Facebook spent much of Wednesday outlining ways that the privacy of its two billion users might have been compromised for years by the company’s lax data policies.

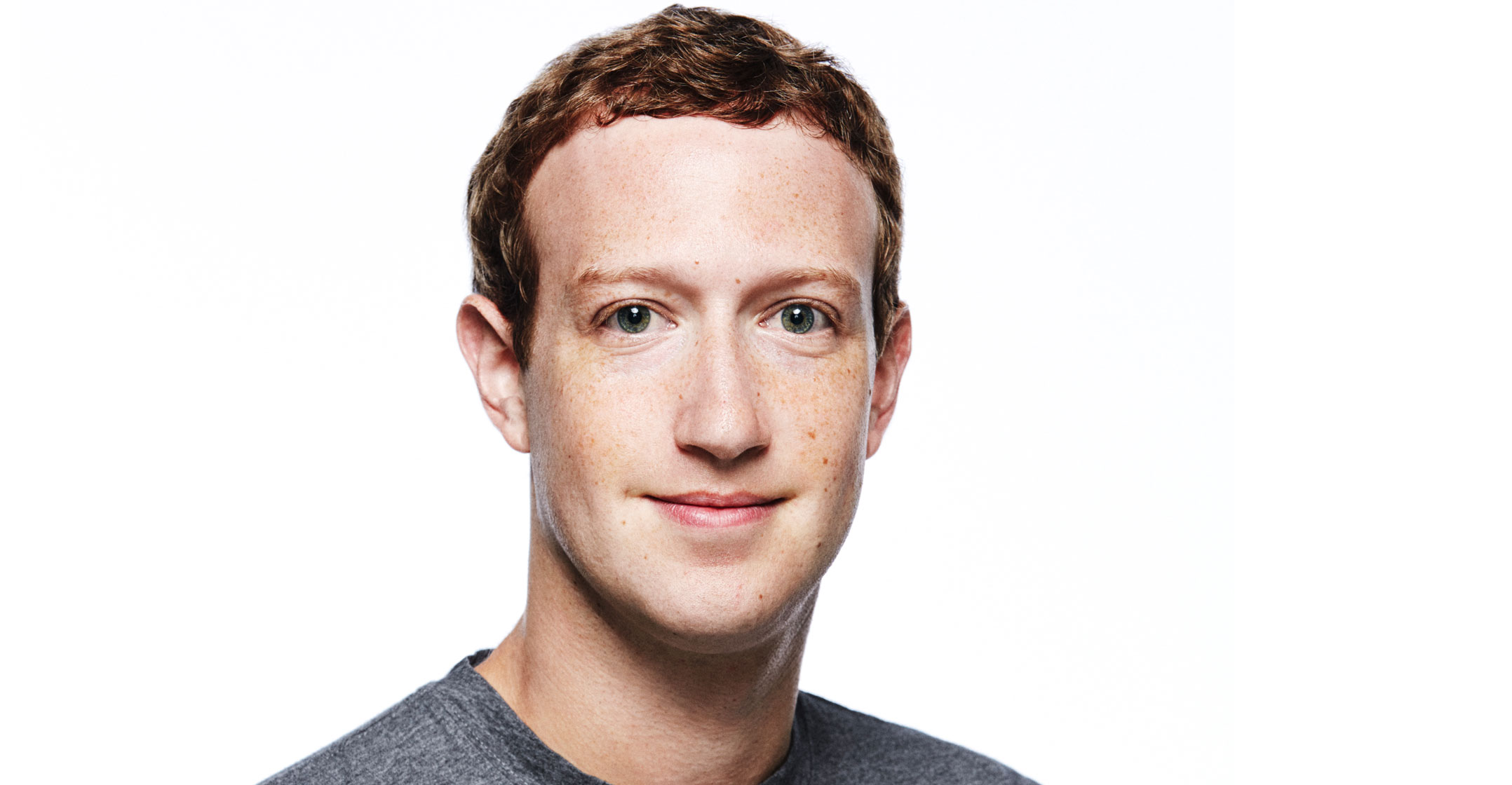

The shares rallied anyway after CEO Mark Zuckerberg stoked optimism that the drumbeat of bad news may be coming to an end.

Most reassuringly for investors, he said he hadn’t observed “any meaningful impact” on the business, despite weeks of revelations, complaints from advertisers and users of the social network, and a #DeleteFacebook campaign to shut Facebook accounts.

Facebook shares rose 3% in extended trading following those comments. The stock closed down less than 1% at US$155.10 in New York.

The world’s largest social media company made a dizzying array of privacy-related disclosures during the day, including a new data policy, updated terms of service and confirmation that it scans links and images that people send via its Messenger service.

The most dramatic update was the removal of a feature that let users enter phone numbers or e-mail addresses into Facebook’s search tool to find other people. That was being used by malicious actors to scrape public profile information. “Most people on Facebook could have had their public profile scraped in this way,” the company said.

Soon after that bombshell, Zuckerberg addressed a crisis that’s been building since revelations last month that political consulting firm Cambridge Analytica improperly accessed data on millions of Facebook users. Legislators and policy makers are now calling for greater regulation of social media, helping to knock almost $100bn off the company’s market value.

“We didn’t take a broad enough view of what our responsibility was and that was a huge mistake. It was my mistake,” Zuckerberg said in a conference call with reporters (listen to the full call below). “We’re broadening our view of our responsibility.”

‘Bad activity’

Facebook won’t find “every single bad use of data, but what we can do is make it a lot harder for folks to do that going forward”, he added. “We will be able to uncover a large amount of bad activity that exists.”

Facebook shares have fallen 16% since the Cambridge Analytic privacy issue emerged because investors are concerned the company’s massive data-gathering operation will be limited, either voluntarily or through regulation. That information is used to target ads, making them much more valuable and profitable.

Zuckerberg defended the business model on Wednesday. “People tell us that if they’re going to see ads they want the ads to be good,” he said, noting that requires keeping track of people’s interests.

Zuckerberg also said he should remain at the helm. “As far as I’m aware, the board has not discussed whether I should step down as chairman,” he said. “Life is about learning from mistakes and figuring out what you need to do to move forward.”

For now, that’s also good news for investors. Next week brings Zuckerberg’s next challenge: public testimony to the US congress — an encounter he’s been reluctant to face. — Reported by Sarah Frier, (c) 2018 Bloomberg LP