A judicial commission of inquiry into banks is the best way to shed light on the reasoning behind their decision to close off accounts with Oakbay Investments, said CEO Nazeem Howa.

In a teleconference with the media, Howa expressed disappointment in the four major banks’ decision to close accounts with the business. He was also sharing news on the group’s maiden financial results for the year ended 29 February 2016.

“We are still in the dark as to why they closed accounts. A judicial inquiry will ensure that the truth comes out,” said Howa. “We intend to reach out in the coming weeks, again, to the four banks, and implore them to reopen our accounts,” the group said in a statement.

Sasfin had withdrawn as JSE sponsor for Oakbay Resources and Energy earlier in the year and audit firm KPMG also severed ties with the company. “It was a big shock for us, all these institutions withdrawing, without giving good reasons,” said Howa.

The group had to adapt to the changes to run the business in a “sustainable” way. Howa said it was “common knowledge” that Oakbay now has a foreign bank, operating with a South African license, to run the group’s accounts.

SizweNtsalubaGobodo has since stepped in as the group’s new auditors. River Group is now Oakbay Resources JSE sponsor. “We believe the new sponsor will take the business to the next level,” he said.

Howa said that reports about state capture were not correct. As a private company, the group has no legal obligation to release results on financial performance. The group intends to be more transparent to bring about clarity on some “myths”. Among these being that the group is “heavily reliant” on government business.

It was reported earlier on Thursday that 8,9% of the group’s revenue was generated from government contracts.

Mining, the group’s largest division, contributed R1,2bn (44,5%) of revenue. This includes JSE listed Oakbay Resources which owns Shiva Uranium and the Brakfontein mine. The group also has a 29% shareholding in Tegeta, which operates Optimum and Koornfontein coal mines.

“Our uranium operations have nothing to do with the wider South African nuclear story. Our expectation is that our life of mine will have comfortably passed before South Africa is ready for nuclear,” the group stated.

The group is also proud of the fact that it could turnaround the financial position of Optimum Coal Mine. Chief operating officer George van der Merwe said this was as a result of improved efficiencies which boosted production.

A second drag line is operational and a third will be introduced in the third quarter to increase production. Optimum was released from its “business rescue” status on 31 August 2016, five months after being acquired by Tegeta. “When we bought Optimum we new we would be able to turn it around,” he said.

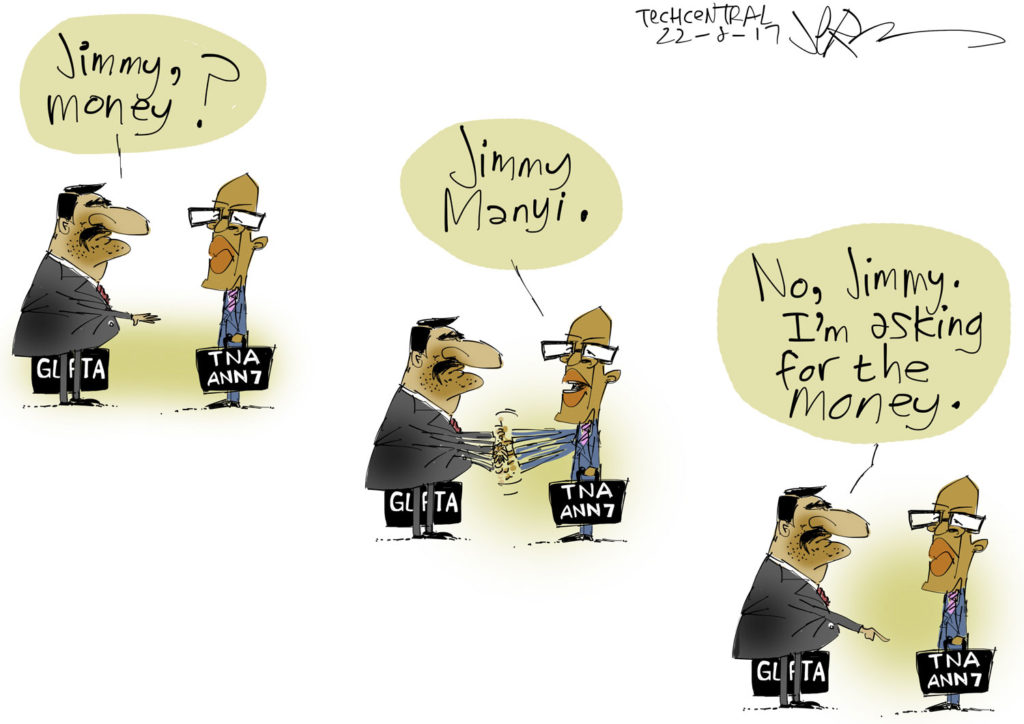

Howa said that the management could not comment on who would be taking over the Gupta family’s stake in the business, as it is a matter for shareholders.