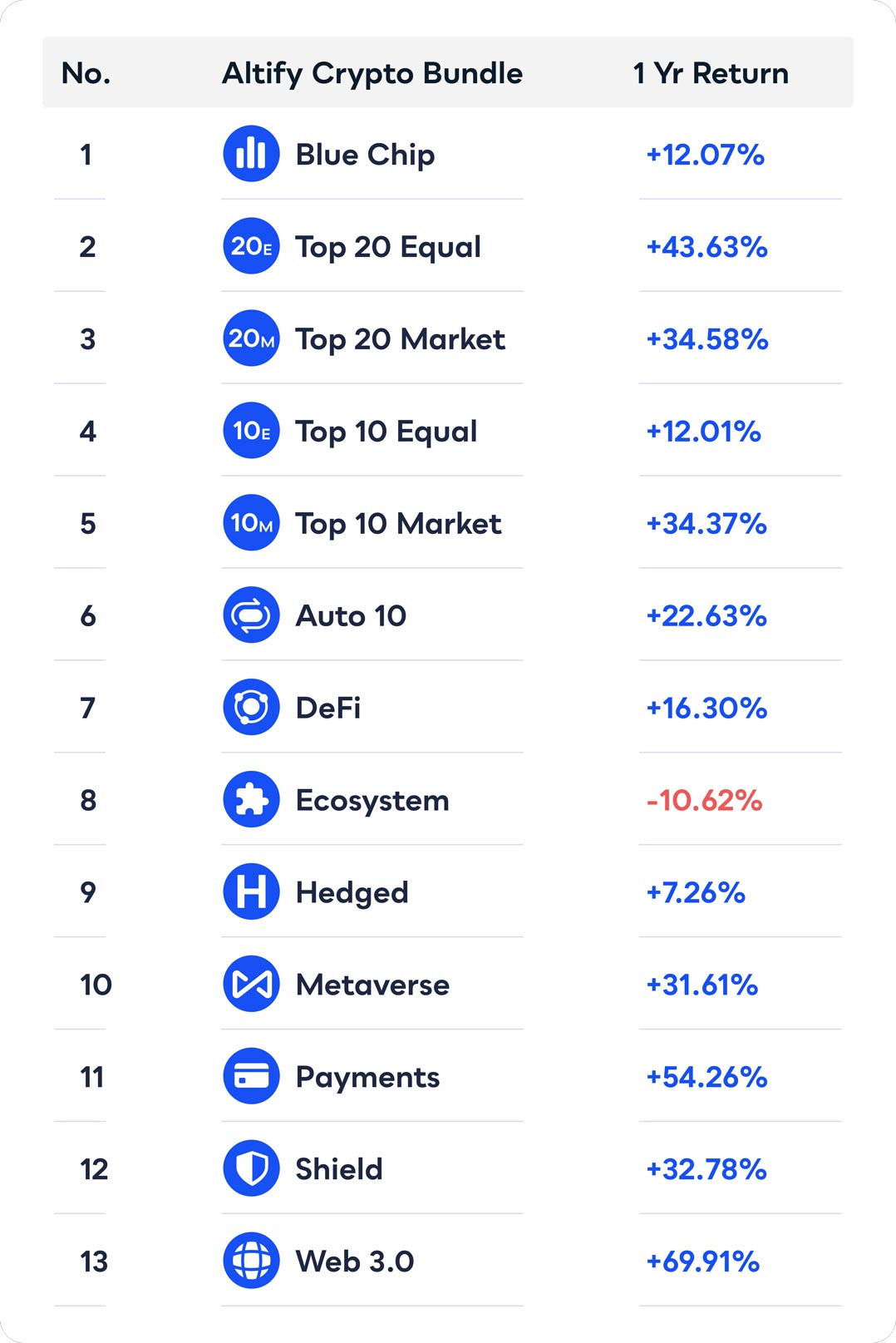

Below is a performance summary of each of Altify’s Crypto Bundles over the past year.

Explore Altify’s diverse Crypto Bundles

Altify offers 13 different Crypto Bundles. You’ll find a description of just three below but you can head over to Altify’s Crypto Bundle page to learn more.

- Top 20 Equal Bundle: This Crypto Bundle provides diversified exposure to the 20 largest cryptocurrencies as measured by market capitalisation, covering over 90% of the total crypto market value. Since this Crypto Bundle is equally weighted, you’ll own a broad range of established cryptos as well as emerging altcoins.

- Blue Chip Bundle: This Crypto Bundle applies the principle of “blue-chip investing” to the world of cryptocurrencies. Investors gain diversified exposure to the top coins across the 10 largest crypto sectors, such as DeFi, Web 3.0, the metaverse and more.

- DeFi Bundle: This Crypto Bundle is designed to give you market cap weighted exposure to the top 10 DeFi cryptocurrencies providing you with direct access to the pioneers of financial technology.

Conclusion

Why spend your time searching for the needle in the haystack when you can just buy the haystack? Altify’s Crypto Bundles provide an accessible, diversified and effortless investing approach in the crypto space while reducing risk through diversification.

Disclaimer

This article is intended for informational purposes only. The views expressed are not and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any of the assets or securities mentioned herein. You should not invest more than you can afford to lose and, before investing, please take into consideration your level of experience and your investment objectives, and seek independent financial advice if necessary.

Risk disclosure

Please consider your personal circumstances when buying or selling crypto as the price can be very volatile. Cryptocurrencies can incur a permanent loss of capital and are therefore not appropriate for all investors. Investing in cryptocurrencies is not supervised by any regulatory framework.

- Read more articles by Altify on TechCentral

- This promoted content was paid for by the party concerned