The latest numbers from JSE-listed Blue Label Telecoms, by far South Africa’s largest distributor of prepaid airtime, suggest MTN is haemorrhaging market share to rival Cell C in the mass market.

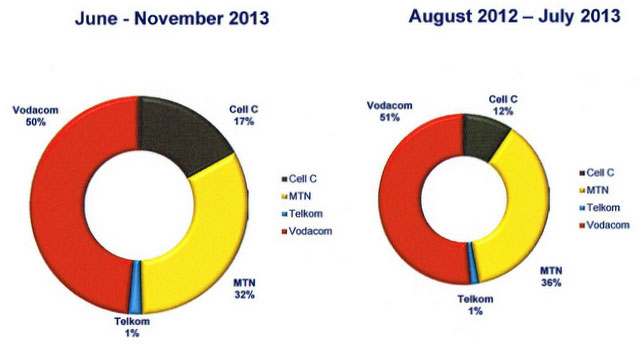

In notes accompanying Blue Label’s interim results for the half year ended November 2013, MTN’s share of prepaid airtime revenue slumped by 11%, from 36% to 32%, while Cell C grew its share of the market by 42%, from 12% to 17%. Vodacom lost only a little ground, with its share of the market going from 51% to 50%.

“Cell C has grown by 2-3%/month on their base,” says Blue Label co-CEO Brett Levy. “MTN is the one that seems to be most affected at this stage of the game.”

The Blue Label numbers exclude contract customers, which are more lucrative for the operators, particularly for MTN and Vodacom, which were licensed earlier and so were able to sign up high-spending early adopters. Levy estimates that Cell C’s share of the overall market, measured by revenue, is only between 9% and 10%.

He says Vodacom has managed to maintain its market share because it has been “unbelievably active” in launching new products that have kept customers from churning to other networks. MTN, on the other hand, “hasn’t come out with anything really exciting in the past six months”.

The MTN group is expected to publish its full-year results on 5 March, providing more detailed insights into the performance of its South African operation, which last week brought litigation against communications regulator Icasa over inter-network call tariffs that favour Cell C to its disadvantage.

“Vodacom has launched a lot of great campaigns. They’re coming up with good new ideas,” Levy says. This has helped the company from losing too much ground to Cell C, which he says has “come out of the most unbelievable price and an unbelievable marketing campaign”.

He adds that it is unusual to have a situation, as in South Africa, where the two dominant operators control 90% of the market by revenue. He says it’s usually less than 70%.

“Somewhere along the line, something has to give,” he says. “Vodacom has about 53% [of overall revenue market share] and MTN about 37%, almost consistently where they’ve been for the past 10 years. Vodacom can’t go to 60% and MTN can’t go to 50%, so the real opportunity is for Cell C to go from 10% to 20%. They are the only ones who really have potential to grow.”

Telkom Mobile, meanwhile, hasn’t made much progress in the past six months, says Levy. Its revenue market share — at least as measured by Blue Label — is stuck at just 1%, despite having aggressively priced products.

“They are not getting market penetration,” says Levy. “It’s not their distribution, it’s just the market perception of where they’re at. Some of their products are really good. They’re not just sitting back. Maybe they are just the product of being the fourth network. It’s very difficult for the fourth network in any country. Can you imagine how hard it is when two leading networks have 90% market share?”

Levy’s brother and co-CEO Mark Levy says that for the first time in South Africa there is “truly competition” in the mobile industry. He says this is healthy and will force operators to innovate. — (c) 2014 NewsCentral Media