Crypto platforms have encouraged traders to embrace the South African Revenue Service’s new disclosure process.

Browsing: VALR.com

South African crypto exchange VALR has disclosed that it has processed more than $10-billion in trading volume since its launch.

The Prudential Authority has issued a “guidance note” to local banks saying they should provide banking facilities to crypto exchanges.

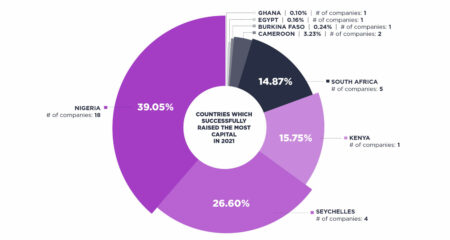

South Africa is falling behind its African peers in the blockchain investment race, but the country is making solid progress in creating a regulatory framework to govern the sector.

VALR.com, the cryptocurrency exchange co-founded by Farzan Ehsani, has raised more than R750-million in funding at a valuation of about R3.7-billion.

The bitcoin price on VALR.com, a local cryptocurrency exchange, topped R1-million in early evening trading on Tuesday

The South African Revenue Service has made it more difficult for taxpayers to get approval on crypto arbitrage trades using their R10-million/year foreign investment allowance.

A Financial Sector Conduct Authority health warning on cryptos comes amid a flood of complaints from investors who lost money or were scammed, says head of enforcement at the regulatory body, Brandon Topham.

It’s certainly not at the same scale as a Tesla or a MicroStrategy, but some privately held South African firms have started converting a portion of their cash holdings into cryptocurrencies like bitcoin.

VALR.com has raised R57-million to help fund further expansion, with proceeds from the capital raise to be used to explore new products for the South African market.