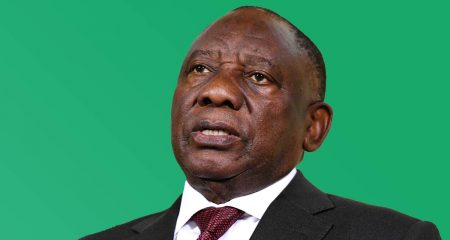

Sekunjalo Investment Holdings said it plans to sue President Cyril Ramaphosa, the presidency and other state organs for R75-billion for “loss of earnings”.

In a statement, Sekunjalo said it intends to claim damages amounting to US$4-billion (about R75-billion), the calculated loss of earnings the group has allegedly suffered due to actions against it by various South African organs of state, including the presidency.

In terms of legislation, the affected parties have six months to mount a defence or conclude a settlement, Sekunjalo has claimed.

Sekunjalo said it had delivered notices to Ramaphosa, national treasury, the ministers of finance and justice, and the state attorney.

“The lawsuits follow a protracted period of targeted sabotage whereby Sekunjalo believes elements of South African state power – all since Cyril Ramaphosa was elected president – have been corrupted and used to deliberately undermine and wish harm on Sekunjalo’s executive chairman Dr Iqbal Survé, and companies allied to the group, with the clear and determined aim of barring them from participating in the South African economy,” read the statement, which was published on Independent Media’s IOL website.

“Sekunjalo is of the firm opinion that the genesis of the attacks on it stem from its purchase of Independent Media in 2013. Independent Media is just that, an independent source of news and information that caters to the views and opinions of the majority of South Africans,” the statement said.

Facing suspension

Meanwhile, the JSE has warned African Equity Empowerment Investments (AEEI) and Ayo Technology Solutions – both ultimately controlled by Sekunjalo – that they could have their shares suspended from trading.

The two companies failed to submit their annual reports within the four-month period stipulated in the JSE’s listing requirements and have until the end of January to comply – or face sanction.

Read: Tricky start to 2024 for Ayo and Iqbal Survé

Ayo’s total market value has taken a battering in the last five years, beginning in 2018 when Ramaphosa ordered a probe into whether PIC officials, including its former CEO, Dan Matjila, followed procedure when it backed Ayo’s IPO.

Matjila was ousted in 2018 and the probe found the PIC had regularly flouted procedures when making investments with government workers’ pension money.

The Competition Tribunal has also dismissed an application by the Sekunjalo group for the extension of an interim relief order preventing several major banks from closing its accounts.

The Competition Tribunal has also dismissed an application by the Sekunjalo group for the extension of an interim relief order preventing several major banks from closing its accounts.

Last year, the supreme court of appeal found that Nedbank could close the accounts of the group after rejecting an earlier decision made by the equality court, a huge setback for Sekunjalo, which has been involved in a four-year legal campaign to prevent South African banks from closing its accounts.

Read: Ayo won’t back down even as auditors raise red flags

Without banking services, doing business in 2024 is likely to become increasingly difficult for Sekunjalo and its companies. – © 2024 NewsCentral Media

AI-generated summary of this article

- Sekunjalo Investment Holdings has threatened to sue the South African government for R75-billion.