The year 2021 was one of unprecedented growth and unexpected developments in the world of crypto. With all the progress made, and multiple new possibilities unlocked, it’s difficult to predict which aspects of the crypto scene will become the big talking points of 2022.

The year 2021 was one of unprecedented growth and unexpected developments in the world of crypto. With all the progress made, and multiple new possibilities unlocked, it’s difficult to predict which aspects of the crypto scene will become the big talking points of 2022.

That said, two trends have gained so much momentum throughout 2021 that it’s almost impossible that they won’t play a defining part in the direction that crypto will take in 2022. In this two-part series, we take a look at these trends.

NFTs will not be ignored

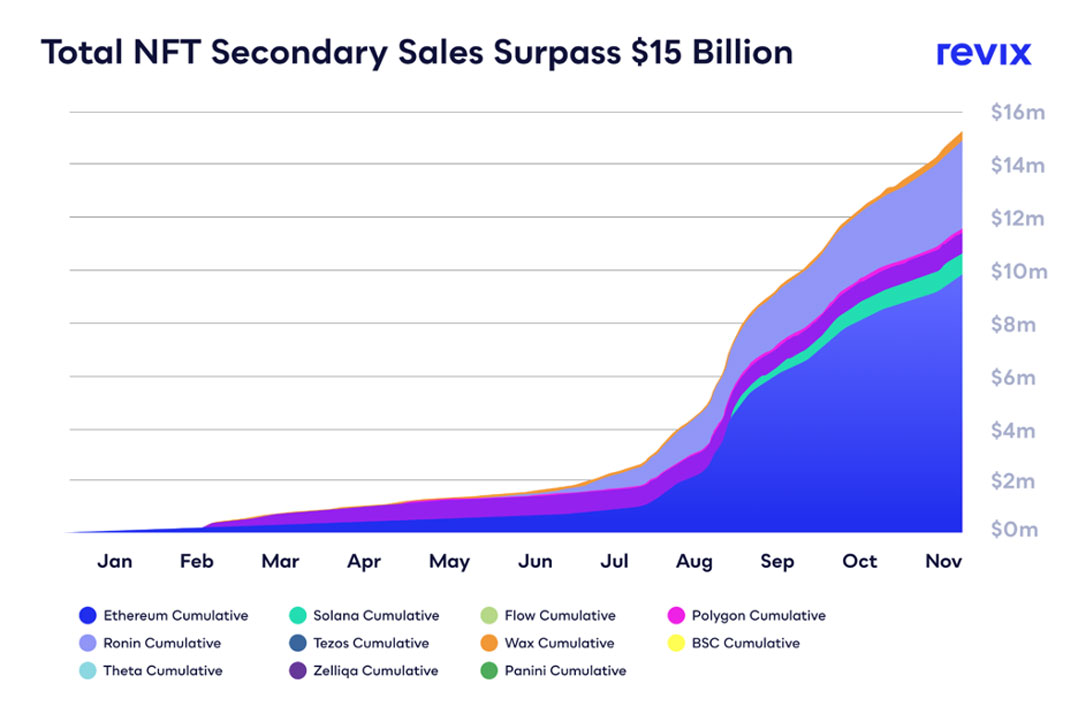

It’s incredible to think about how significantly the NFT space has expanded and developed in just a year. But by any measurement, NFTs are just getting started. We saw NFTs develop from experiments in crypto communities to become assets generating close to US$15-billion in turnover across all platforms. In doing so, NFTs have created an entirely new economy that’s based on the trade of digital property.

NFTs are “one-of-a-kind” assets in the digital world that can be bought and sold like any other piece of property. These digital tokens can be thought of as certificates of ownership for virtual assets.

NFTs were introduced to the market as a way to prove ownership of digital art, so investors can be forgiven for considering them a passing fad. After all, what good is proof of ownership of a piece of art that anyone can download for free? In 2021, though, the use cases for NFTs have exploded and investors are paying attention.

In an article explaining the value proposition of NFTs, Harvard Business Review calls NFTs “digital deeds”. The article says owning an NFT “effectively makes you an investor, a member of a club, a brand shareholder, and a participant in a loyalty programme all at once. At the same time, the programmability of NFTs supports new business and profit models. For example, NFTs have enabled a new type of royalty contract, whereby each time a work is resold, a share of the transaction goes back to the original creator.”

Brett Hope Robertson, an investment analyst at Cape Town-based crypto investment platform Revix, says NFTs and the ecosystem around them are a key trend to watch in 2022. “The NFT space is developing into areas that help many, from individual artists to companies and everyone in between. It’s about the transference of an asset or right to an asset to anyone. This transference happens without the need for excess fees or third-party influence. It’s an exciting development that has created a marketplace for digital properties, and we can see from the NFT volumes being traded that this is not a passing fad.”

NFT platforms like OpenSea, games like Axie Infinity and artworks like CryptoPunks now have a dedicated corps of traders, creators and service providers. Considering that the number of unique NFT wallets grew more than 1 000% in 2021, this is a trend that is likely to continue into the new year.

The future is tokenised

Tokenisation is the process of creating digital tokens that represent ownership and other rights to virtually any kind of asset — be they virtual, equities, real estate, debt, bonds, copyrights, art or collectables.

The Frankfurt School Blockchain Center (FSBC) says the market size of tokenised assets in Europe will grow to $1.5-trillion within the next three years.

Blockchain technology has made fractional ownership of property possible; simple even, with records of all holdings and legal rights locked into an unchangeable record. The same is now happening in other forms of securities such as debt, bonds and equities.

“This is what NFTs, tokenisation and blockchain technologies are capable of — it’s a game changer,” says Hope Robertson. “One of the great promises of crypto is that it would bring financial inclusion to the masses, and this is certainly a major step in that direction. For many people, investing in alternative investments or traditional assets is either inaccessible, or it’s just too expensive. Blockchain technologies are going to create ways to invest in all sorts of assets, while crowdfunding can make investments available to even the smallest investors. Tokenisation can make investing truly simple and affordable. You can already buy a tiny fraction of a property backed by real assets. That can generate rental income and see capital appreciation. What’s more, investors can then sell their tokens when they want to exit the investment.”

While NFTs may have rocketed beyond expectations in 2021, are they the only facet of crypto to keep an eye on in 2022? Not by a long shot. Both continued institutional investment in the major cryptos and Web3 becoming a reality are going to be critical factors when making investment decisions. That’s why we’re looking at both of them in part 2 of this article, coming soon!

This festive season, make smart investments a new family tradition!

This festive season, make smart investments a new family tradition!

With all the momentum the crypto market has gained this year, 2022 is set to be an exciting investment opportunity. This festive season is your chance to make the habit of investing a part of your life, and the lives of your family and friends.

“I think the simple act of saving can make a life-changing difference to people’s financial well-being. Instead of giving another candle or beach towel this Christmas, maybe people should think about giving an asset or an investment to their friends and family. Giving an investment means giving something that will appreciate in value over time and possibly help those who receive it tenfold in the future … much more than that beach towel ever will,” says Hope Robertson of Revix.

You don’t need another reason to make December 2021 the month that you and your loved ones start your investment journey together but Revix is giving you one.

Between 17 and 29 December 2021, give the gift of smart investments and refer someone to Revix using your unique referral code. They’ll receive R500 when they sign up and verify their account. What’s more, you’ll earn Revix Rewards Points which can be redeemed for bitcoin.

It’s your chance to help your loved ones to discover a safe and simple way to invest in crypto.

- This promoted content was paid for by the party concerned