[dropcap]S[/dropcap]oftBank Group is taking over Google parent Alphabet’s robot dreams, buying Boston Dynamics to pursue a future when more machines intermingle with humans.

As part of the transaction with Alphabet, SoftBank also agreed to buy Japanese bipedal robotics company Schaft. Terms of the deal weren’t disclosed.

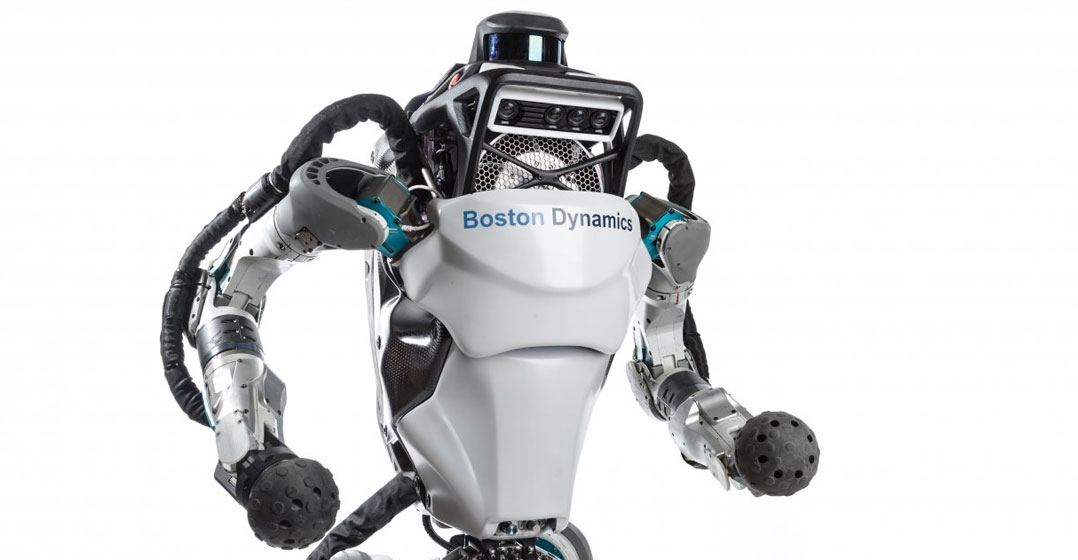

Boston Dynamics, bought by Google in 2013 as part of a robotics acquisitions spree, made its name with a series of two- and four-legged machines that are able to stay upright even when pushed or traversing rocky terrain. Videos of the robots, known for their animal-like movements, are popular on YouTube. While SoftBank has already made investments in robotics, those efforts have yet to deliver hit products or pay off. That may change with this new deal.

“Boston Dynamics is seen as the best in the world,” said Tomotaka Takahashi, a University of Tokyo associate professor and the founder of Robo Garage. While there might be some concerns whether it might be difficult to work with the “geniuses” at Boston Dynamics, he said “it will be interesting to see what they come up with when they’re free to conduct research”.

It wasn’t clear whether Boston Dynamics would remain within SoftBank, a Tokyo-based telecommunications and tech investment company, or become part of the Vision Fund, the US$93bn technology investment fund started by SoftBank founder, Masayoshi Son. The fund will allow the billionaire to cut even more ambitious deals than he’s been able to do with his highly leveraged company. The Vision Fund already has the right to acquire 25% of SoftBank’s holdings in ARM Holdings, OneWeb, US-based online lender Social Finance and US chip maker Nvidia.

Humanoid

This would be Son’s second venture into robotics. In 2012, SoftBank acquired French company Aldebaran Robotics and two years later unveiled Pepper, a $1 600 humanoid promoted as the world’s first robot endowed with emotions. Son envisioned building an ecosystem of apps that would let Pepper man storefronts as well as entertain people at home. But culture clashes between the Japan parent and French engineers as well as challenges of creating artificial intelligence capable of understanding natural language has left Pepper underwhelming and with lackluster adoption limited to Japan.

“SoftBank may not have struggled as much if they bought a better robotics company” instead of Aldebaran, Takahashi said.

The shares of SoftBank rose as much as 7,7% in early trading in Tokyo. The stock was buoyed by Alibaba Group’s 13% jump in US trading, which boosted the valued of SoftBank’s stake in the Chinese e-commerce giant to $105,6bn.

“Typically, when Son makes a big acquisition, the markets are worried,” said Tomoaki Kawasaki, an analyst at Iwai Cosmo Securities. “If this deal goes through the Vision Fund, no one will fret about the impact on SoftBank’s balance sheet.”

Alphabet decided to put the company up for sale earlier this year because it didn’t anticipate a marketable product in the next few years, people familiar with the company’s plans have said. Boston Dynamics was among the largest in a slew of robotics companies that Google bought in a short period. Before the acquisition, the Cambridge, Massachusetts-based company developed large, heavy robots mostly for potential military purposes, through research contracts with US government agencies.

The acquisitions, orchestrated by former Android chief Andy Rubin, formed a hodgepodge unit inside the company, called Replicant internally. But the teams never cohered around a singular strategy, and Rubin left Google in 2014. Alphabet shifted all its robotics companies, aside from Boston Dynamics and Schaft, to its X research lab last year.

“One of the challenges they’ve had is that the robotics don’t scale as well for mass production,” said Gene Munster, an analyst at Loup Ventures. “That’s why they never fit with Google’s model.” — Reported by Pavel Alpeyev and Mark Bergen, with assistance from Yuki Furukawa, (c) 2017 Bloomberg LP