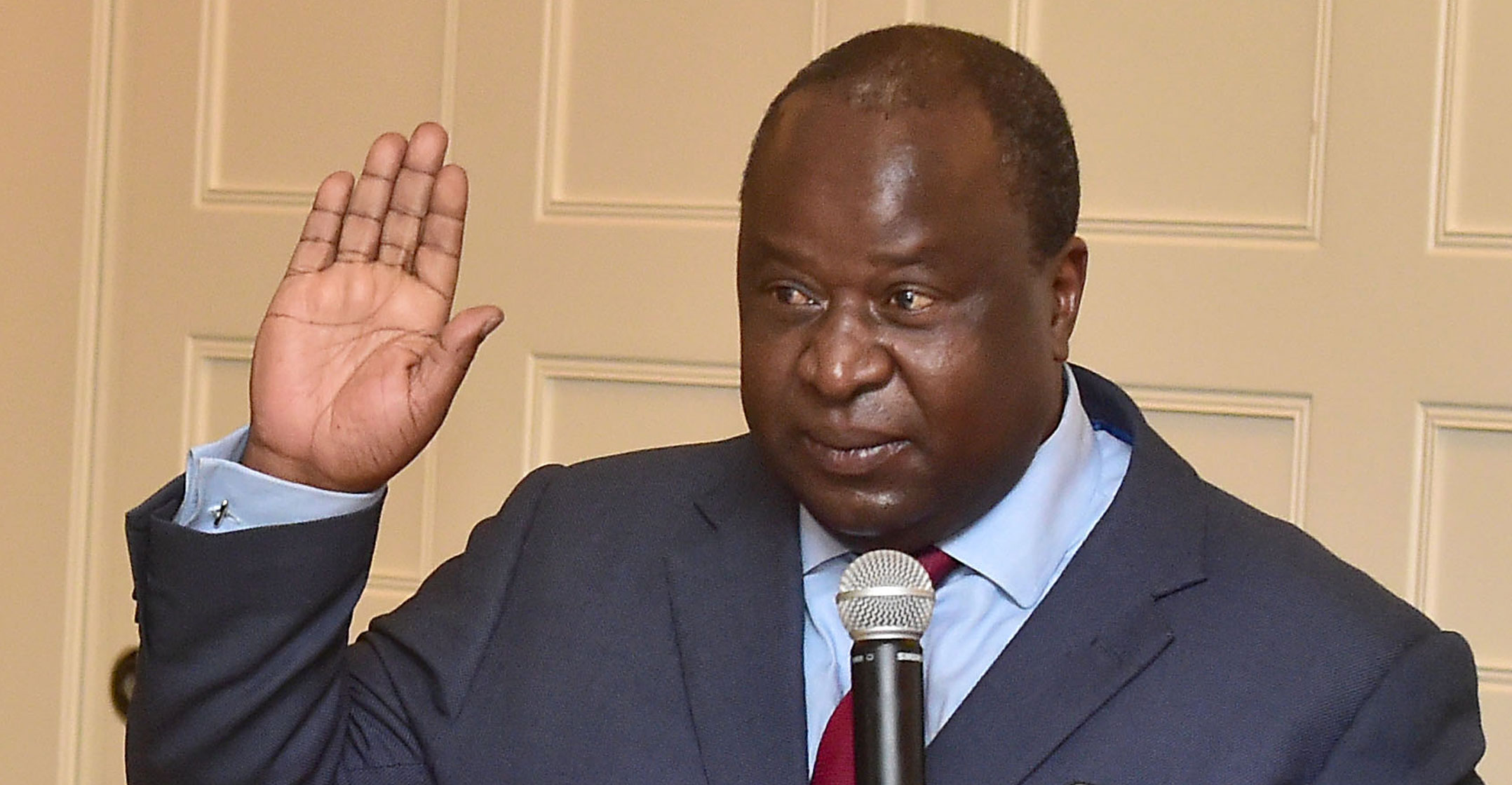

Finance minister Tito Mboweni’s plan to pull the economy out of its longest downward cycle since 1945 may have put him on a collision course with cabinet colleagues, fellow ruling-party members and labour unions.

The minister envisions the state relinquishing its near monopoly of electricity, port and rail services, relaxing rules to make it easier to do business and privatising assets to stabilize its finances. He also favours maintaining a flexible exchange rate, inflation targeting and sustainable fiscal policy, according to a policy paper released by the national treasury on Tuesday.

Some of the proposals conflict with recent calls from within the ANC and its union allies for the government to play a more interventionist role in tackling rampant poverty and a 29% unemployment rate. Official policy positions, which have been adopted by the party but have yet to be implemented, include nationalising the central bank, land seizures and implementing a costly national health insurance system.

The treasury paper hasn’t been presented to the cabinet and its adoption isn’t assured. While Mboweni may be unsuccessful in implementing all the proposed reforms, by putting them all on the table a compromise could mean at least some of them find easier passage.

“There will be tension, there will be differences,” said Roland Henwood, a political science lecturer at the University of Pretoria. “I think what Mboweni has done now is to underline the crisis. Government cannot go on talking about the crisis of unemployment and lack of economic growth and we are not seeing any action.”

South Africa’s economic woes stem from policy missteps and rampant graft that characterised the nine-year rule of former President Jacob Zuma, who quit under pressure from the ANC 18 months ago and was replaced with his deputy, Cyril Ramaphosa.

Compounded

The problems have been compounded by a meltdown at Eskom — it’s needed a multibillion-rand bailout to remain solvent and its failure to supply sufficient electricity helped cause the economy to contract an annualised 3.2% in the first quarter, the most in a decade.

The treasury’s plan seeks to lift the average annual economic growth rate by two to three percentage points and create more than a million jobs over a decade. Its most contentious suggestion is to sell some of Eskom’s plants, subject to power off-take agreements.

Raymond Parsons, a professor at North-West University’s Business School in Potchefstroom, west of Johannesburg, said the treasury has provided a viable road map for the country to address its economic malaise, but its success will hinge on effective implementation.

Raymond Parsons, a professor at North-West University’s Business School in Potchefstroom, west of Johannesburg, said the treasury has provided a viable road map for the country to address its economic malaise, but its success will hinge on effective implementation.

Boosting growth “will require the necessary political will to take the tough decisions”, Parsons said. “The fundamentals for a higher growth trajectory must be laid now to reap tangible benefits later.” — Reported by Mike Cohen and Amogelang Mbatha, with assistance from Paul Vecchiatto, (c) 2019 Bloomberg LP