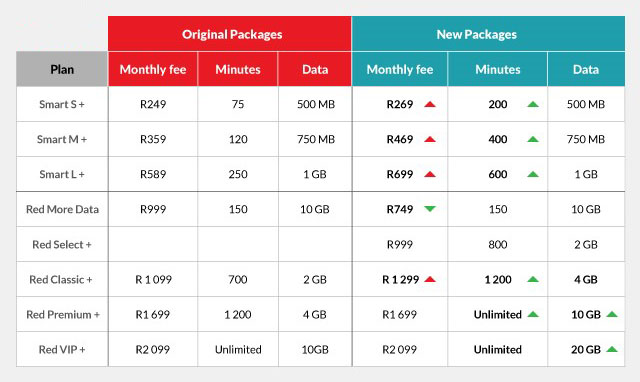

While Vodacom’s “overhaul” of its Smart and Red integrated contract plans has meant an increase in the number of bundled minutes, SMSes and data practically across the board, it has also managed to lift the pricing for these plans.

While Vodacom’s “overhaul” of its Smart and Red integrated contract plans has meant an increase in the number of bundled minutes, SMSes and data practically across the board, it has also managed to lift the pricing for these plans.

Its mid-level Smart M+ plan is now R469/month (excluding a device subsidy), from R349 in the promotional period (August to March), and R319 prior to that. In that time, customers would have gone from a bundled allocation of 120 minutes, 300 SMSes and 300MB of data per month; to 120 minutes, 120 SMSes and 750MB of data; to 400 minutes, 400 SMSes and 750MB of data.

Customers are getting significantly more but, in this case, the monthly subscription has increased by 47%. We know data usage is soaring, but the real question is whether customers care that they now have 400 voice minutes and an equally unusable number of SMSes.

It is important to recognise that these changes only apply to new contracts. Legacy plans are not available to new customers and subscribers on those packages will be able to migrate to these new packages at the end of their contract term. You can be sure that Vodacom will work very hard to “upgrade” customers to these new plans and get as many of them off the legacy ones as possible.

Of course, to be fair to Vodacom, the world looks very different today when compared to March 2013 when it first released the Smart and Red price plans. The company will argue that of course it had to alter allocations within these plans, as habits and usage has changed. It might also say that the price increases in each of these Smart plans are justified, because customers now receive so much more “value”.

The Smart M (M+) example was used deliberately at the start of this analysis as it includes an amount of bundled data that aligns almost perfectly with what Vodacom reports separately as the “average” amount of data used by smart device customers. This went from 254MB/month in December 2013 to 667MB/month in December 2016, an increase of 163%. The bundled data would have been sufficient in 2013 (at 300MB) and now (750MB).

It had to react to this increased usage over time, especially since nearly nine in 10 of its contract customers are in these “integrated price plans”.

Now, the “average” — as cited by Vodacom — is across a massive base of 16,6m smart devices (phones, tablets and dongles) and is certainly far lower than the average data usage of those reading this column.

Vodacom recently disclosed that “high-end smartphone” usage is up 31% in the past year to an average of 1,7GB/month (as of the October-December 2016 quarter). This is far more representative of the typical iPhone and Samsung Galaxy user (and of those reading this).

Its higher-end Red plans have gone from three prior to 31 March to six, extending all the way from R749 to R2 099/month. Vodacom has effectively introduced additional tiers to prevent the jumps from being unnecessarily large (previously, legacy plans cost R999, R1 599 and R1 999). Data allocations were, quite frankly, miserly. The new amounts of bundled data are far more apt for 2017.

On the face of it, the Red Select+ plan makes very little sense when compared to Smart L. An additional 1GB data bundle (to bring the two plans to parity on that basis) would cost R149, meaning a monthly total of R848 (versus R999 for Red Select+). And expecting customers to pay an extra R100/month for the top-up version of Red Select+ is simply outlandish. On the ultra high-end, the revised data allocation for Red VIP+ is now finally far more realistic for a customer spending over R2 000/month.

For data users who have little need for voice minutes (and even less need for SMS), the most attractive price plan across both the new Smart+ and Red+ packages is easily Red More Data. This is very competitively priced! Compared to Vodacom’s own plans, it’s R50/month more than Smart L+ (with a pitiful 1GB of bundled data), and is less than half the price of the cheapest other Red package with 10GB (Premium+).

Now, if only Vodacom designed all its contracts in the way it’s approached Red More Data… But it just cannot bring itself to, can it?

- Hilton Tarrant works at immedia. He owns shares in Vodacom, first purchased in June 2013

- This column was originally published on Moneyweb and is used here with permission