Mobile gaming is expected to account for the lion’s share of growth in the South African videogame market in coming years, while PC gaming will stagnate and online gaming will fall behind growth globally due to South Africa’s comparatively costly and slow Internet access.

These are some of the findings contained in PwC’s latest annual “South African Entertainment and Media Outlook” report.

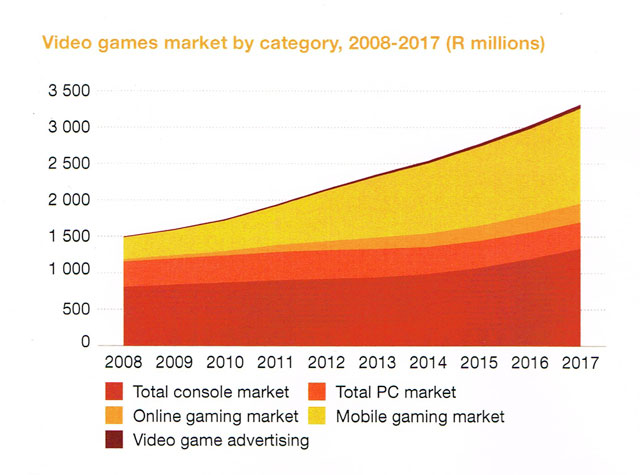

By 2017, the videogame market in South Africa will be worth R3,3bn, up from R2,2bn in 2012. The growth will be driven by mobile gaming. Console and mobile gaming will dominate, while PC gaming will stagnate and poor and costly Internet connectivity will continue to stymie the online gaming market.

According to the report, online gaming and digital distribution of games in South Africa lags behind more mature markets because of a low level of broadband access, particularly with regard to fixed services.

“South Africa’s early strength in the PC gaming market and a robust multi-generational console market offer a stable platform for future gaming and a launch pad to the rest of the continent,” the report says.

However, it’s mobile gaming that will become the “star of the show”, reflecting South Africans’ commitment to mobile as their “primary interactive entertainment platform”.

It’s this love of mobile that’s expected to diminish the demand for handheld consoles that lack the “multi-functionality and convenience” of tablets and smartphones.

According to PwC, tablets remain a largely untapped market that will boost mobile gaming over the medium term as the experiences they offer become more complex and compelling. Their convenience and mobility are also attractive to consumers.

PwC says the forthcoming consoles from Sony and Microsoft — the PlayStation 4 and Xbox One — will shape the future of the console market and that a boost to the console sector overall is likely. Sony has chosen to emphasise the gaming credentials of its offering, while Microsoft is positioning the Xbox One as a multimedia device. “The market’s reaction to the different approaches is yet to be seen.”

The report argues the effect of smart devices on the console market can be seen in sales of Nintendo’s Wii U, which sold 3,5m units globally between its launch in November last year and March. The original Wii console sold 5,8m units between November 2006 and March 2007.

“If sales of Nintendo’s Wii U are representative of a declining market for gaming consoles, Microsoft’s device may outplay the rest as it offers alternative functionality for users and may represent the birth of new home entertainment systems by offering consumers an all-in-one package.”

Digital gaming — downloading games from online services like Steam or EA’s Origin — will represent 50% of all PC game revenues in South Africa by 2017, according to PwC. But that is far lower than the predicted 83% worldwide because fixed broadband is less prevalent and more expensive.

Online gaming faces similar challenges, but is expected to produce the most substantial growth in the local gaming market, growing from R124m in 2012 to an estimated R257m in 2017. This type of gaming is particularly appealing because many of the games target a wider audience than traditional games and many can be played for free with advertising used to generate revenue.

Mobile gaming is also expected to see substantial growth, from R694m in 2012, to R1,3bn in 2017, because of the increased number of smartphone and tablet users, the falling cost of devices and the fact that games are easy to play and have broad appeal. Furthermore, in 2013 the estimated cost of a mobile game is just R15, compared to R345 for a title for a handheld game, R545 for a console game and R365 for a PC title.

The local videogame advertising market is “nascent”, according to PwC, but will nevertheless enjoy a substantial compound annual growth rate of 16,3% between 2012 and 2017, growing from R24m to R52m over the period. — (c) 2013 NewsCentral Media