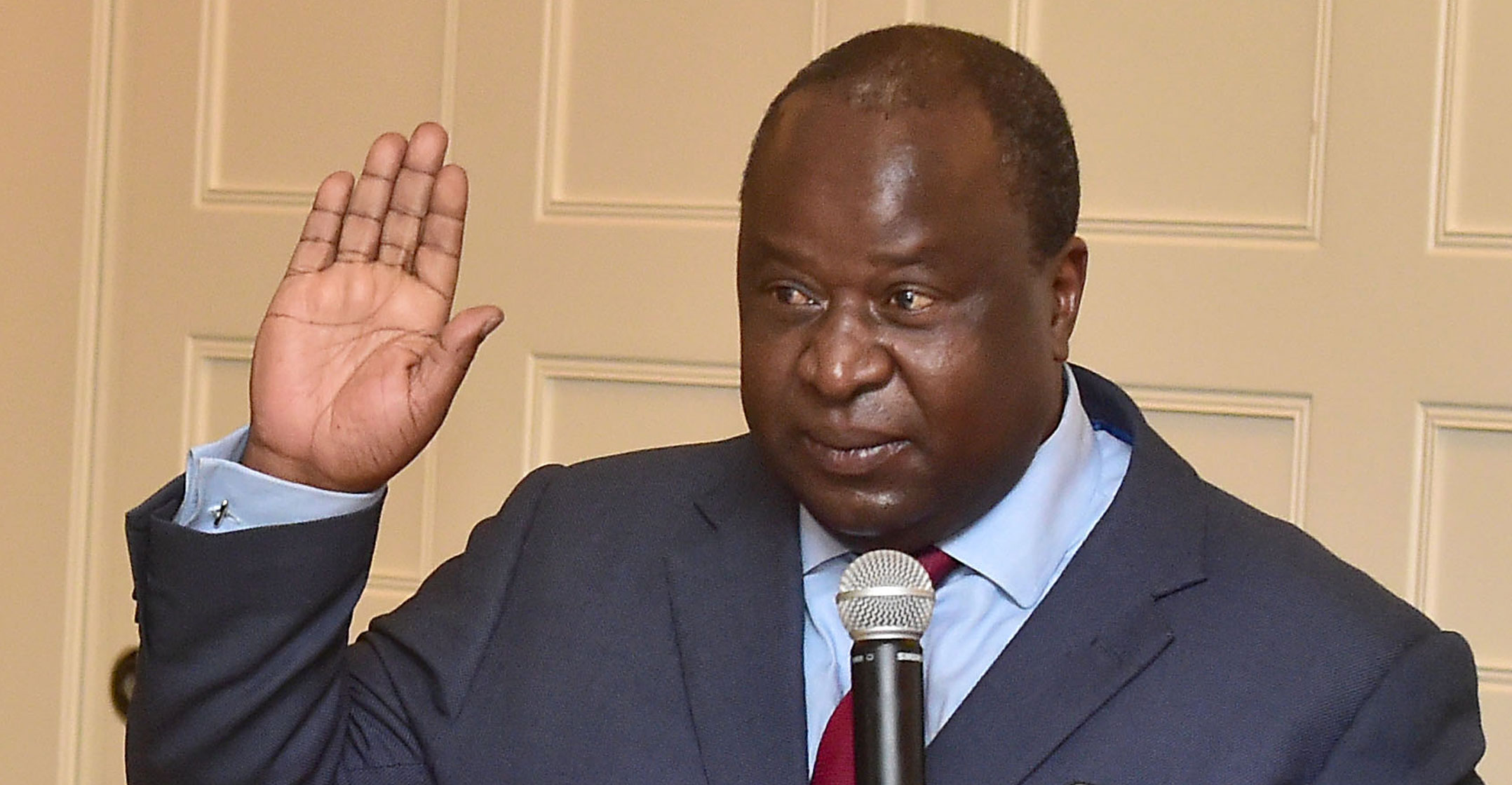

South Africa may increase its borrowing plans following the latest bailout announced for struggling state-owned power utility Eskom, finance minister Tito Mboweni told MPs on Tuesday.

Eskom, seen as the biggest threat to the nation’s economy, will get an additional R59-billion spread over two years.

Mboweni reiterated that the aid, combined with lower expected tax revenue, will come at a significant cost to taxpayers. Still, President Cyril Ramaphosa’s government is under pressure to show it’s got a plan to deal with Eskom as the utility struggles under more than R440-billion of debt.

An increase in government debt to help Eskom could raise the risk that the country loses its sole remaining investment-grade credit rating from Moody’s Investors Service. The minister’s warnings that the government may miss its revenue collection target and have to change its borrowing plans before the mid-term budget in October and its other spending plans may further spook financial markets.

The government is urgently working to stabilise Eskom, which needs the aid to meet its financial obligations this year, while working on a broad strategy for its future, Mboweni said. Eskom is not financially sustainable as it stands, he said. — Reported by Paul Burkhardt and Rene Vollgraaff, with assistance from Mike Cohen, (c) 2019 Bloomberg LP