The future of JSE-listed electronics and technology group Ellies is in some doubt after it warned this week that Covid-19 has cast “material uncertainty” over its ability to continue as a going concern.

The future of JSE-listed electronics and technology group Ellies is in some doubt after it warned this week that Covid-19 has cast “material uncertainty” over its ability to continue as a going concern.

In full-year results for the year ended 30 April 2020, published on Thursday, Ellies said: “If the economy and, as a result, the performance of Ellies deteriorate and management is unable to stem the losses incurred in a major subsidiary, these present a material uncertainty to Ellies remaining as a going concern.”

It said its directors believe the group currently passes the test of a going concern, but that Covid-19 has created “material uncertainty” in this regard.

“These matters indicate that there is a material uncertainty related to events or conditions that may cast significant doubt about the group’s ability to continue as a going concern and therefore that it may not be able to realise its assets and discharge its liabilities in the normal course of business.”

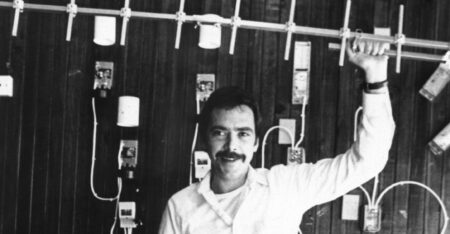

Ellies was founded 41 years ago in Johannesburg by businessman Elliot (Ellie) Salkow as a seller of television aerials. (Salkow stepped down from the board earlier this year.) By the mid-1990s, it had expanded into a national business and today is an investment holding company for businesses involved in the manufacture, trading and distribution of terrestrial television and satellite products and related accessories; electrical; signal distribution; residential and commercial LED lighting solutions; solar PV; and sound and AV equipment distribution and installation.

Sufficient

The group said that based on its cash flow projections, its banking facilities should be sufficient to see it through the next 12 months.

Non-executive chairman Timothy Fearnhead said in his chairman’s report that the 2020 financial year was one of “clean-up”, which “adversely affected reported results”.

“I regret that although last year we believed we had done the major clean-up, this has not proved to have been a correct assumption and this year we have seen further significant write-offs and impairments on inventory, properties and goodwill,” Fearnhead said, adding that the group is “now well positioned” for growth.

CEO Shaun Prithivirajh, in his report to shareholders, said the 2020 financial year was marked by “considerable change”, with “significant decisions being taken to improve governance, cost management and operational efficiencies”.

CEO Shaun Prithivirajh, in his report to shareholders, said the 2020 financial year was marked by “considerable change”, with “significant decisions being taken to improve governance, cost management and operational efficiencies”.

The group migrated its Johannesburg warehouse and distribution function to Value Logistics. This triggered a staff reduction exercise, both in the Johannesburg warehousing and distribution function as well as a restructuring of several head office functions. “With a strong focus on core activities, the operations and support functions’ restructuring stand it in good stead to deliver value into the future.”

Historic stock issues have also been addressed, Prithivirajh said. “This decision was necessary, as to continue carrying stock that was unsaleable would have continued to affect the performance of the business.”

For the full year, Ellies’ revenue declined by 13.8% to R1.17-billion. It reported a total comprehensive loss of R196.1-million, from a loss of R30.7-million in 2019. Net asset value per share plunged by 62% to 18.2c. Cash flows from operating activities fell from R63.8-million to R18.9-million. It ended the year with R33.7-million in cash and equivalents, down from R42.4-million previously. Unsurprisingly, no dividend was declared. – © 2020 NewsCentral Media