Telkom is expanding its lead over competing mobile operators, providing the most consumer value for contract plans in South Africa, a new and independent research study has found.

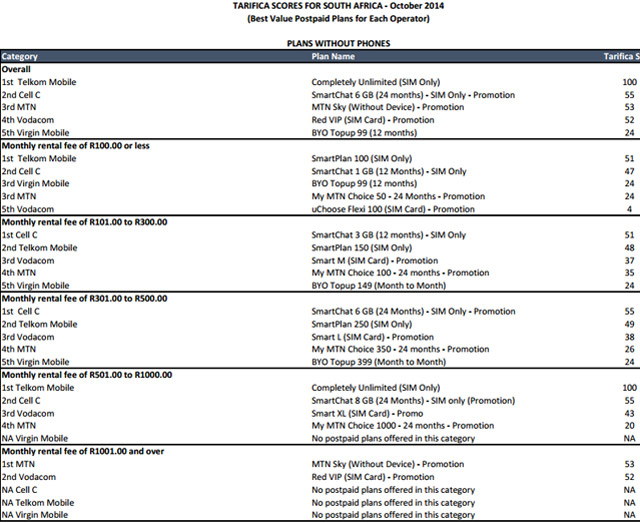

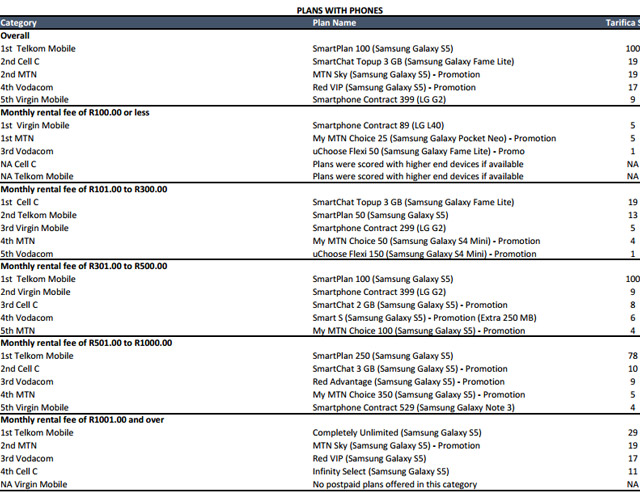

The study, conducted by telecommunications research firm Tarifica using a proprietary algorithm that weighs up every feature of a mobile plan, determined that Telkom’s mobile plans led the field in October, achieving “top value plan” status in five groups. (See below for the tables.)

Cell C was rated second best, winning three of the 10 price segments, while MTN and Virgin Mobile were each able to earn just one top value plan.

Vodacom, after offering the top overall Sim card-only plan in the market two months earlier, was “shut out entirely”, according to Tarifica.

The company’s South Africa analyst, Melissa Mascarenhas, said the addition of unlimited on-net data to Telkom’s SmartPlan 100, 200 and 500 tariff plans with the purchase of a phone “considerably enhanced” what was already “solid consumer value”.

“There simply is no similarly priced alternative in South Africa that includes the volume of allowances available with these plans. Given that Telkom already had the top Tarifica scores in September, this new promotion served to further expand the operator’s lead,” said Mascarenhas.

According to Tarifica, Telkom’s plans performed “extremely well, with the operator offering the top value plan in both the ‘Sim only’ and ‘with phone’ categories”.

“Plans from the operator also demonstrated the best value in five different price segments. Telkom’s high Tarifica scores were driven by the company’s relatively low prices and the generous data allowances included with many of its plans,” the company said.

“Moreover, Telkom’s plans frequently included attractive additional features, such as access to the company’s Wi-Fi network.”

At the other end of the scale, Tarifica found that Vodacom “failed to capture the top value plan position in any price segment in October”.

“In general, Vodacom’s plans ranked near the middle of the pack in terms of consumer value. The operator’s country-leading download speeds were, for the most part, counterbalanced by its relatively high prices.”

MTN was the winner in just one price segment – Sim-only plans that cost in excess of R1 000/month.

“MTN’s relatively poor performance was primarily due to the fact that its plans cost more per service than similar plans from competitors.”

Cell C scored relatively well, offering the top plans in three market segments (between R101 and R300 and R301 and R500 for Sim-only plans, and in the R101 to R300 “with phone” category).

Compared to similarly priced plans from MTN and Vodacom, Cell C’s plans generally included more minutes, SMSes and data, according to the research.

“While the carrier often imposes time restrictions on some of its plans’ included data, even after reducing the data volumes in the Tarifica Score algorithm to account for this reduction in usability, Cell C generally offered more included data than any of its rivals with the exception of Telkom. The primary element keeping Cell C’s plans from being competitive in more market segments was the operator’s average download speeds, which were the slowest in the country.”

Tarifica first conducted the research in South Africa in July this year and has continued to do it monthly since then.

After the operators’ contract tariff plans are scored, plans are divided into two categories, namely “with phone” and “Sim only”, and then subdivided into five price segments, creating a total of 10 groups. Tarifica weighs up every feature of a mobile plan, including usage allotments, geographic coverage, data speeds, value added features and promotional elements, against the plan’s total costs. This is then used to determine a plan’s precise consumer value relative to all other offers in the market.

Scores range from 0 (worst) to 100 (best). — (c) 2014 NewsCentral Media