Vodacom shareholders have reason to be happy. On practically every measure, the full-year numbers published on Monday for its South African operation are probably the best in recent memory.

Vodacom shareholders have reason to be happy. On practically every measure, the full-year numbers published on Monday for its South African operation are probably the best in recent memory.

Everything is pointing in the right direction: customer numbers are up, service revenue is growing healthily and data continues to drive growth. And, despite a decline in international subscriber numbers thanks to registration requirements in the Democratic Republic of Congo and Mozambique, operations outside South Africa look in equally good health.

The group has even gone so far as to upgrade its three-year targets, which speaks directly to the confidence the board and management has in the continued execution of their strategy (investors, however, seemed to expect a bigger increase in the dividend).

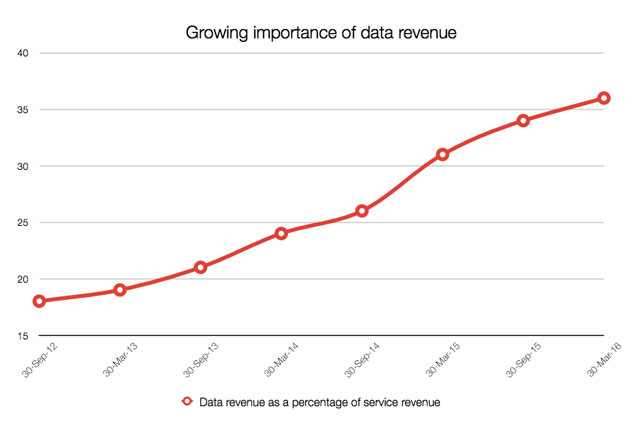

Last May, Vodacom said one of its medium-term priorities was to “grow data revenue to 40% of service revenue”. In South Africa, it’s within spitting distance at 36% for the second six months of the financial year (October to March), from 31% in the same period a year ago. Tick.

Its deliberate strategy of investing ahead of its rivals in building out an expansive 4G/LTE network, and continuing to expand its 3G one is yielding results. Closest competitor MTN is (finally) adding sites at around the same pace, but it is trying to recover from years of under-investment.

Sixty-two out of every 100 devices Vodacom sold in this country over the past 12 months were smart devices, compared with 51 out of each 100 in its 2015 financial year.

It sold 2,5m Vodacom/Vodafone-branded smart devices in the year (including 1,3m in the first six months). Given their price points, these devices are critical in driving smartphone and tablet adoption and data usage among lower-income customers.

There is strong pent-up demand: Vodacom is seeing a bigger uplift in the average revenue per user when it moves them from 2G to 3G and 3G to 4G. A year ago, those uplifts were 10,8% and 12,6% respectively. Now, it’s practically double at 20,5% and 19,7%. This means a customer spending R100/month (on average) on 2G, will spend R120 on 3G (with a similar jump between 3G and 4G).

The number of 4G/LTE customers on the network has almost doubled, from 1,5m to 2,8m.

Some early warning signs

But, there are some (very) early indicators of a peak in mobile data growth.

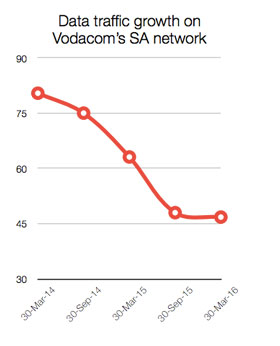

Growth in data traffic is slowing. At the end of its 2014 financial year, year-on-year data traffic growth was 80,4% (its peak over recent years). This year, it says traffic grew by 46,8%. Of course, it would be unreasonable to imagine it sustaining a rate of growth close to 100% back to back for a number of years. For one, its network would be buckling right now. But, that deceleration is real.

I’d certainly be worried if Vodacom reports data traffic growth of anything under 30% next May. (That said, the numbers are still enormous… If, for argument’s sake, it had 100 petabytes of traffic on its South African network in the year to end March 2013, by this year (to March 2016), that number would have grown to nearly 450 petabytes!)

It nearly doubled (+85.9%) the amount of mobile data bundles sold in its 2016 fiscal, from 184m to 343m. Those numbers look great in isolation. But a year ago it managed to more than double that number (+139%) from 82m to 196m (one assumes that the 2015 figure has been adjusted down).

It nearly doubled (+85.9%) the amount of mobile data bundles sold in its 2016 fiscal, from 184m to 343m. Those numbers look great in isolation. But a year ago it managed to more than double that number (+139%) from 82m to 196m (one assumes that the 2015 figure has been adjusted down).

Growth in active data customers is choppy, but remains (largely) at the low teens range. Save for a dip, year-on-year growth for each of the six past half-year periods has been remarkably consistent. For September 2012 to September 2013 it was 13%; March 2013 to March 2014, 12%; September 2013 to September 2014, 11%; March 2014 to March 2015, 3%; September 2014 to September 2015, 7%; and March 2015 to March 2016, 13%.

Had growth not recovered to those levels in the numbers published on Monday, I might have been a lot more concerned.

One way of looking at it, however, is figuring out the ratio of smart devices on the network to active data customers. In practice, of course, you’ll find exceptions, but I’d consider this a useful indicator: 24 months ago, the ratio of smart devices to active data customers was 55%; now, it is 76%. This tells you one thing: the number of smart devices on the network is growing significantly faster (nearly twice) than the overall number of active data customers. It also suggests that Vodacom is running out of runway for the rates of growth it’s been able to deliver in years past. The rate of growth in smartphones and tablets will revert to the overall rate of growth of active data customers (this is already happening).

And one gets the sense that Vodacom is going to soon be hitting the limits as far as re-farming spectrum for 4G is concerned. The lack of new spectrum — and there are zero signs of progress on this front locally — is going to necessarily limit growth in years to come.

Don’t get me wrong, the data boom will continue. Data revenue growth will continue to more than offset the declines in voice, messaging and interconnect. But, after data, what next?

- Hilton Tarrant works at immedia. He owns shares in Vodacom, first purchased in June 2013

- This column was first published on Moneyweb and is used here with permission