Samsung Electronics reported its worst operating profit drop in more than four years, buffeted by falling memory chip prices and slowing smartphone sales.

Samsung Electronics reported its worst operating profit drop in more than four years, buffeted by falling memory chip prices and slowing smartphone sales.

Operating income fell 60% to about 6.2-trillion won (US$5.5-billion) in the three months ended March, according to preliminary results released on Friday from the Suwon, South Korea-based company. That was the biggest decline since a similar drop in the third quarter of 2014. Analysts surveyed by Bloomberg had expected a 56% slump to an average of 6.93-trillion won.

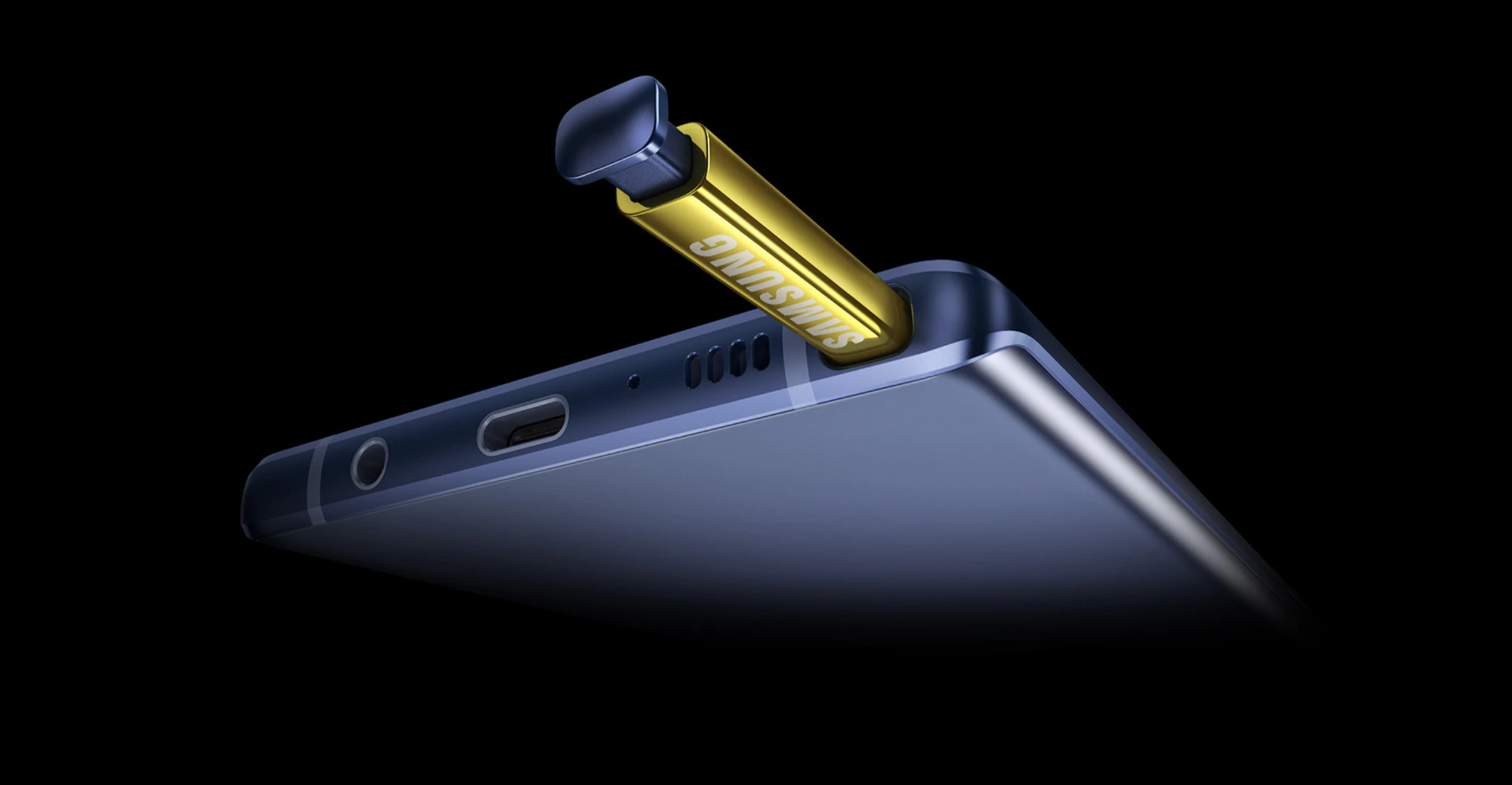

Samsung issued a rare warning last month that its results would be short of estimates, reflecting slower orders from data centre owners such as Amazon.com and handset makers including Apple. That’s pushed down prices for both DRAM and NAND memory and compounded the struggles for the South Korean company as it counts on new devices such as the Galaxy S10 smartphone to help it fight back against increased competition.

“We do expect server DRAM demand to pick up as well as the S10 sales and foldable-phone sales to be better than expected going into the second half,” Daniel Yoo, global strategist at Kiwoom Securities, told Bloomberg TV. “Therefore the earnings pickup should lead the share price going into the future.”

Samsung shares fell 0.5% in early Seoul trade on Friday. The stock had gained 21% this year through to Thursday’s close after slumping 24% in 2018.

Data centres are working through their stockpiles of unused memory chips while Apple cut its sales forecast earlier this year amid continued trade frictions between the US and China. The Chinese economy, the biggest destination for Samsung-made components, has been slowing as well, while the World Trade Organisation has cut its 2019 trade projection to the weakest in three years.

Missed expectations

Sales for the quarter were 52-trillion won, missing expectations for 53-trillion won. Samsung won’t provide net income or break out divisional performance until it releases final results later this month.

The market for dynamic random-access memory is set to reach $77-billion this year, dropping 22% from a year earlier, according to IHS Markit. In the first quarter, contract prices for 32GB DRAM server modules fell 38% while those for 128GB MLC NAND flash memory chips slid 23%, according to inSpectrum Tech. DRAM prices fell in the “sharpest decline in a single season” since 2011, TrendForce said on 5 March.

“Samsung is going through the toughest period of time before demand likely picks up again in the bottom half of the year,” Song Myung-sup, an analyst at HI Investment & Securities, said before the results. “Inventory levels at clients are right now high and purchases have temporarily come to a halt.”

In January, Samsung said it was reducing spending to focus on the profitability of its memory operations after fourth quarter net income plunged the most in two years. Rival SK Hynix said it could also cut investment if necessary. Last month, Micron said it was curtailing output. The three companies control the bulk of the market for DRAM chips, used to store data on PCs and servers.

In January, Samsung said it was reducing spending to focus on the profitability of its memory operations after fourth quarter net income plunged the most in two years. Rival SK Hynix said it could also cut investment if necessary. Last month, Micron said it was curtailing output. The three companies control the bulk of the market for DRAM chips, used to store data on PCs and servers.

Samsung’s first-quarter profit included the sales of Samsung’s Galaxy S10 smartphone released last month. Samsung has been struggling to stem a decline in its smartphone business as consumers wait longer to upgrade their devices.

Its display division, which supplies Apple, has also been hurt by lower-than-expected sales of iPhones and competition from Chinese makers of monitors and televisions. Apple cut its revenue outlook in January for the first time in almost two decades. — Reported by Sam Kim, (c) 2019 Bloomberg LP