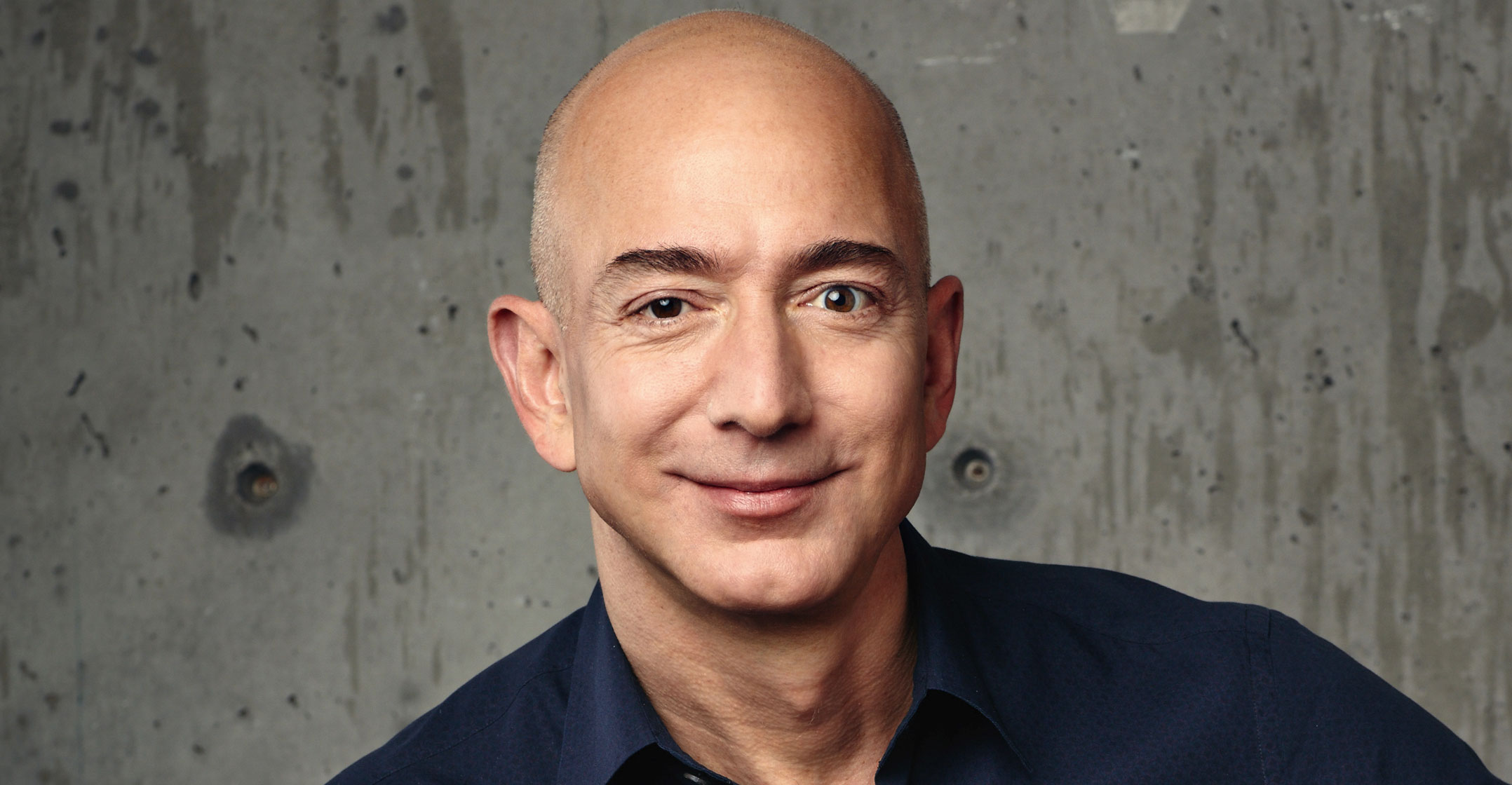

Jeff Bezos is the world’s newest US$100bn mogul.

The Amazon.com founder’s fortune is up $2.4bn to $100.3bn (R1.4 trillion at the time of writing), as the online retailer’s shares jumped more than 2% on optimism for Black Friday sales.

Online purchases for the day are up 18.4% over last year, according to data from Adobe Analytics, and investors are betting the company will take an outsized share of online spending over the gifting season.

The $100bn milestone makes Bezos, 53, the first billionaire to build a 12-figure net worth since 1999, when Microsoft co-founder Bill Gates hit the mark.

Bezos’s fortune rose $32.6bn this year through to Thursday, the largest increase of anyone on the Bloomberg Billionaires Index, a daily ranking of the world’s 500 richest people. Amazon has climbed 5% this week alone.

As Bezos’s wealth flirts with new heights, there’s likely to be more questions about what he intends to do with it. Unlike Gates, who was the world’s richest person until Bezos passed him in October, or US investor Warren Buffett, the world’s third richest person with $78.9bn, Bezos has given relatively little of his fortune to charity.

Bezos is only just starting to focus on philanthropy, and in June tweeted a request for ideas on how to help people. Since 2002, Bezos has given away Amazon shares worth about $500m at current prices, according to a Bloomberg analysis of Form 4 filings. The billionaire said in April that he sells $1bn of Amazon stock every year to fund his space business Blue Origin.

Gates, 62, who has a net worth of $86.8bn according to the Bloomberg index, would be worth more than $150bn if he hadn’t given away almost 700m Microsoft shares and $2.9bn of cash and other assets to charity, according to an analysis of his publicly disclosed giving since 1996. The index numbers are based on the close of trading in New York Wednesday. Bezos’s fortune and Amazon share data reflect Friday’s closing trading prices in New York. — Reported by Tom Metcalf, with assistance from Spencer Soper and Nick Turner, (c) 2017 Bloomberg LP