Throughout history, financial intermediaries have connected buyers to sellers, enabling the exchange and transfer of products and money that make up markets. The middlemen, brokers and banks take their cut along the way — a just reward for facilitating financial transactions.

Throughout history, financial intermediaries have connected buyers to sellers, enabling the exchange and transfer of products and money that make up markets. The middlemen, brokers and banks take their cut along the way — a just reward for facilitating financial transactions.

These centralised financial institutions make colossal deals with each other that exploit entire markets, receiving returns unattainable to the average person. In this world, it’s not who you know but how big your bank balance is.

On a smaller scale, banks take custody of people’s money, investing the funds to earn a return as well as loan the funds out to other customers at high rates. They add bank fees to these incomes for their services, facilitating loans and savings interest to the masses. This made sense in the past. Without banks, finding someone to borrow money from for a quick and liquid investment would be impossible for the average person.

This financial system has remained relatively unchanged for hundreds of years, with the famous Medici Bank established in 1397. Even the advances in software and the Internet have done little to change the financial services industry. While consumer expectations have changed, financial institutions have responded with aesthetic touch-ups, like improved user interfaces and expanded online offerings, but traditional business models have persisted.

This is in stark contrast to the complete disruption experienced by many other industries, from retail commerce and hospitality to media. Film cameras all but disappeared in the wake of digital cameras, and when was the last time you went to a video store? In the age of rapid innovation, we will see many outdated models giving way to new and better ways of operating. Traditional finance is next.

What is DeFi?

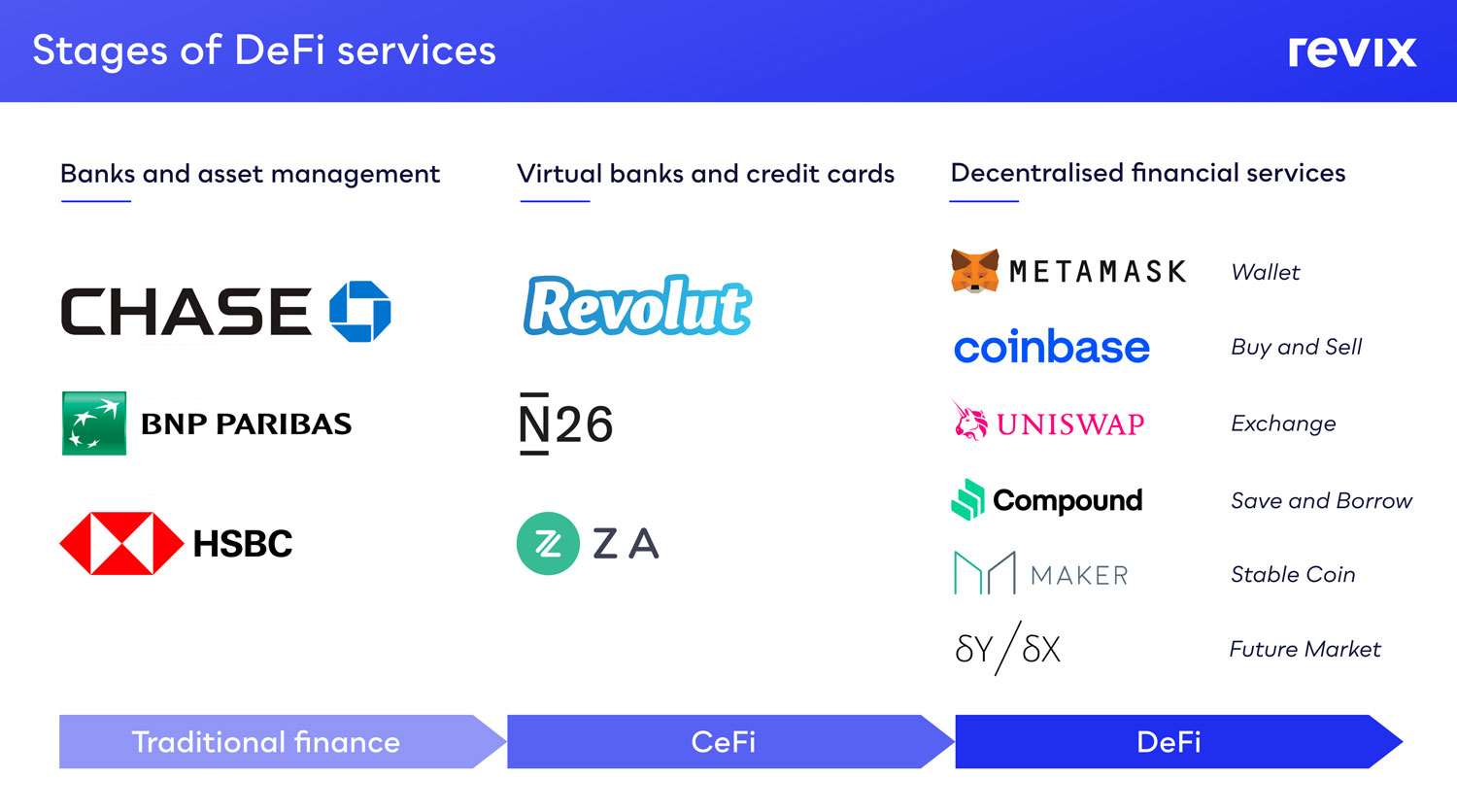

Decentralised finance (DeFi) is about reconstructing the entire financial system on decentralised blockchains. It transforms centralised, manual, inefficient financial services into automated, blockchain-based programs called smart contracts. For the first time in history, markets don’t need a centralised financial intermediary (in a world known as CeFi, or centralised finance) to connect buyers and sellers. Smart contracts connect them directly. This has seismic implications.

What can you do with DeFi?

Through DeFi programs, anyone with an Internet connection can borrow and save, send and receive, buy and sell, and even insure their money. This takes place between users all over the world via peer-to-peer blockchain-based networks. There’s no more need for the bank, stock exchange or insurance broker as we know them today.

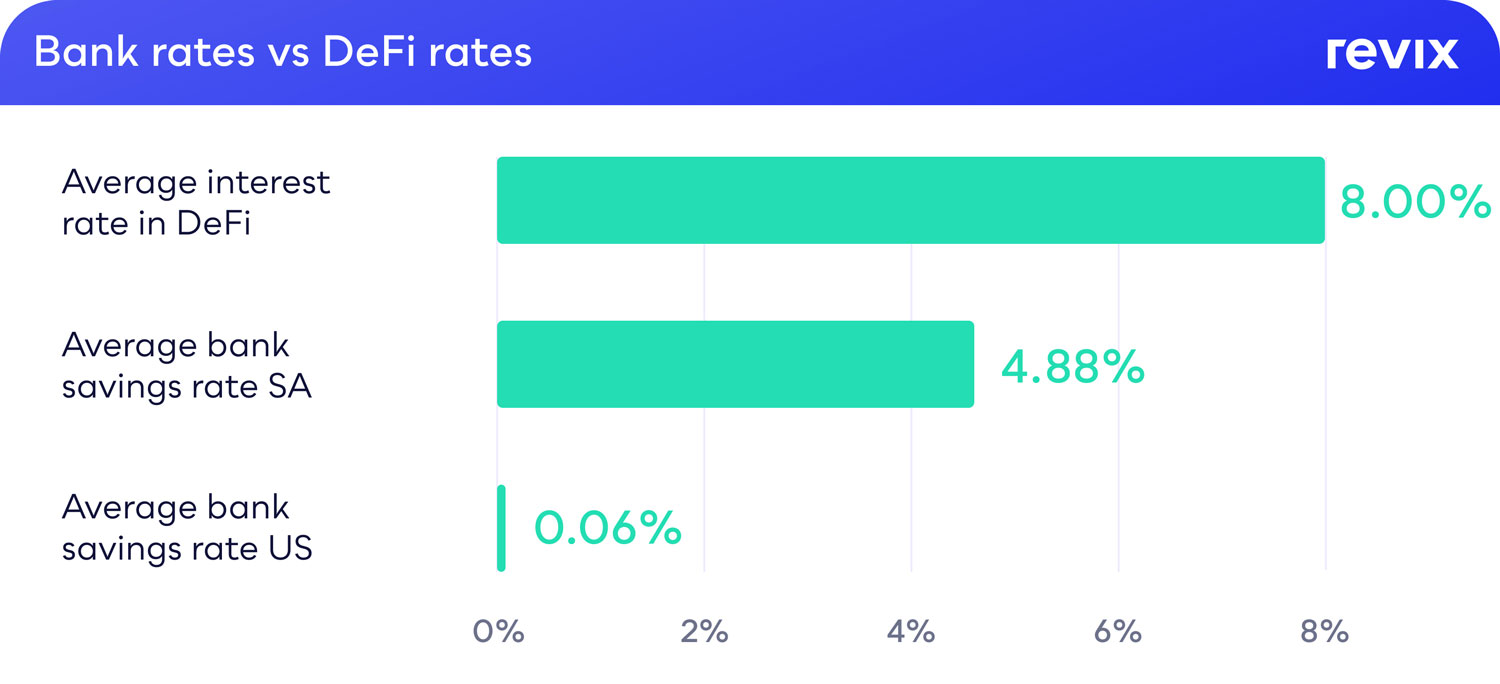

DeFi users can earn the highest return on their wealth without the need to give the middleman their cut. It gives users the freedom and visibility to manage their finances in ways that banks simply can’t compete with.

The other side of the coin is over-collateralised loaning services. DeFi users can instantly borrow up to 85% of the value of their deposited crypto without credit history and 0% interest. When you consider the annual growth of premium cryptocurrencies such as bitcoin or ether and overlay DeFi services, you quickly see the scale of disruption ahead.

While DeFi networks already manage more than US$200-billion, we are still early in the technology adoption cycle. Mass adoption will follow institutional money, and right now institutions are waiting for regulation and institutional-grade development, both of which are well under way.

You only need to look at two of the world’s leading accounting firms, EY and Deloitte. Both are breaking new ground with Polygon and Avalanche blockchains, respectively, developing audited and secure portals for their clients to use DeFi.

It’s not just the open ledgers or the blockchain that receive audits. The code base behind DeFi networks and smart contracts is audited to the highest specification possible in a growing sector of certification and security. The collective brainpower in crypto is unlike anything the world has seen, and it’s just getting started.

A recent survey by Valk found that a third of investors from eight major finance sectors invested in crypto for the first time in December 2021. Of these, 68% plan to invest in DeFi in 2022. With global markets experiencing volatility and traditional finance institutions offering less yield by the month, institutional adoption of DeFi is just a matter of time.

Being an early investor in disruption of this scale pays outsized dividends. To facilitate this early access, Revix, a Cape Town-based investment platform backed by JSE-listed Sabvest, has built an easy-to-use and customer-friendly portal to all things crypto. On Friday, 25 March, Revix launched a new themed DeFi Bundle, offering users exposure to the cryptocurrencies building the future of finance.

Make your investment before institutional adoption.

The DeFi Bundle, which saw 137% growth in 2021, offers a selection of the world’s leading DeFi tokens in one convenient investment. Through the DeFi Bundle, you receive exposure to the world’s largest decentralised exchanges, lending platforms and payment platform cryptocurrencies. It’s a lot like buying property off-plan in a great neighbourhood — you know what the end product will look like, and you’re taking a calculated risk on its future value.

The bundle automatically rebalances (meaning it makes slight changes to the weighting and assets in the bundle) on the 1st of every month. It takes advantage of opportunities available from the most reputable DeFi cryptocurrencies through buying or selling each asset. This dynamic and fully automated approach makes investing effortless, maximising your returns and saving you time.

You’re not too late to be early

You’re not too late to be early

Ready to be an early investor? Avalanche is only two years old and Revix is the first financial platform in South Africa to list the AVAX token.

To celebrate the launch, we’re offering you zero fees when you buy AVAX over the next two weeks. This means that from 22 April to 8 May 2022, you can invest in AVAX completely fee-free!

About Revix

Revix brings simplicity, trust and excellent customer service to investing in cryptocurrencies. Its easy-to-use online platform allows you to securely own the world’s top cryptocurrencies in just a few clicks. Revix guides new clients through the sign-up process to their first deposit and first investment. Once set up, most customers manage their own portfolio but can access support from the Revix team at any time.

Disclaimer

Remember, cryptocurrencies are high-risk investments. You should not invest more than you can afford to lose and, before investing, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. This article is intended for informational purposes only. The views expressed are opinions, not facts, and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any cryptocurrency.

To learn more visit www.revix.com.

- This promoted content was paid for by the party concerned