On the face of it, Telkom’s headline results for the year to 31 March were “robust”. Revenue was flat but declines in fixed-line and IT revenue (BCX) were offset by a sharp jump in mobile service revenue (up 34.5%).

On the face of it, Telkom’s headline results for the year to 31 March were “robust”. Revenue was flat but declines in fixed-line and IT revenue (BCX) were offset by a sharp jump in mobile service revenue (up 34.5%).

Ebitda (earnings before interest, tax, depreciation and amortisation) increased by 12%, with headline earnings per share up 53%. However, there are some worrying signs hidden in the numbers …

1. Mobile service revenue growth has halved

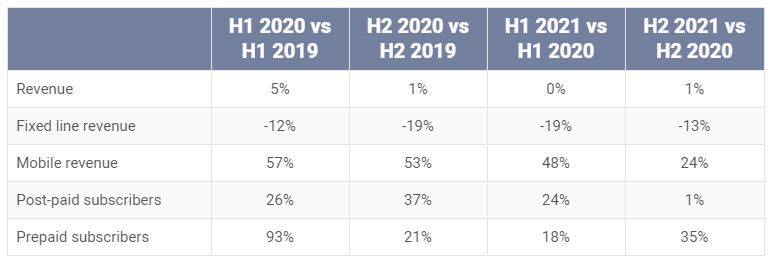

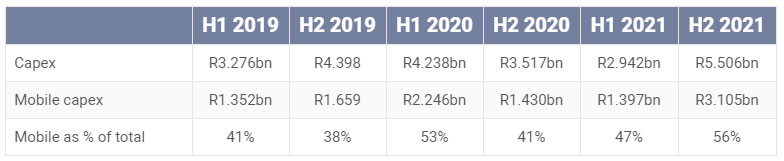

The company’s growth engine, mobile, saw a pronounced slowdown in the second half of the last financial year. The growth in service revenue slowed from 48% year on year in the six months to 30 September 2020 to 24% in the six months to 30 March 2021. Some of this could be explained by “front-loaded” demand due to lockdown in the first half, but growth in 2020 was above 50% in each half.

Year-on-year post-paid subscriber growth has stalled, with the operator actually shedding 30 000 subscribers in the last six months. The growth rate of mobile subscribers and mobile service revenue in the current quarter is going to be critical in establishing what the trajectory going forward could be.

2. Is free cash flow actually still negative?

2. Is free cash flow actually still negative?

On Monday, Telkom touted a significant improvement in free cash flow in the last year to R2.1-billion. This, it says, “was driven by the 20.6% growth in cash generated from operations … driven mainly by growth in the mobile business and cash release initiatives of approximately R1.2-billion”.

Excluding the costs of its voluntary retrenchments (voluntary separation packages and voluntary early retirement packages), free cash flow was a negative R1.4-billion in the six months to September 2019. The picture looked a lot better by March 2020, where it reported free cash flow of R1.8-billion, due to “improved working capital management in the second half”.

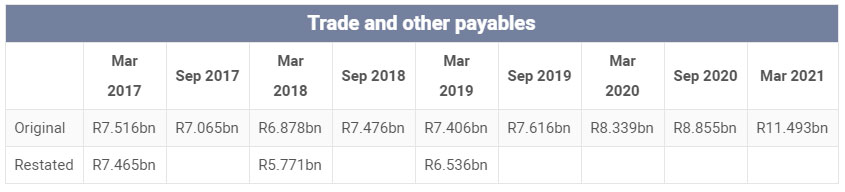

In those six months, trade and other payables increased by R723-million, but the year-on-year increase was even more pronounced at R1.8-billion. One could argue that if the amounts owing to creditors hadn’t increased by R1.8-billion, free cash flow would’ve been a lot closer to zero than to R2-billion.

Fast-forward to the most recent financial year, and trade and other payables increased by another 37.8% to R11.5-billion. Telkom says this was “mainly driven by growth in the mobile business”. This is an increase of R3.2-billion!

Adjust the reported free cash flow of R2.1-billion by this sharply higher amount owing to creditors and it’s easy to see a scenario where free cash flow is still negative. Put another way, trade and other payables are now 26.6% of revenues, from 14.5% in March 2018.

There is nothing in the reported numbers to explain why the mobile business has required such a large increase in amounts due to creditors.

Total capex was R693 million higher in the past year (splits between the halves are lumpier than usual because of the Covid-19 lockdown in the first half). But the increase in amounts due to creditors in the last 12 months is equal to the operator’s total capex on its mobile network in the second half. Had it not paid a single supplier by 30 March? Did it suddenly pay them all in April?

Inventories are up R54-million year on year (to R1-billion) due to “a network equipment bulk order discount deal”, but this also cannot explain the increase in payables. Telkom has not responded to a request for comment regarding the increase in trade payables.

3. What is the real net debt picture?

3. What is the real net debt picture?

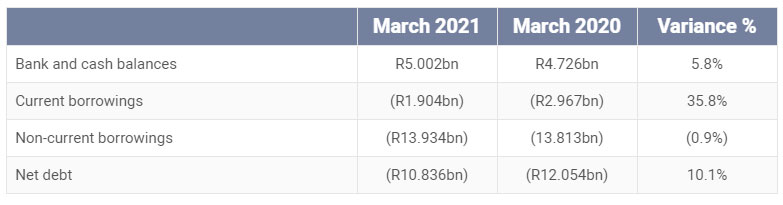

Telkom says net debt to Ebitda improved to 0.9 times, from 1.3 times in March 2020. It says its “conservative funding approach enabled us to report a healthy cash balance of R5-billion as at 31 March 2021″.

“We de-risked our balance sheet by repaying net loans of R1.1-billion.”

The repaid borrowings were a portion of its current loans. Non-current borrowings are effectively at the same level as they were a year ago.

The repaid borrowings were a portion of its current loans. Non-current borrowings are effectively at the same level as they were a year ago.

Bank/cash balances are up by R276-million, but with a R3-billion increase in amounts payable to creditors, these bank balances should, realistically, be lower. This would push net debt to above levels from a year ago. It has guided net debt to Ebitda to be “less than or equal 1.0x” over the next three years.

It says “management believes that Telkom is in a position to reconsider the suspension of the dividend policy”.

“Therefore, the dividend policy will be reviewed, and a new dividend policy will be communicated on release of the FY2022 interim results in November 2021.”

Quite where cash flow for R1.8-billion in dividends is going to come from remains to be seen. The pressure is on.

- This article was originally published by Moneyweb and is used here with permission