Naspers is one of the most closely watched and debated shares on the JSE. Aside from the fact that it is the bourse’s most pricey share, it has been one of its stellar performers — growing by 430% since 2012.

In March 2009, Naspers had a market capitalisation of US$6,2bn and its stake in Chinese technology company Tencent was worth $4,4bn.

Fast forward to May 2015 and Naspers’s market cap is $64,9bn and its 34% stake in Tencent is worth $65bn.

Industry analysts are now divided over whether the share is worth investing in and holding at these levels.

The answer probably lies in whether investors believe Tencent, which has driven the growth in the share, is fairly valued or not.

The Chinese e-commerce giant now accounts for all of Naspers’s market capitalisation.

In the 2014 financial year, Tencent generated revenues of $12,7bn and earnings of about $3,5bn. Its market cap is $193bn and its p:e ratio is a hefty 53.

It sounds high, but Tencent is not unique in this regard. Globally, Internet and other high-tech companies are demanding high multiples, writes Sanlam Private Wealth portfolio manager Emile Fourie in the company’s latest newsletter.

Facebook is trading at a 73 p:e, with a market cap of $223bn; Twitter’s market cap is $31bn and it made a loss last year; and Uber’s valuation of $41,2bn is 15 times the equity raised for this private company.

China’s technology sector is up by about 70% year-to-date, more than three times the broader Chinese index — which is also soaring. The median Chinese technology company has a p:e ratio double that of the median US technology company at the height of the US dot-com bubble, Fourie says. “The current share price is therefore pricing in significant growth over a long period of time. One might argue Tencent has grown earnings at 24% per annum over the past five years and has excellent growth prospects. But remember the company is now one of the 30 biggest in the world.”

None other than Warren Buffett laid down the challenge to big companies in 2001, he adds. “Buffett offered to wager ‘a very significant sum that fewer than 10 of the 200 most profitable companies in 2000 will attain 15% annual growth in earnings-per-share over the next 20 years.’”

Thus, on a 53 p:e, very high earnings growth is required. But as Buffet observed, few big companies manage to grow earnings by more than 15% per annum over 20-year periods.

Tencent, in its less-than-15-year-lifespan, has become highly profitable and has taken several steps to grow its platforms and user experience, in the process locking in users.

To understand the company’s potential, one has to understand a few things: social media in China — because it’s like nothing else on earth; what the Tencent “ecosphere” comprises; and how big Tencent is in the context of a huge market.

China’s entire population is about 1,4bn people; 620 million are Internet users, 625m are active social media users and 1,2bn are mobile subscribers, according to the website Socialmediatoday.com.

Tencent’s QQ is the largest online chat community in the world and offers a variety of services, including online social games, music, shopping, microblogging and movies. It boasts more than 800m active accounts — which also suggests that many Chinese IM users manage multiple accounts.

QQ is the primary entry point for Qzone, a Facebook-style social network that is accessed by QQ instant messaging friends. QZone was architected to work on any phone in China, even cheap models running on 2G. Consequently, it’s difficult to find anyone in China without a QQ account.

While QZone claims to have the highest number of social networking users, Tencent’s Weixin, or WeChat, a free instant voice messaging app, along with its smaller rival Sina Weibo are the current darlings of social media with 355m and 129m monthly active users respectively, according to socialmediatoday.com.

Stroke of genius

Tencent founder and CEO Pony Ma’s real stroke of genius was his bet on mobile. When Chinese downloads of mass interactive games on PCs flagged, and sales of mobile smartphones started taking off a couple of years ago, he shifted the bulk of Tencent’s engineers onto mobile development.

Mobile devices are now China’s Internet tools of choice, with 81% of the country’s “netizens” accessing the Internet via mobile handsets.

In the process, the Internet industry in China has been reshaped with rapid development of mobile game and entertainment activities, enhanced importance of mobile advertising, growing adoption of mobile payment and the emergence of O2O (online to offline) opportunities across industry verticals such as restaurants, transportation and household services.

In the process, mobile payment adoption expanded significantly.

Tencent has been instrumental in driving and shaping these trends. In 2014, it focused on its “Connection” strategy, which sought to create an “ecosphere” linking (some would say “tying in”) users with content, services and hardware to enhance their lives online and offline.

Last year, the company invested heavily in content for businesses such as its literature service, music service and video service, contributing to substantial traffic growth. Its portfolio of mobile utilities, including mobile security, browser and application store, achieved healthy market share gains, according to the company’s latest financial report.

Tencent also moved into financial services with the introduction of its wealth management platform and the inception of Internet banking company WeBank.

WeBank is in the early phase of its development, but is potentially transformative — as Capitec was in South Africa. The Chinese banking sector is not particularly user friendly — having been run by the big four state-owned banks. If WeBank succeeds in delivering the right products at the right price, it could become the bank of choice for a significant portion of the Chinese population.

Tencent has also repositioned its e-commerce business — choosing to partner with specialists rather than control every aspect of the online value chain.

“This will free up our internal resources to focus on the core strengths of our platforms, while enabling us to continue to benefit financially from the growth potential of the underlying industries via our significant equity stakes in partners,” the company says in its latest financials.

Many of Tencent’s opportunities are at an early stage of development and, if successful, will provide many years of profitable growth for Tencent.

Tencent is not without risk, though. While it and the country’s other two giant Internet conglomerates — Baidu (search engine) and Alibaba (e-commerce) — control a significant slice of the country’s Internet real estate, there is no shortage of start-ups fighting for users and marketing dollars, especially in the social sphere.

But is it a buy?

It is the nature of the high-tech social media space that makes companies like Tencent difficult to value. And just how divergent opinions are on Naspers and Tencent is revealed by the fact that within one investment house, Sanlam Private Wealth, portfolio managers do not necessarily share the same view.

Investment analyst Renier de Bruyn acknowledges the concerns around Tencent’s valuation, but argues that the company has a strong profit track record and high barriers to entry created by the network effect of its social network platforms.

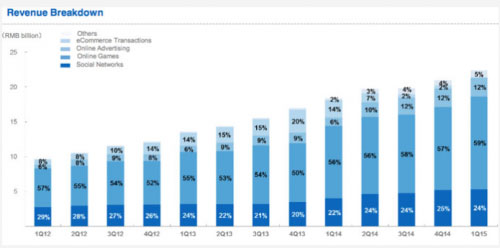

“The bulk of earnings are still derived from online games where smartphone usage is currently sustaining the growth. While Facebook and Google derive the bulk of their revenue from online advertising, Tencent has only begun to tap into this source of revenue. Strong growth in advertising revenue, coupled with strategic investments in online retailer JD.com and online classifieds business 58.com, are expected to contribute towards the next stage of growth for Tencent.

“Growth in the global economy is slow, but it is changing its shape, creating winning and losing companies. Naspers is on the winning side and I will therefore hold onto my Naspers shares in the context of a diversified portfolio — even though its performance may be volatile.”

On the other hand, value investor Emile Fourie has a different view. “Even though Tencent’s long-term growth prospects remain positive, history illustrates the danger of paying expensive-looking prices for tech companies.

“Value investors should ask what the probability of long-term success for the Tencent investor is at current levels. Given the size of the company, the complexity of valuing a fast-changing tech company and the high current price discounting aggressive future earnings growth, I find it difficult to have confidence in Naspers (as Tencent has been the historic driver and still currently is by far the most dominant asset in Naspers) on a probability basis, and have therefore sold Naspers in the value equity portfolio.”

- This article was first published on Moneyweb’s The Investor and is republished here with permission