Imagine a world where the new supply of any commodity – gold, oil, coffee – suddenly halves overnight. You can imagine what would happen to the price of jewellery, petrol and even your favourite cappuccino. In the world of digital commodities, namely bitcoin, this is not a hypothetical situation but a programmed reality known as the bitcoin halving. Just as you would expect your cappuccino to increase in price, this event has historically led to major increases in bitcoin’s price.

Imagine a world where the new supply of any commodity – gold, oil, coffee – suddenly halves overnight. You can imagine what would happen to the price of jewellery, petrol and even your favourite cappuccino. In the world of digital commodities, namely bitcoin, this is not a hypothetical situation but a programmed reality known as the bitcoin halving. Just as you would expect your cappuccino to increase in price, this event has historically led to major increases in bitcoin’s price.

Brett Hope Robertson, head of investments of the Cape Town-based investment app Altify, shares his insights on what exactly the halving is, how it affects bitcoin’s price, anticipated price projections, and details on an exclusive, limited-time investment offer from Altify.

What is the bitcoin halving?

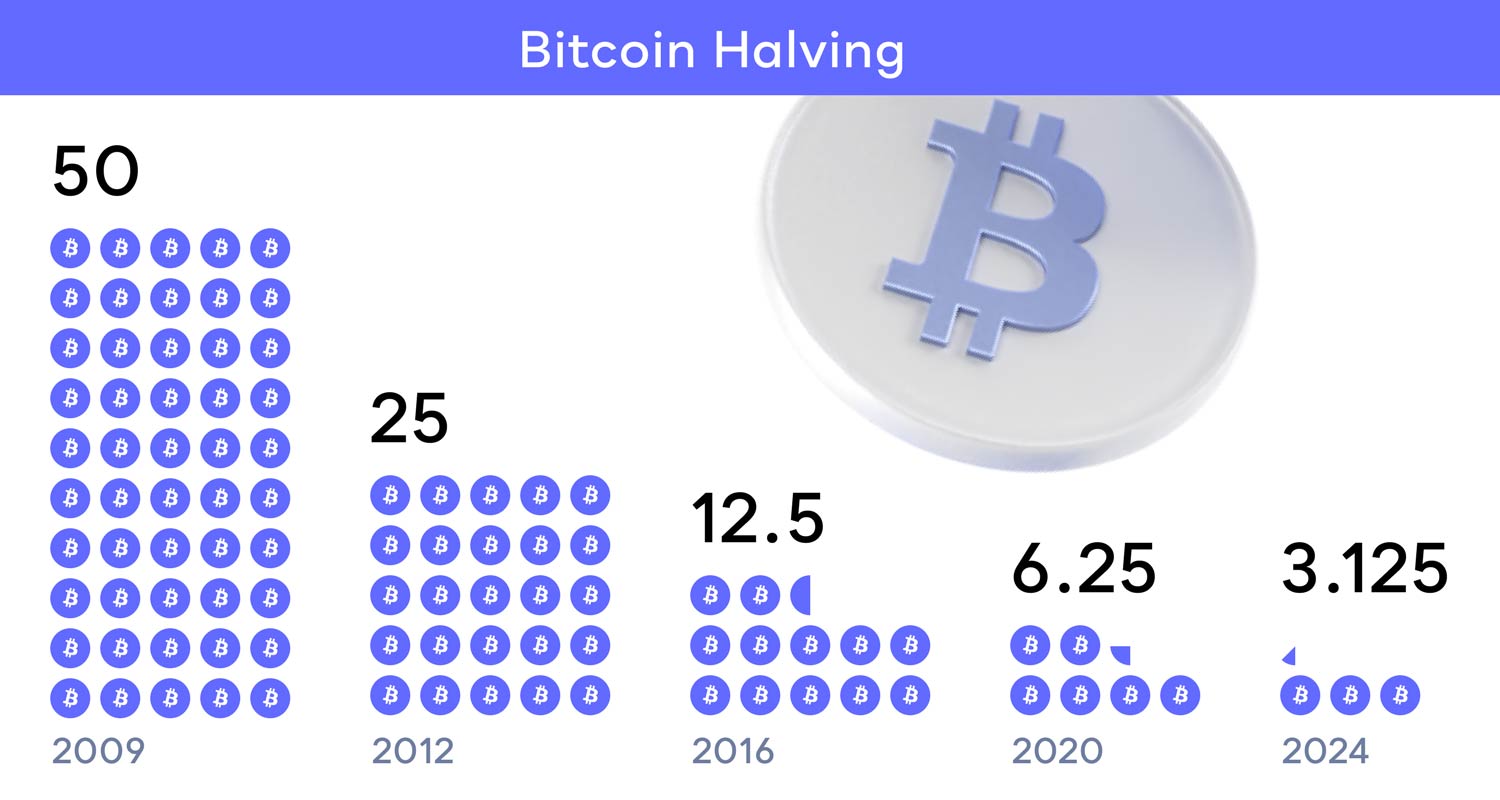

To grasp the concept of the upcoming bitcoin halving, it’s essential to understand that all cryptocurrency projects are nothing more than software with programmed rules. Bitcoin is programmed so that only 21 million coins will ever be created, ensuring scarcity. Additionally, the rate at which these coins are generated — achieved through a reward given to miners for adding new blocks to the blockchain — gradually decreases over time.

But what causes that decrease in the supply of new coins? The bitcoin halving does.

As an analogy, imagine you’re at a tea party where the amount of cake available is strictly limited to ensure that everyone gets a fair share. Initially, guests enjoy large slices. As the event proceeds, to extend the cake’s availability, the host halves the size of future slices. This strategy doesn’t shrink the cake but ensures every piece thereafter is smaller.

Relating this to bitcoin, the “cake” symbolises the finite 21 million coin supply, and the “slices” are the miner rewards for securing transactions. The bitcoin halving, akin to the host’s action at the tea party, reduces these rewards by half every four years.

Why is the bitcoin halving important?

This reduction maintains bitcoin’s scarcity and value, similar to how halving the cake slices keeps the party fair and enjoyable for longer.

The next bitcoin halving is projected to occur on 20 April 2024, where the 6.25 bitcoins that are currently created for each new blockchain block will be cut to 3.125 bitcoins.

Economics 101 tells us that if demand stays constant while there is a reduction in the supply of an asset, the price of the asset will increase. This is what investors have been getting excited about with bitcoin — it’s an asset that has both growing demand and is programmed to become scarcer over time.

The halving’s impact on bitcoin’s price

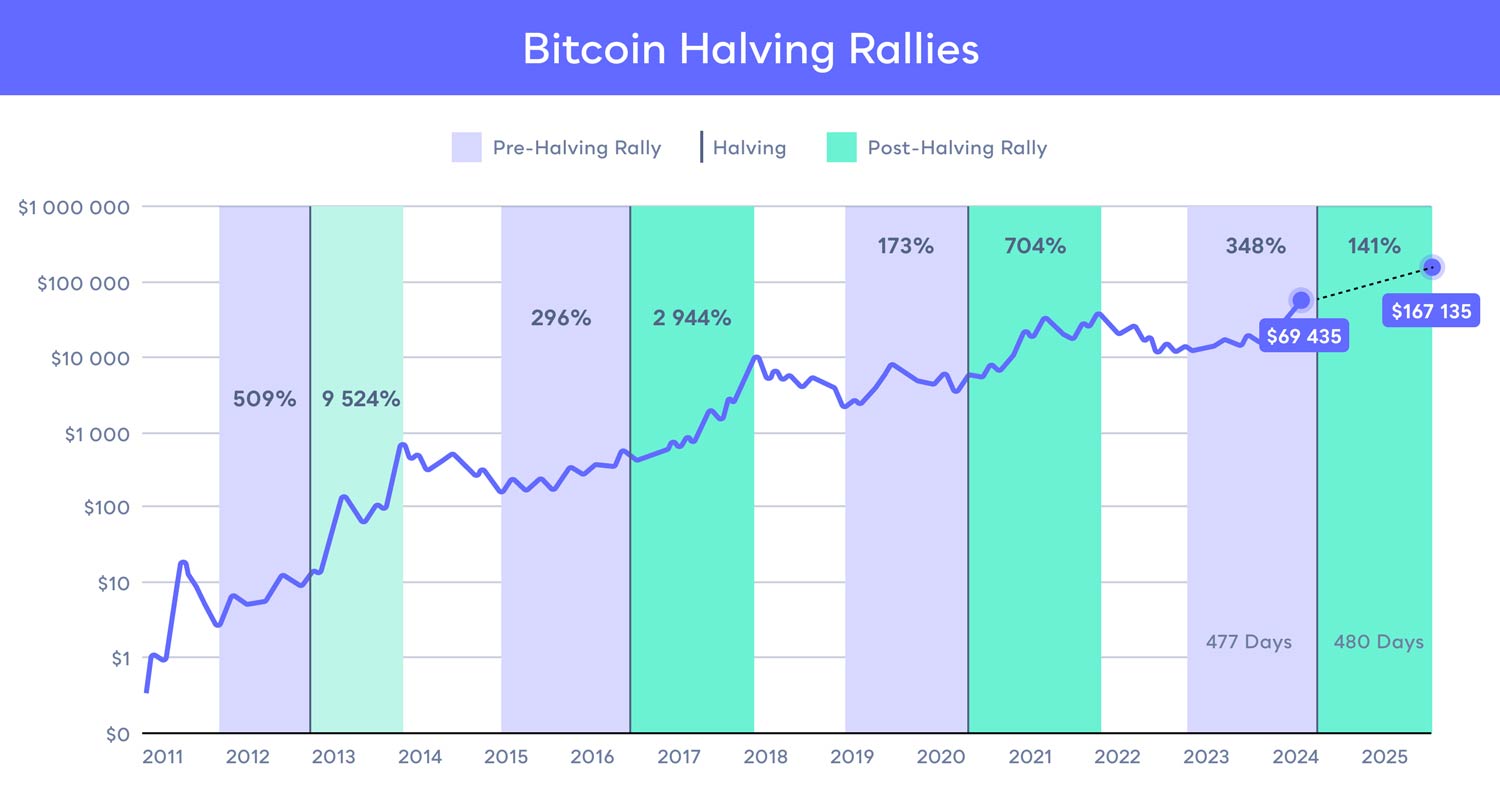

Historically, halvings have had a major impact on the price of bitcoin, but it takes roughly 2.6 years to play out. The chart below shows what would happen if bitcoin repeated its performance around previous halvings.

- Pre-halving price rallies: Typically, the pre-halving price increases, known as rallies, tend to start around 1.3 years (477 days) before the halving. At this point, the bitcoin price bottom has formed and subsequently, the climb in price leading up to the halving begins. Historically, these price rallies have averaged a gain of 320% over previous halvings.

- Post-halving price rallies: After a halving, bitcoin’s price usually jumps. On average, this price boost lasts for 480 days, from the halving to the peak of the next big price increase, showing gains of about 25-30% compared to the last halving’s rise.

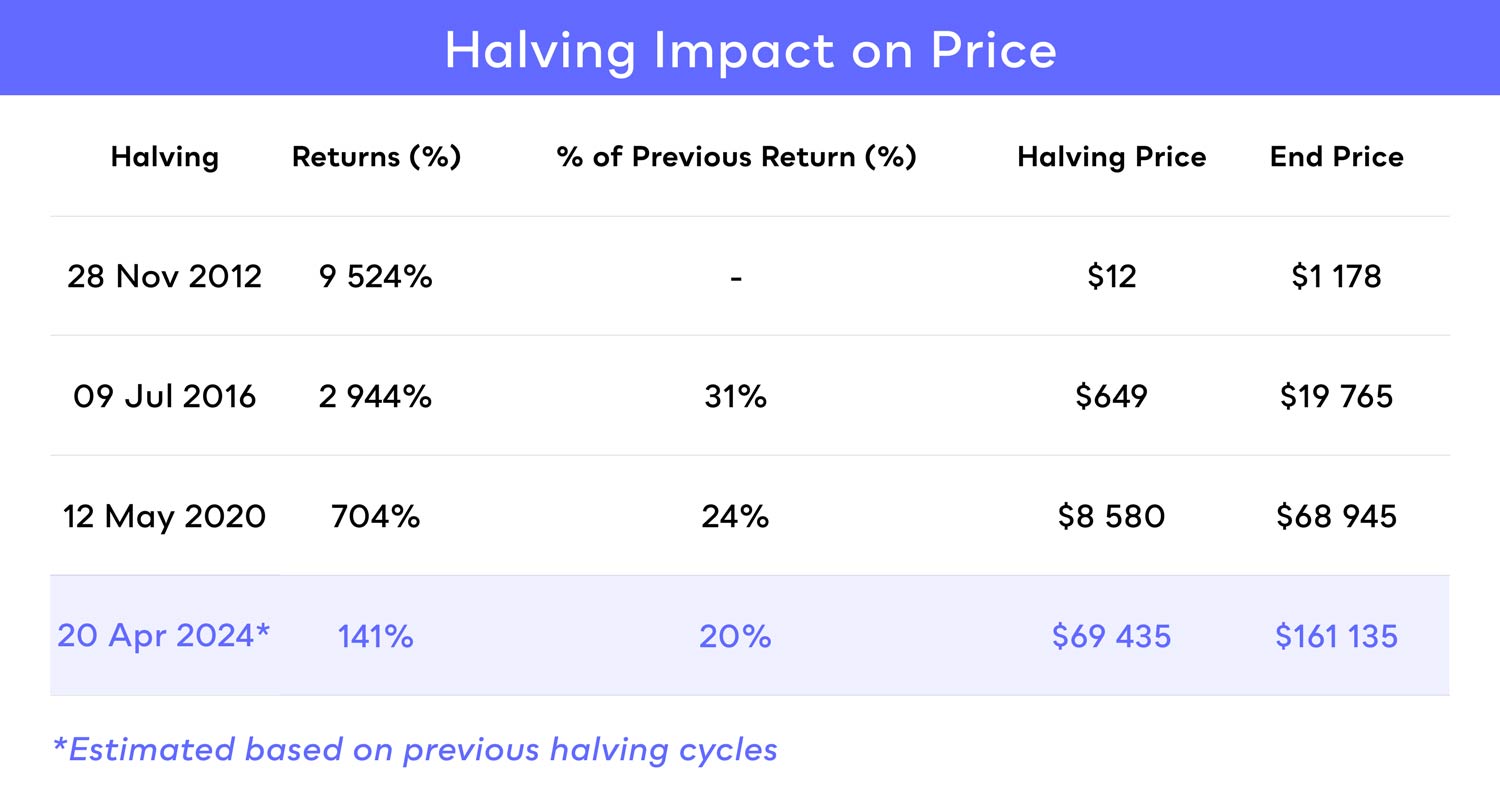

The table above displays the results of the last three bitcoin halvings (black) and the estimated effect of the upcoming halving (blue). Over the last three halvings (black), the bitcoin price increase reflected a return of 31% and 24% of its previous halving return, respectively.

If we assume this pattern continues, estimating only a 20% increase on the previous halving return, bitcoin’s price could go over $167 135 by August 2025.

While it’s important to note that past performance doesn’t always indicate future returns, bitcoin’s already proven itself to be far more than a fleeting trend. Since its inception in 2009, bitcoin has weathered numerous cycles of extreme volatility, regulatory challenges and speculative bubbles, yet it remains the top-performing major asset of the last decade.

As we count down to the next bitcoin halving, Altify has an exclusive limited-time offer for those interested in investing in bitcoin.

Use the promo code BTCHALVING when you sign up and invest at least R500 to receive an additional R200 in your account. This not only covers all your investing fees but also gives you a 40% return before you’ve even started.

It’s a unique chance to kick-start your investment with Altify and navigate the exciting waves of the bitcoin and crypto market, especially as we navigate towards a potential $150 000 milestone. Promotional terms and conditions apply.

Sign up to Altify here.

Disclaimer

This article is intended for informational purposes only. The views expressed are not and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any of the assets or securities mentioned herein. Altify provides a reception and transmission brokerage service for crypto asset orders without giving any investment advice or personalised recommendations.

While we believe in crypto accessibility for all, we also know that it might not be appropriate for everyone. Before investing, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. You are encouraged to conduct thorough research into cryptocurrencies before making any investment.

As an investor, you are responsible for making decisions regarding your investments. Please consider your personal circumstances when buying or selling crypto as the price can be very volatile. Remember, investing in cryptocurrencies is considered a high-risk investment as the value of cryptocurrencies is subject to extreme price fluctuations and may both appreciate and depreciate over time. Investing in crypto assets may result in the loss of capital.

Remember, past performance does not guarantee future results, and we can’t guarantee returns since asset prices move based on supply and demand, so never trade with funds you can’t afford to lose. You should seek professional advice if you’re uncertain about the suitability or appropriateness of any investment for your specific circumstances or needs.

Further information can be found in the General Risk Disclosures and Crypto Risk Disclosures on our website. Investments should only be made by investors who understand these risks. For more information, please visit www.altify.app.

About Altify

Altify is headquartered in London, with satellite offices in Cape Town and Vienna. The fintech business is backed by notable investors Sabvest, High-Tech Gründerfonds, CVVC, Emurgo and Calm Storm Ventures, to name a few. Altify’s desktop and mobile platforms provide a user-friendly, low-cost way for more than 80 000 users to invest beyond the stock market — offering access to 15-plus individual crypto assets, including bitcoin and ethereum, as well as the world’s largest range of ETF-style Crypto Bundles and gold.

- Read more articles by Altify on TechCentral

- This promoted content was paid for by the party concerned