Shares of MTN Nigeria hit an all-time high while those of rival Airtel Africa jumped to a six-month peak on Monday after the telecommunications companies received approval to operate mobile money services in Africa’s most populous country.

Shares of MTN Nigeria hit an all-time high while those of rival Airtel Africa jumped to a six-month peak on Monday after the telecommunications companies received approval to operate mobile money services in Africa’s most populous country.

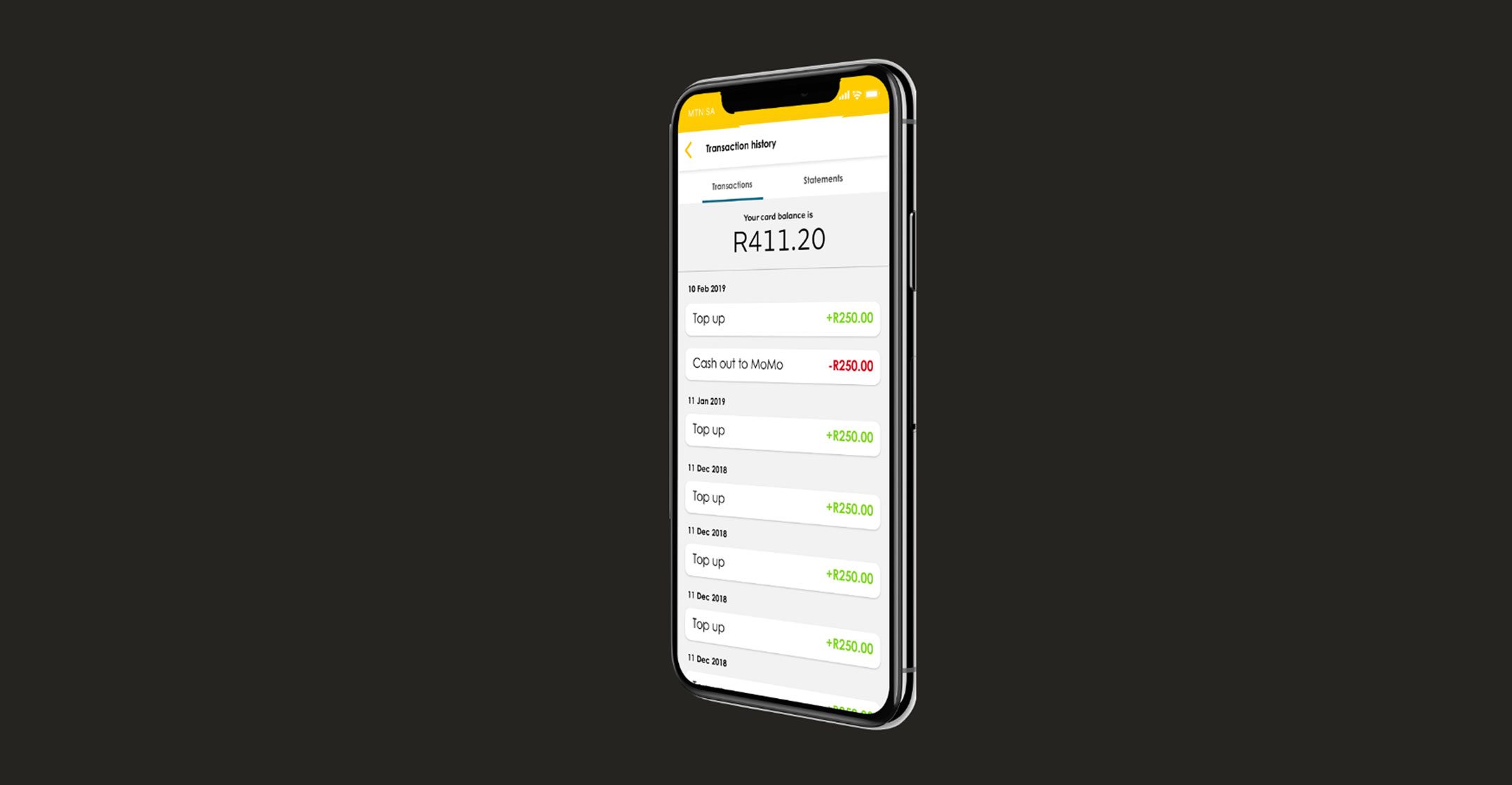

Mobile phone operators like South Africa’s MTN Group — MTN Nigeria’s parent company — have been pushing into financial services on the continent, where a large part of the population does not have good access to traditional banking services.

MTN and Airtel Africa said on Friday they had been granted the in-principle approval by the Central Bank of Nigeria (CBN).

The licences, which Nigeria hopes will help drive financial inclusion and innovation, has been pending for more than two years after MTN and Airtel Africa applied to the central bank.

“The approval in principle comes as a surprise but it is the first step towards final approval subject to meeting all conditions set,” said Akintola Akinbamidele, sub-Sarahan Africa equity sales analyst.

He noted that average revenue per user (Arpu), a key performance metric for the telecoms sector, has been declining, with companies looking to financial services for growth.

“We think it (the approval) is positive for both players and it could be the driver of additional and material growth for the telco industry,” he said.

Shares soar

Shares in MTN, Nigeria’s second biggest listed company, rose as much as 9.34% while Airtel Africa rose 10%. The gains helped to propel Nigeria’s share index its highest in two-and-a-half years.

Shares of MTN Nigeria have more than doubled in value since falling to the listing price of ₦90 in March 2020, hammered by lockdowns to slow the spread of coronavirus.

MTN has said it is looking to become one of the continent’s biggest fintech firms — an ambition that would be difficult to fulfil without Nigeria, home to some 200 million people.

Its MoMo service currently has 51 million active users. It said in 2019 it wanted its user base to hit 60 million. The company’s fast-rising fintech revenues now contribute almost 9% of its total income. — Reported by Chijioke Ohuocha, (c) 2021 Reuters