Groupe Canal+ has again increased its stake in MultiChoice, acquiring more than 30% of its, according to a regulatory filing.

Browsing: Tim Jacobs

France’s Canal+, which has steadily been buying shares in MultiChoice Group since 2020, has now significantly increased its stake.

France’s Groupe Canal+ has again increased its stake in MultiChoice Group, taking its position in the South African broadcaster to 20.1%.

Groupe Canal+, the pay-television operator owned by French media conglomerate Vivendi, has again increased its stake in DStv parent MultiChoice Group.

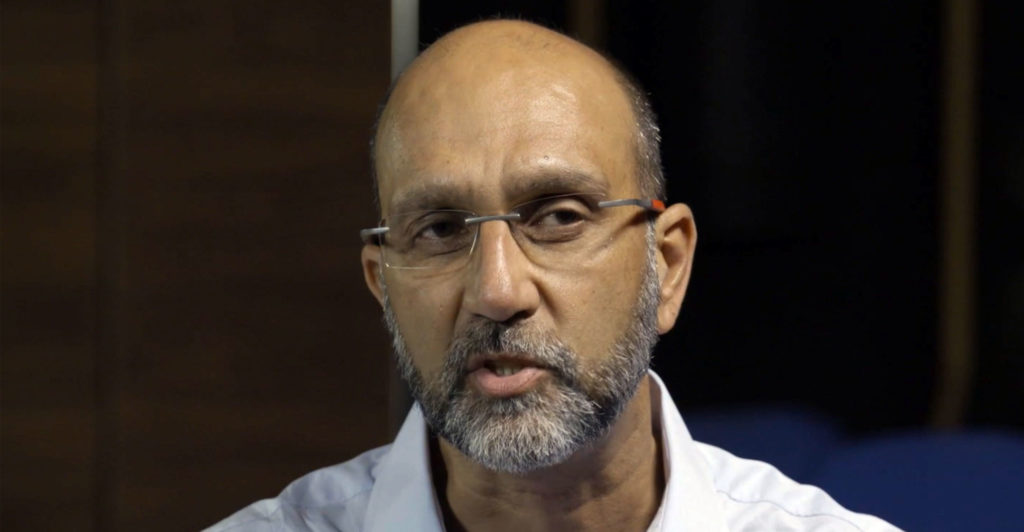

MultiChoice Group chief financial officer Tim Jacobs has said in an interview with TechCentral that the pay-television broadcaster will “keep an open mind” to any approach by France’s Canal+.

MultiChoice Group has decided to carry competing streaming television services on its upcoming Explora PVR because the broadcaster wants to position itself as a “super aggregator” of content.

Shareholders in MultiChoice, which was unbundled from Naspers on 4 March, rejected the group’s executive pay at Thursday’s AGM.

MultiChoice Group executive chairman Imtiaz Patel received almost $1.5-million (about R21.4-million at the time of writing) in base salary, bonuses, pension and short-term incentives in the 2019 financial year.

The decline in the number of subscribers to DStv Premium accelerated slightly in the year to March 2019 and MultiChoice is actively looking at ways to stem the erosion.

MultiChoice Group soared 16% in debut trading in Johannesburg as the pan-African pay-TV company embarks on a new era of independence following a spin off by technology giant Naspers.