Calling the crypto market volatile would be quite the understatement — just look at the last couple of months. We all know that the cryptocurrency ecosystem can be a volatile place, and the unlucky few that finally got crypto exposure when bitcoin was priced at US$60 000 are probably feeling more than a little down at the moment. But what if there was another answer? A way to make stable wealth creation in a sea of volatility?

Calling the crypto market volatile would be quite the understatement — just look at the last couple of months. We all know that the cryptocurrency ecosystem can be a volatile place, and the unlucky few that finally got crypto exposure when bitcoin was priced at US$60 000 are probably feeling more than a little down at the moment. But what if there was another answer? A way to make stable wealth creation in a sea of volatility?

Just how volatile is crypto?

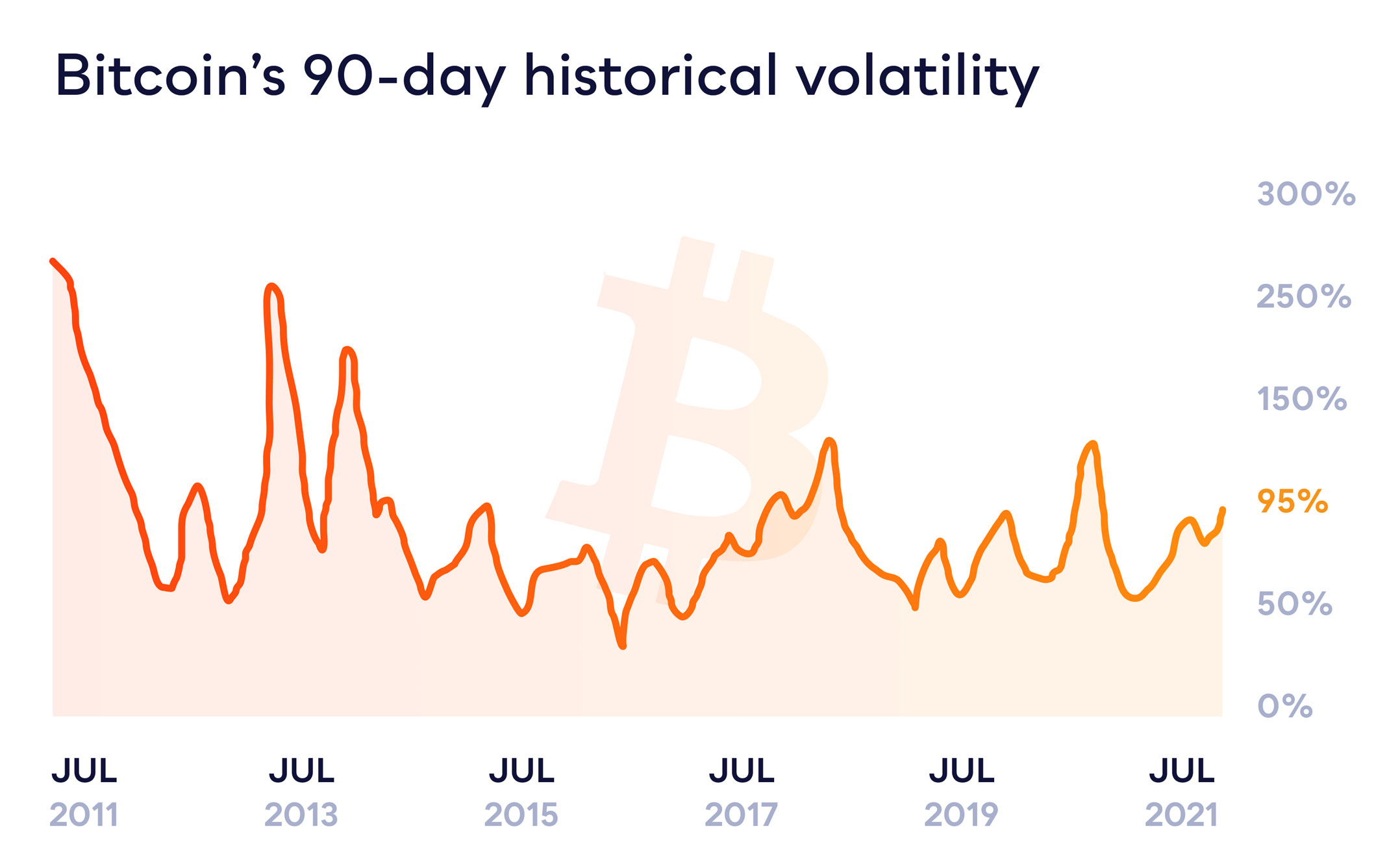

Bitcoin has seen its fair share of ups and downs over the past 10 years, and these price swings are explained by volatility. When looking at past bitcoin volatility, we use historical volatility to paint a picture of how risky the asset is.

Historical volatility is an indicator to show the extent at which a price may diverge from its average value in a given period. Hence, increased price fluctuation results in a higher historical volatility value.

Volatility in crypto is high when compared to traditional assets in specific sectors. Bitcoin has often been compared to gold, banking or tech, so it’s only fair to compare those volatilities. If we use spot gold (16% 90-day vol), JPMorgan (24% 90-day vol), and Tesla (70% 90-day volume) as a proxy for gold, banking and tech, we can see that bitcoin (95% 90-day vol) clearly has superior volatility. So based on historical volatilities investors now know that the returns of Bitcoin fluctuate by approximately 95% quarter-over-quarter (90-day vol).

Volatility was worth its weight in gold

Volatility was worth its weight in gold

Although this volatility may scare potential investors, many have been rewarded greatly for this risk. Bitcoin has seen a 115% increase year over year over the last 10 years (+211 000% total return), making it the best-performing asset class in the last decade.

But if volatility isn’t your game, you can rejoice! Because there’s also a stable way of growing your wealth using cryptocurrencies, namely stablecoins.

Stable coins, stable growth

Stablecoins are a type of cryptocurrency programmed to track the value of another asset like government monies or gold.

Fiat-collateralised stablecoins are cryptocurrencies backed one-to-one by an underlying government currency (like the US dollar or the euro) stored in a traditional financial institution.

Simply put, stablecoins are a digital version of fiat money and are pegged to that currency. For example, USD coin (USDC) is a stablecoin that is pegged to the dollar and, as such, its value is $1.

The South African saviour

South Africans have a unique need for US dollar exposure, seeing that the rand depreciates against the dollar roughly 5%/year every year — something that’s been going on for a long time now.

This means that it’s getting increasingly difficult for South Africans to accumulate international wealth while they save in a currency that is making them 5% poorer every year. This is why you may hear the words “rand hedge” being thrown around your dinner table. In essence, this means that you get exposure to an asset that “hedges out” this 5% leak.

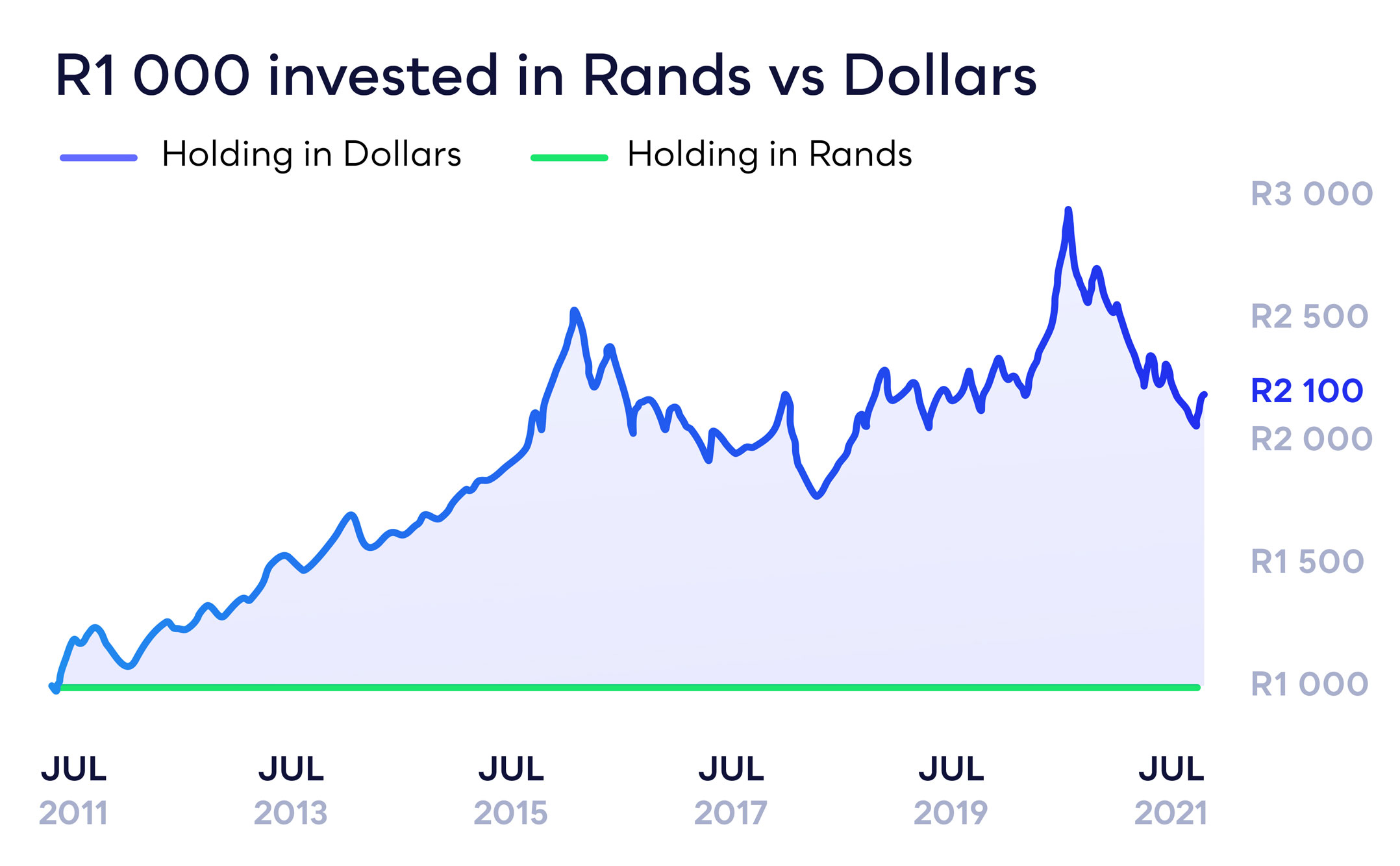

The graph below shows the effect of holding your wealth in dollars versus rands over the last 10 years.

If you had taken R1 000 10 years ago, converted them to dollars and just kept them earning zero interest, they would be worth R2 100 today, while your rands would still be worth R1 000. That means you’ve lost quite a bit of buying power. In fact, you’ve lost 7.6% year on year and 115% in total.

If you had taken R1 000 10 years ago, converted them to dollars and just kept them earning zero interest, they would be worth R2 100 today, while your rands would still be worth R1 000. That means you’ve lost quite a bit of buying power. In fact, you’ve lost 7.6% year on year and 115% in total.

Stablecoins can help stop this wealth erosion and make it work for you, not against you. By simply taking your hard-earned rands and converting them into dollars, you increased your wealth by 7.6%/year over the last 10 years.

But it gets better. With the creation of stablecoins comes the creation of savings accounts.

Let’s save

With stablecoins comes the opportunity to create savings accounts or “DeFi savings vaults” as Revix likes to call them. These savings vaults offer a fiat-denominated savings account that earns an interest rate well above market (up to 7%).

“Stablecoins have allowed many South Africans to win two-fold. One, they get to hedge out their rand risk and pick up an extra 5% year on year just by not holding a devaluing currency. Two, they get to put these US dollars in a savings account that can earn between 2% and 7%, above and beyond the 5% saving they get from not holding rands. That’s a possible 13% net gain every year. Over 20 years, that 13% would translate to a 1 100% gain,” said Brett Hope Robertson, investment analyst at investment platform Revix.

Where can I find these solutions?

Investment platform Revix understands how hard it is to save, and saving in rands can be a disheartening task when it comes to holding a weakening currency.

At Revix, you can gain access to USDC as a stablecoin solution. USDC is a 1:1 representation of $1 and you can always redeem one USDC for $1, giving it a stable price.

Take advantage of this launch, as Revix will be offering it as a fee-free product, which makes it better and accessible for you.

Revix is also releasing a USDC Flexible DeFi Savings Vault. This is a US dollar-denominated savings account that offers an interest rate above market (prior 12 months: 4.33%) with no lockup periods.

So, if you are looking for a rand hedge and a stable way to grow their wealth, then this is the product for you.

Through Revix, you can also gain access to their ready-made “crypto bundles”. Bundles allow you to own an equally weighted basket of the world’s largest and, by default, most successful cryptocurrencies.

For more information about crypto bundles, or a direct way to invest in bitcoin, ether, Pax Gold or USDC, visit Revix.

- This promoted content was paid for by the party concerned