Graphics chip designer Nvidia on Wednesday forecast a sharp drop in revenue in the current quarter on the back of a weaker gaming industry, knocking its shares down about 5% in after-hours trading.

The company said it expected third quarter revenue of US$5.9-billion, down 17% year on year, but said the declines would be partially offset by growth in the data centre and automotive business.

Analysts, however, raised concerns it may face more bad news as former growth areas slow. “We think Nvidia may see further downside from the crypto-mining and data centre end markets,” said Kinngai Chan, Summit Insights Group analyst.

Nvidia graphics chips, called GPUs, have been used for cryptocurrency mining and sales have taken a hit as the crypto market has crumbled. Analysts have been concerned about a slowdown in data centre growth, which has supported chip sales.

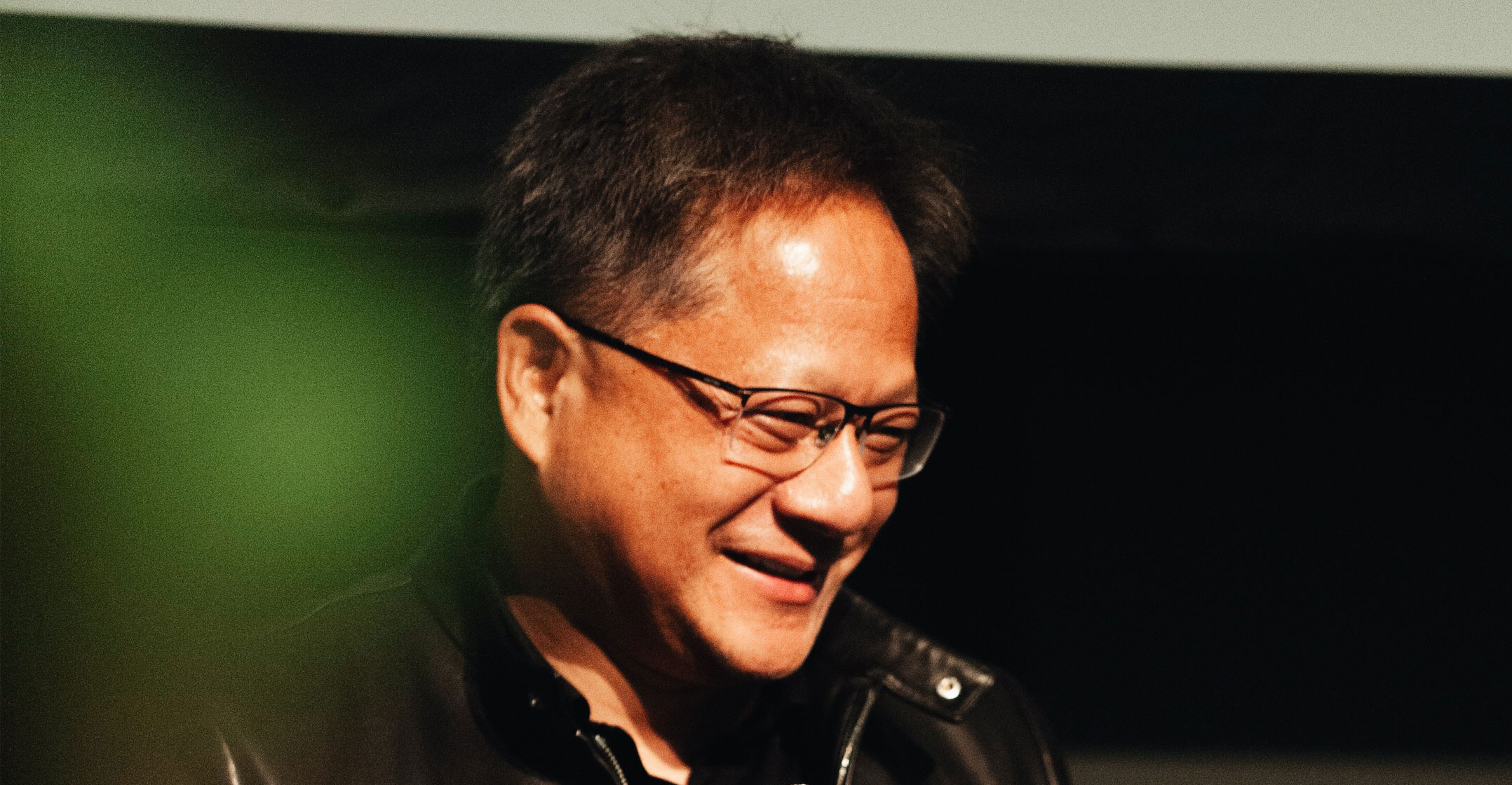

Nvidia CEO Jensen Huang said on an earnings call that Chinese cloud service providers’ infrastructure investment had slowed a lot in the second quarter, but this had been offset by strong growth in the US.

The company’s second quarter revenue of $6.7-billion was significantly lower than the $8.1-billion Nvidia forecast in May. Its gaming division posted revenue of $2.04-billion, down 33% year on year. Data centre revenue held up at $3.81-billion, up 61% year on year.

The gaming industry has been showing signs of weakness as consumers pull back from discretionary purchases such as videogaming gear amid decades-high inflation.

Inventory

Nvidia said it took a $1.34-billion charge in the second quarter as it wrote down inventory built up when it thought the gaming and data centre markets would be much stronger. “I know the demand is strong, but we expected the demand to be even stronger,” Huang said in an interview about the writedown of data centre inventory.

Huang told analysts on the call that the company also faced supply-chain challenges that prevented it from selling more systems to data centres. “We’re seeing a great deal of demand for GPUs in the cloud,” Huang said on the call. “We were challenged this quarter with a fair amount of supply-chain challenges.” — Eva Mathews, (c) 2022 Reuters